Breitbart Business Digest: Treasury Secretary vs. The Regulatory Woketopus

This is the Breitbart Business Digest weekly wrap, in which we coincidentally run through the economic and financial news of the previous seven days.

This is the Breitbart Business Digest weekly wrap, in which we coincidentally run through the economic and financial news of the previous seven days.

The Federal Reserve’s latest Summary of Economic Projections reveals that the inflation hawks have stood down, and Fed Governor Christopher Waller was right all along.

A Trumpier Fed Isn’t An Inflation Threat The financial press has been trying its best for months to gin up a panic over the independence of the Federal Reserve. We’ve had a number of dress rehearsals for the supposed death

The conservative movement in America is now decisively in favor of tariffs.

Until very recently, there was lots of talk on Wall Street and among Federal Reserve officials of the danger of inflation expectations becoming “unanchored” due to tariff-induced price increases.

Weekly Wrap: Netflix Cuts In On Paramount’s Dance With Warner Bros Discovery Welcome back to Friday! This is our weekly wrap-up of economic, financial, and business news—proving that you can never step into the same stream twice. It’s been quite

The Fed Will Cut Next Week The Federal Reserve is all but certain to cut interest rates by 25 basis points next week, bringing the federal funds rate down to a range of 3.5 to 3.75 percent. Markets are pricing

Gloom to Boom: A Holiday Shopping Odyssey American consumers sure have a funny way of expressing their gloomy mood. For months, U.S. consumers have been telling pollsters that the economy is precarious, that they can’t afford anything, and that buying

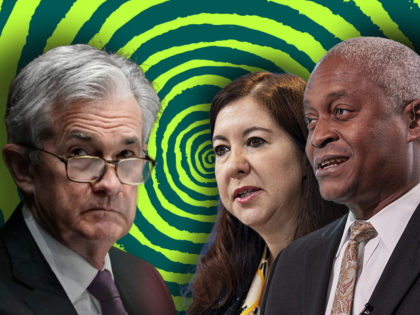

The man Trump calls a “stubborn ox” might prove stubborn enough to stick around when his term as Fed chairman expires, operating as a kind of monetary policy resistance leader for the next two years.

President Trump has floated the idea of sending $2,000 checks to most Americans, funded by tariff revenue.

The Plymouth Colony’s survival depended on two linked transformations that echo loudly in today’s economic debates: abandoning collectivism for private property and severing dependence on imports in favor of domestic production.

Commerce Secretary Howard Lutnick went to Brussels this week with a refreshingly direct message.

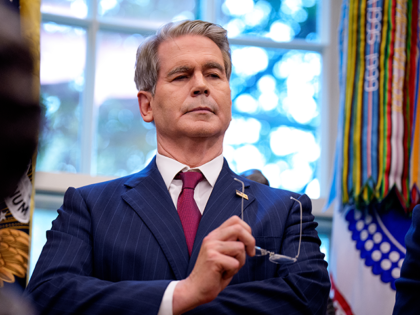

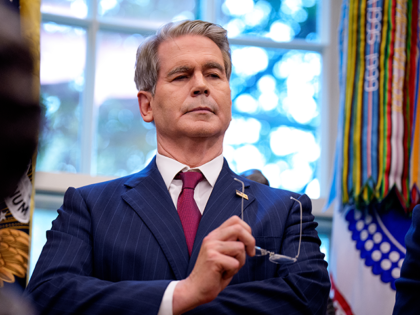

Treasury Secretary Scott Bessent told Breitbart Business Digest in an exclusive interview that the Trump administration is determined to end America’s dangerous dependence on China for critical materials and pharmaceuticals, describing the effort as “taking back our sovereignty.”

This week, the government finally revealed the September jobs data, and we learned about the mysterious resignation of yet another Fed official.

Tariffs paired with immigration policy, capital policy, and monetary policy are tools for breaking a low-wage equilibrium and pushing the economy toward more capital, more productivity, higher real wages, and a cooler price path.

The new San Francisco Fed paper on tariffs opens the door for using customs duties in a way that the economics profession has almost never considered: as a macroeconomic policy tool.

The Federal Reserve spent 2025 worried about the wrong problem, mistakenly holding back on rate cuts out of fear that Trump’s tariffs are an inflation threat.

A new paper from the Federal Reserve Bank of San Francisco suggests that the economic establishment’s narrative that tariffs drive up inflation is wrong.

The Federal Reserve released research proving its own rate-holding decision was based on a theoretical mistake.

The Trump administration is floating an idea that sounds intuitive to a lot of people: portable mortgages.

Federal Reserve hawks may be on the verge of making a reckless bet based on incomplete information.

The 50-year mortgage risks converting a generation of would-be homeowners into highly leveraged tenants of their own dreams—a generation of owners in name but renters in substance.

American companies are freely purchasing Chinese AI services while Chinese companies have zero ability to purchase American AI services. That’s exactly the sort of one-way trade barrier that President Trump has promised to end.

The white collar workers in Brooklyn who elected Zohran Mamdani are experiencing the economic displacement felt by blue collar workers in the Rust Belt three decades ago. They are the natural next chapter of the Make America Great Again coalition.

Zohran Mamdani won big because he tapped into something that cuts across traditional class boundaries: a pervasive sense that the fundamental bargain of American economic life has broken down.

Yesterday we explored how the battle over rate cuts has scrambled old alliances inside the Federal Reserve. Today we look closer at what’s driving that split and what it means for markets.

Donald Trump gained an unexpected ally Monday in his fight with the Federal Reserve: Governor Lisa Cook, the Fed official he attempted to fire this summer.

This is the Breitbart Business Digest weekly wrap, where we tell scary stories about this week’s economic news.

The recent Harvard Business School study on tariffs is deeply flawed in ways that undermine confidence in its findings.

Each year, more of what Americans buy is made abroad, and more of what Americans earn comes from borrowing that replaces the income lost to trade. The system sustains itself not through productivity but through the continual creation of dollar assets.

The U.S. fiscal deficit is the mirror of the trade deficit. Attempts to close one without addressing the other merely shift the imbalance around the balance sheet.

Tariffs still aren’t raising prices, Putin got sanctioned again, and Democrats are shattered by chandeliers—all that and more in the Friday Breitbart Business Digest weekly wrap.

A new paper from researchers at the Boston Fed warns of another inflation surge. But their warning rests on questionable measurement choices, contradictory data, and a misleading citation of academic research.

For months, critics of President Trump’s tariff strategy have warned of an inevitable wave of inflation. That wave turned out to be a ripple, and it seems to have already ended.

The St. Louis Federal Reserve released a study claiming that Trump’s tariffs added roughly 0.5 percentage points to consumer inflation. There’s just one problem: the study didn’t actually show that.

The Trump administration floated a bold idea to break China’s monopoly on rare earth minerals and attract long-term investment in U.S. rare earth production.

A federal judge has temporarily blocked the Trump administration from proceeding with mass layoffs of federal employees during the government shutdown, calling the move “unprecedented” and “the epitome of hasty, arbitrary, and capricious decisionmaking.”

The final part of our series on this year’s Nobel Prize winners, we examine what happened when economists tested their creative destruction theories against real-world data and discovered what Rust Belt voters have been saying for decades.

Philippe Aghion and Peter Howitt’s Nobel Prize-winning research exposes why China’s systematic IP theft violates the core conditions required for innovation to flourish.

The 2025 Nobel Prize in Economics is a major milestone for the economic nationalism that fueled the election of Donald Trump and popular support for Brexit.