Chinese Foreign Minister Wang Yi on Thursday urged the international community to lift economic sanctions on Afghanistan, warning that the country’s financial turmoil threatens to cause a “huge economic and security burden” for neighboring countries as refugees flee the country.

“Economic sanctions on Afghanistan must end,” Wang said during a virtual G20 foreign ministers meeting on September 22.

“The various unilateral sanctions or restrictions on Afghanistan should be lifted as soon as possible,” he said, as quoted in an official readout of the meeting issued by China’s Foreign Ministry.

“Afghanistan’s foreign exchange reserves are national assets that should belong to and be used by its own people, and not be used as a bargaining chip to exert political pressure on Afghanistan,” Wang added.

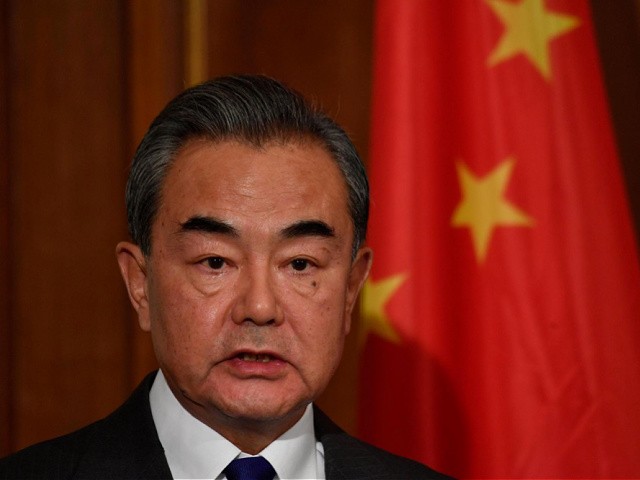

Chinese Foreign Minister Wang Yi addresses a joint press conference with the German foreign minister after talks on February 13, 2020, at the German Foreign Ministry’s Villa Borsig in North Berlin. (John MacDougall/AFP via Getty Images)

The foreign minister warned that refugees fleeing Afghanistan’s financial crisis could become a “huge economic and security burden” for both neighboring countries and the wider international community. He called on the U.S. and North Atlantic Treaty Organization (N.A.T.O.) members to “bear the main responsibility” in remedying Afghanistan’s economic situation.

The Taliban seized control of Afghanistan on August 15 by deposing Kabul’s U.S.-backed government. The action prompted the U.S. to block the Taliban’s access to practically all of the Afghanistan central bank’s $9.4 billion in reserves, the majority of which resides in the U.S.

The International Monetary Fund (IMF) followed suit, suspending its plans to distribute about $460 million in emergency reserves to Afghanistan. The financial freezes precipitated an acute shortage of U.S. dollars in Afghanistan, which has led to rampant inflation.

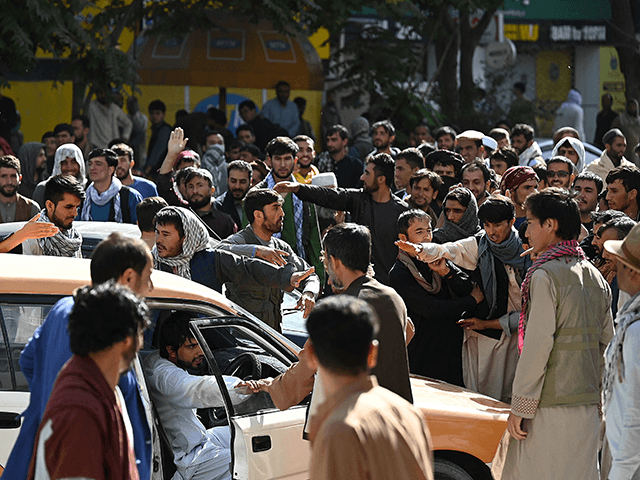

Taliban fighters stand guard by a black market currency exchange at Sarai Shahzada market in Kabul, Afghanistan, September 4, 2021. (AP Photo/Wali Sabawoon)

“With no new shipment of dollars arriving to shore it up, the local currency, afghani, has crashed to record lows, sending prices soaring. Prices of staples like flour, oil and rice have risen by as much as 10 percent-20 percent in a few days,” Deutsche Welle reported on August 24.

The U.S. Treasury holds a controlling share in the IMF and pressured the fund to cancel its planned aid distribution to Afghanistan on August 18, according to Reuters.

“There is currently a lack of clarity within the international community regarding recognition of a government in Afghanistan, as a consequence of which the country cannot access SDRs or other IMF resources,” an IMF spokesperson said in a statement at the time.

“As is always the case, the IMF is guided by the views of the international community,” the statement further read.

The joint financial blockade orchestrated by the U.S. and the IMF in August has dealt a severe blow to Afghanistan, which already suffered under economic sanctions imposed by the U.S. and the United Nations (U.N.) dating back to 2001.

Bank account holders gather outside a closed bank building in Kabul on August 28, 2021, following the Taliban’s stunning military takeover of Afghanistan. (Aamir Qureshi/AFP via Getty Images)

“The most powerful leverage that the United States and the rest of the world hold against the Taliban are sanctions, which have been employed aggressively to starve the group of financing and curtail the ability of its leaders to travel,” the New York Times observed on August 21.

“A 2020 agreement between the Trump administration and the Taliban called for a review of U.S. sanctions against the Taliban with the goal of removing them, but the group’s toppling of the Afghan government makes this less likely,” according to the newspaper.

“Afghanistan now emerges into the international community into a sea of sanctions that are tied to the Taliban dating back to 9/11,” Juan C. Zarate, who served as the first-ever assistant secretary of the U.S. Treasury for terrorist financing and financial crimes, told the Times.

“Sanctions will be a defining barrier to both legitimacy and commercial activity with the Taliban and Afghan entities and the economy,” he predicted.

Medical staff checks the children of a burqa-clad woman during a free medical camp for internally displaced people at Shahr-e-Naw Park in Kabul on September 11, 2021. (Hoshang Hashimi/AFP via Getty Images)

The U.N. Security Council’s additional economic sanctions on the Taliban make it “even more complicated to reverse them even if countries such as China and Russia want to do business with Afghanistan,” the Times noted.

“Aid groups and nongovernmental organizations will have difficulty operating in Afghanistan while the sanctions are in place,” according to the newspaper.

COMMENTS

Please let us know if you're having issues with commenting.