The GameStop Bubble and the Capitol Hill Show

On January 1, the stock price of the bricks-and-mortar video game retailer GameStop (stock symbol: GME) was idling at less than $19 a share. Then the stock swelled into a giant bubble, becoming for a time the most traded stock on the planet and reaching, on January 28, an interday high of $483, an increase of more than 2,500 percent. Then the stock fell back to earth again, closing at a mere $40 on February 19.

Along the way, the GameStop parabola received enormous attention, as accusations flew about market manipulation. And so it was inevitable that Congress would get involved.

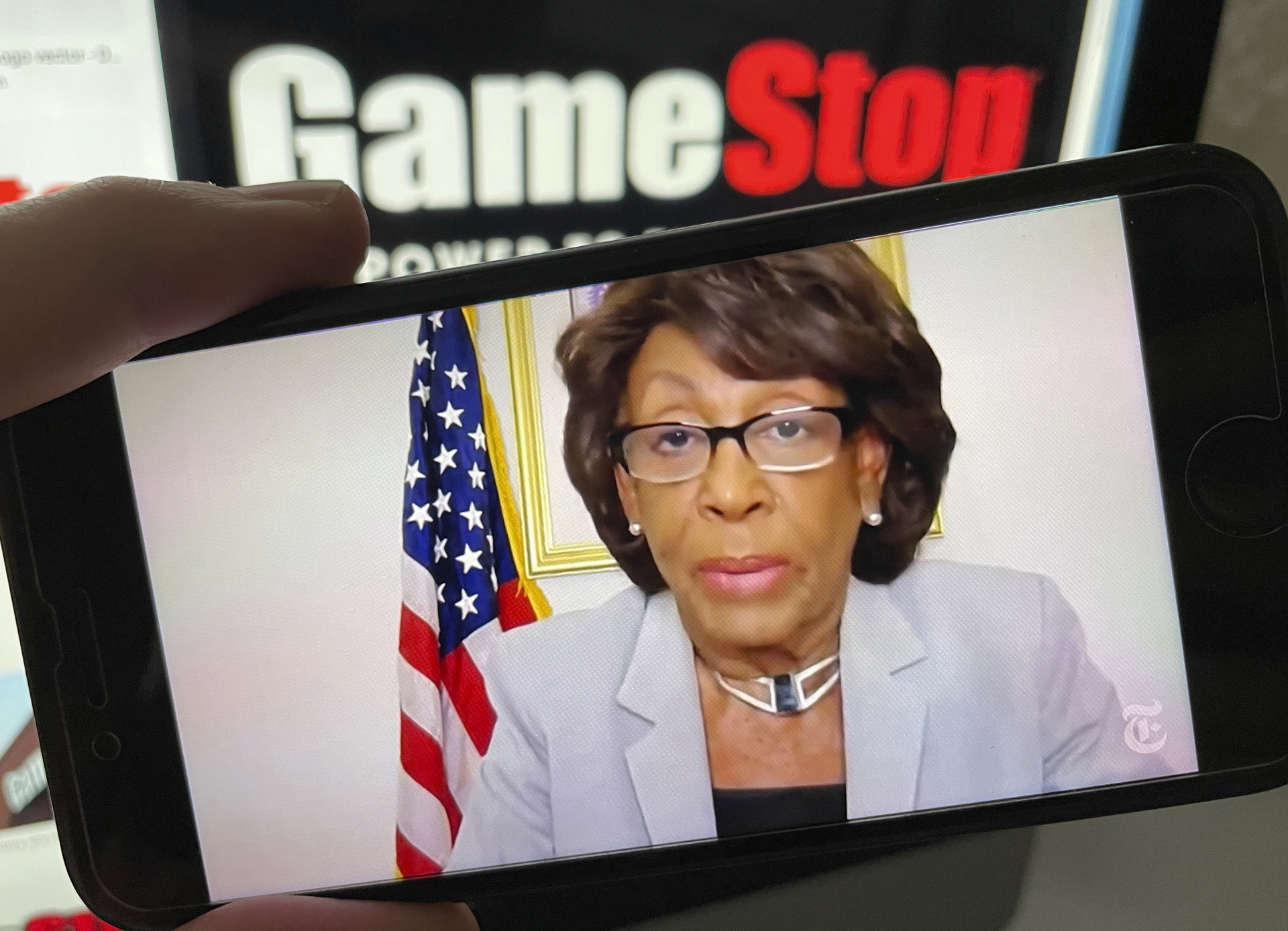

That involvement came big time on February 18, when the House Financial Services Committee, chaired by Rep. Maxine Waters (D-CA), convened a hearing, given a showy title in advance: “Game Stopped? Who Wins and Loses When Short Sellers, Social Media, and Retail Investors Collide.”

Sure enough, reporters and gawkers were all on hand, virtually. Waters called six witnesses; interestingly, the CEO of GameStop was not one of them. The company seems to have been a passive bystander in the bubbling—and popping—of its stock price.

Yet the witnesses on call provided plenty of entertainment. For instance, Vlad Tenev, CEO of Robinhood, the popular online app that helped put the air in the GameStop bubble, apologized for his actions last month–that is, when he wasn’t being interrupted by Waters, as happened about 30 seconds into his opening statement, and many times thereafter–when he restricted trading on the stock at the height of its frenzy. Robinhood’s deeds were widely criticized at the time as a favor to financial giants, which had been “shorting” GameStop stock (that is, betting it would go down) and losing billions as activist investors, mostly small fry, relentlessly bid the price up.

One of those financial giants that was losing money—and was at risk of losing a lot more until Robinhood stepped in—was Citadel. Its founder and chief, billionaire Ken Griffin, also called to testify and was told by Waters that his company “may pose a systemic threat” to the financial system. The words “systemic threat,” we might add, are a legal term of art, fraught with legal and regulatory implications for Citadel. Meanwhile, Waters pledged to investigate further and to hold yet more hearings.

A viewer watches video on a handheld mobile device of House Financial Services Committee Chair Rep. Maxine Waters (D-CA) at a virtual committee hearing in Washington, DC, on Thursday, Feb. 18, 2021, to discuss GameStop. Lawmakers are examining whether the wild swings in the stock price of the video game retailer GameStop exposed conflicts in the market’s structure that can hurt unsophisticated investors. (AP Photo)

Vlad Tenev, chief executive officer of Robinhood Markets, Inc., testifies during a virtual hearing on GameStop in Washington, DC, on Thursday, Feb. 18, 2021, before the House Financial Services Committee. (House Financial Services Committee via AP)

Kenneth Griffin, chief executive officer of Citadel LLC, testifies during a virtual hearing on GameStop in Washington, DC, Thursday, Feb. 18, 2021, before the House Financial Services Committee. (House Financial Services Committee via AP)

Keith Gill, a GameStop investor, also known in social media forums as Roaring Kitty, testifies during a virtual hearing on GameStop in Washington, DC, on Thursday, Feb. 18, 2021, before the House Financial Services Committee. (House Financial Services Committee via AP)

Still, if we step back and look at the GameStop episode through an historical prism, we can see that the company’s stock has now joined many other infamous bubbles of financial history, from the tulipmania of the 17th century, to the South Sea Bubble in the 18th century, to the Credit Mobilier scandal of the 19th century, to the 1929 stock market crash, which saw the Dow Jones Industrial Average nearly quadruple from 1922 to 1929—and then fall 90 percent from 1929 to 1933.

In each instance, the story was manic buying, followed then by panic selling. So in this historical sense, as a study in the manias of human emotion, the GameStop Bubble is nothing new.

Yet even so, the details of this latest bubbling are interesting because we can espy important social and technological trends, destined to reverberate far beyond the stock market, all the way to politics. Yes if the politicians can come to GameStop, the GameStoppers will find their way to politics.

Goliath vs. Davids

The billion-dollar battle over GameStop (stock symbol: GME) has been commonly depicted as a David vs. Goliath story. On the Goliath side: big hedge funds such as Citadel, using highly sophisticated institutional trading systems. On the David side, many Davids, using Robinhood and similar apps.

Moreover, the Davids have been creating a new kind of organization. And that was through Reddit, the online chat site. Reddit users, known as Redditors, have self-organized into smaller units, known as subreddits, where they hold forth on any and all issues—including, of course, finance.

Thus the subreddit r/wallstreetbets boasts 9.1 million members—plus an unknown number of simply visitors. Together, they’re all a motley crew of day-traders, lurkers, YOLO adventurers, and pontificators, both anonymous and identified, and sprinkled, as well, with celebrities; on February 2, for instance, billionaire Mark Cuban sat down with r/wallstreetbets for an online AMA (Ask Me Anything); during that session, Cuban praised his audience for “changing the game,” adding, “No disruption is easy or happens in a straight line. Stay with it. I am a believer.” (Did we mention that the founder of r/ wallstreetbets has scored a movie deal?)

There’s also a subreddit devoted just to GME, boasting more than 67,000 members.

From this fiesty matrix has come a new horde of “finfluencers” (a gluing together of “financial” and “influencers”). Perhaps the most famous, or notorious, of these is one Keith Gill, 34, who has cut a swashbuckling figure online, wearing a bright red headband, using the online handle of “DeepF__ingValue.” Gill has been instrumental in the GME action, and so he stands out as an meme stock seer, a cyber-leader—or, as some insist, a troublemaker. On Thursday, he, too, was a witness.

Thus we see that newfangled technology, joined with old-fashioned human nature—including its innovative, showy, even ornery, side—has come together to challenge and perhaps transform the financial markets.

Without a doubt, the old guard of Wall Street sees Gill & Co. as a threat. One such old guarder is the 77-year-old hedge-fund billionaire Leon Cooperman, who last month denounced the GME stampede as a new kind of class warfare: “It’s a way of attacking wealthy people.”

Meanwhile, other Wall Street veterans have a far different view. For instance, there’s Chris Arnade, who quit his job in finance to start a new career as a muckraking chronicler and photographer of the downtrodden. Summoning up his cynical recollection of industry practices, Arnade tweeted:

Hedge Funds 1) Take big positions, then talk them up in the media & to their friends 2) Put on those position via complex financial products to get the most leverage & exploit weaknesses in markets. That is exactly what Reddit is now doing to Hedge Funds & so they are upset.

Hedge Funds

1) Take big positions, then talk them up in the media & to their friends

2) Put on those position via complex financial products to get the most leverage & exploit weaknesses in marketsThat is exactly what Reddit is now doing to Hedge Funds & so they are upset

— Chris Arnade 🐢 (@Chris_arnade) January 27, 2021

To put that another way, the big hedge funds have been having it their way and doing just fine—and they don’t much like it when interlopers disrupt their profitable inside schemes.

So GME’s rise and fall is a phenomenon worth studying, not only for its financial and legal implications, but also for its political implications. You see, the GME flap further strengthens that most intriguing of political phenomena: the horseshoe. That is, the uniting of the populist right and the populist left, at least on some particular issues.

Hence this January 31 New York Times heading: “Lawmakers Look at GameStop Furor and See a Populist Issue to Seize: Ted Cruz. Alexandria Ocasio-Cortez. The rush by both parties to side with young traders disrupting the markets reflects the broad recognition of the impulses driving American politics.”

As the article observed, “It’s Occupy Wall Street, the sequel. It’s elements of the Tea Party, again. It’s Bernie bros and MAGA-maniacs.” The piece quoted Rep. Jeff Fortenberry (R-NE), offering a Bryanesque Great Plains perspective on the East Coast shenanigans:

Big Hedge, with outposts in South Hedge-i-stan (Wall Street) and North Hedge-i-stan (Greenwich, CT), has made trillions shorting great American companies facing a rough patch. Now they are getting a comeuppance from flash mobs of day traders and are paying dearly.

It’s worth emphasizing that this is a Republican talking–admittedly, a different kind of Republican than what we’re used to.

As many Redditors have said, the anger over GME reaches back to the 2008 financial crisis, when the bigs were bailed out, while the smalls were shafted. One widely read post from ssauron recalled:

I was in my early teens during the ’08 crisis. I vividly remember the enormous repercussions that the reckless actions by those on Wall Street had in my personal life, and the lives of those close to me . . . When that crisis hit our family, we were able to keep our little house, but we lived off of pancake mix, and powdered milk, and beans and rice for a year.

In the meantime, ssauron continued in regard to the GME price-surge, “We have a once in a lifetime opportunity to punish the sort of people who caused so much pain and stress a decade ago, and we’re taking that opportunity.”

One needn’t have a refined position on the intricacies of the GME battle to see that a generational struggle—and yes, maybe, too, a class struggle—is playing itself out.

The Endless Frontier of Online Activism

In addition to the manifest anger of the young activists, we can add the new power of online technology; the fight over GME is just the latest in a long list of instances in which Internet flashmobs have flared up—and quite often seared someone or something. For example, back in 2004, bloggers led the campaign to uncover the truth about Dan Rather’s phony memos smearing George W. Bush. Then, in 2011, Occupy Wall Street was social media-driven. In 2016, we had the fight known as Gamergate. And in 2019-20, came the fan-driven brouhaha over, yes, the movie Sonic the Hedgehog.

The common thread in these and many other “Netcidents” is this: Online activists target something they don’t like, self-organize, and then find some new way to exploit the weakness of their target to try to force change.

Some might say that, regardless of ideology, there’s something, well, Alinsky-ish abut the way these cyber-activists are operating. Others would say, “No, this is just good old-fashioned American ingenuity expressing itself yet again; only this time, the inventors are inventing new online strategies, and the tinkerers are tinkering with their iPhones.”

And more is coming: As Bloomberg News reports, “guerrilla investors” are now moving on to other stocks, to silver, and to cryptocurrencies.

Yes, the future is in our handhelds.

When the Techtivists Come to Politics

If we’re seeing this much raw energy and this much tech savvy in the world of stocks, it’s a safe bet that we’ll soon be seeing it, too, in politics, including electoral politics. That is, new activists bursting with new ideas are likely to change electioneering just as surely as the Redditors have changed investing. As a play on “tech” and “activists,” we might call them techtivists.

To be sure, Reddit already has plenty of political subreddits, such as r/politics, but these are mostly discussions of current issues. Yet as for subreddits attuned to the populist right, it should come as no great shock that Reddit—it’s Big Tech, after all— banned the subreddit The_Donald last summer, then putting the kibosh on another subreddit, DonaldTrump, just last month.

So by now it’s no surprise that rowdy MAGA groupings on Big Tech platforms are likely to be cancelled. Thus new approaches are needed.

One approach, of course, is to migrate to some new platform, although the case of Parler—which was shut down for the better part of a month—shows that it’s hard to escape Big Tech’s hammer. To stop this, as this author has written, conservatives, and all Americans, need a political plan for putting themselves at the Tech table. That is, use direct political power to protect websites, and access to those sites, in the same way that public authorities mandate that utilities serve all customers. The free market is great, but sometimes, to protect rights and freedom, you have to pass a law.

And if we start thinking about the political power needed to achieve goals, our thoughts must come to voting. So now we might ask: What’s the online version of political activism for the sake of voting and actually winning elections?

Most obviously, anyone who can build an online group might also be able to build an online bloc of voters. To be sure, politicians and parties have been assembling voter blocs for eons and yet there’s always a new and better way, based on some emerging issue, such as, most recently, GameStop. And there’s always some new emerging technology, such as, most recently, handheld apps. Can Redditors—or users of other platforms, including the newest newbie, Clubhouse—figure out a better way to build a vote-minded platform or ecosystem?

Apple’s App Store page for the social media app Clubhouse is displayed on a smartphone screen in Beijing, Tuesday, Feb. 9, 2021. Chinese authorities are blocking access to Clubhouse, a social media app that allowed users in China to discuss sensitive topics with people abroad including Taiwan and treatment of the country’s Muslim minority. (AP Photo/Mark Schiefelbein)

As of now, nobody has figured out a specific political agenda that appeals to cyber-investor activists. And yet even now, we can see at least some of the possible outlines: It would be oriented toward small investors, toward upward mobility, and toward technological ingenuity. And it would be against entrenched cronyism. So far, at least, from a Republican point of view, what’s not to like?

Of course, there’s no knowing for sure where GameStoppish political energy would end up, and what other political or policy ideas these energizer bunnies might have. All we know is that if an appropriate ideological and political platform could be shaped, it could potentially attract the urgency, and the votes, of all those millions of activists.

For instance, we can wonder: Could an Internet flashmob be the next victory coalition in an election? We might particularly zero in on primary elections, where the vote-universe is much smaller—and so a motivated group of voters could organize and win, fair and square.

We can further add: If we could find a way to harness the minds that figured out how to crowdsource such exotic concepts as the gamma squeeze, we might then have a potent force on our hands, beyond even its numbers, ready to rumble with the establishment—including the GOP establishment—in ways that we can’t foresee. That’s the thing about new people and new ideas: they have a way of confounding the wisdom of the wise.

Yes, there are a zillion causes that people might wish to mobilize on behalf of, some old, some new. And now, as we have seen, they have the power in their own handhelds.

Yet all causes and their champions in any era face the same challenge: They must trek their way through the unknown territory of the future to some new destination. And for that trek, the more tech tools they have, the better.

In politics, as in anything else, victory will come to those who best envision, motivate, gear up, and, most of all, implement. A good idea with no follow-through isn’t worth much. A good idea with follow-through can change the world.

COMMENTS

Please let us know if you're having issues with commenting.