‘Afraid to Actually Fight’: Hunter Biden Drops Lawsuit Against Two IRS Whistleblowers

Hunter Biden has dropped a lawsuit against a pair of IRS whistleblowers, who say he is afraid to take the issue to court.

Hunter Biden has dropped a lawsuit against a pair of IRS whistleblowers, who say he is afraid to take the issue to court.

Federal officials have indicted seven foreign nationals in Kentucky, accusing them of moving huge sums of cash for a Mexican drug cartel.

The acting commissioner of the Internal Revenue Service (IRS) was replaced days after he was appointed amid reports of a clash between Elon Musk and Treasury Secretary Scott Bessent.

No one likes tax time, but one fresh character might offer at least some entertainment.

The Treasury Department and DHS have reportedly finalized a deal that will help ICE agents more easily locate millions of illegal aliens.

The Internal Revenue Service (IRS) on Tuesday will launch an effort to update its technology systems to create the “most efficient” service that also protects taxpayers’ data.

Microsoft co-founder and billionaire leftist Bill Gates’ nonprofit may be in danger of losing its tax-exempt status.

President Donald Trump’s Internal Revenue Service (IRS) is nearing a historic deal with the Immigration and Customs Enforcement (ICE) agency that will allow agents to more efficiently locate and arrest illegal aliens already ordered deported from the United States.

Tom Homan says a data-sharing partnership between the IRS and ICE is critical to stopping illegals from stealing Social Security numbers.

A network of progressive non-profits has quietly spent years pushing the IRS’s new “Direct File” service.

Treasury Secretary Scott Bessent on Tuesday said that Internal Revenue Service whistleblowers who spoke out on the Hunter Biden case have been hired as senior advisors for the Treasury Department.

The Trump administration is moving to modernize the Internal Revenue Service’s (IRS) technologies to better serve the American taxpayer.

The U.S. Internal Revenue Service (IRS) is considering walking half of its approximately 90,000 employees out the door, multiple reports Tuesday claimed.

President-elect Donald Trump announced that he had picked former Rep. Billy Long (R-MO) to serve as the Commissioner of the Internal Revenue Service (IRS).

The Internal Revenue Service (IRS) officials who blew the whistle on the Biden administration’s Department of Justice (DOJ) obstructing the investigation into Hunter Biden’s crimes in June 2023 have slammed President Joe Biden for pardoning his son.

Vice President Kamala Harris — who on Saturday copied a campaign promise first announced by former President Donald Trump to eliminate taxes on tips — voted in 2022 to pass legislation that allowed the IRS to track down workers’ tips so that they could be taxed.

The Internal Revenue Service has reviewed some one million claims for coronavirus pandemic-era Employee Retention Credit (ERC) tax breaks representing $86 billion and declared the “vast majority” are at risk of being improper.

The Israeli government said Monday that the U.S. should investigate the “Palestine Chronicle” news website, which is officially listed as a charitable organization, after one of its contributors was allegedly found to be holding Israeli hostages.

Americans who fail to keep up with their tax payments may soon feel a sting in the pocketbook, thanks to the Internal Revenue Service (IRS).

Sen. Joni Ernst (R-IA) put forward legislation Tuesday to block the Internal Revenue Service (IRS) from using taxpayer funds to buy guns and ammunition and to take away the guns currently held by the IRS before they can used against the American people.

An Internal Revenue Service (IRS) job posting shows the tax collection agency is hiring armed agents to work in all 50 states.

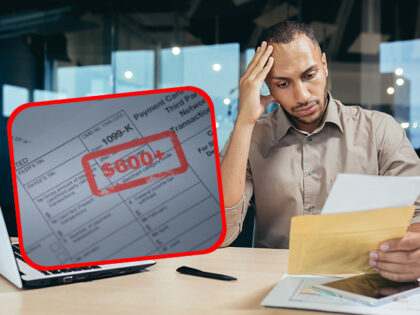

Biden’s expanded IRS is about to flood Americans with 1099 forms for basic transactions over $600 that they didn’t know they had to pay tax on.

Most Americans agree that Congress should repeal funding for new IRS agents, a Rasmussen Reports survey released Tuesday found.

The Internal Revenue Service (IRS) is targeting low-wage working-class Americans, as well as those in the middle class, with audits while earners making a million or more annually are reviewed at a lower rate, a report detailing federal data reveals.

Pennsylvania Lt. Gov. John Fetterman (D) says he “certainly would have voted” for President Joe Biden’s Inflation Reduction Act set to squeeze $20 billion from working and middle class households with new Internal Revenue Service (IRS) audits.

Breitbart News Editor-in-Chief Alex Marlow announced Monday that he filed a formal Internal Revenue Service (IRS) complaint against the George Soros-backed Good Information Foundation for allegedly attempting to tamper with the 2022 midterm elections.

Sen. Joni Ernst called for an audit of the IRS while referencing a report finding 1,250 agency employees failed to comply with tax rules.

A former lawyer for the Internal Revenue Service (IRS), who accused the agency of going after elderly Americans, says President Joe Biden’s “Inflation Reduction Act” will undoubtedly target working and middle class Americans with new IRS audits.

While signing the “Inflation Reduction Act” into law on Tuesday, President Joe Biden said no Americans “earning less than $400,000 a year will pay a penny more in federal taxes” as a result of billions to drastically boost Internal Revenue Service (IRS) audits.

The Democrats’ “Inflation Reduction Act” is set to squeeze $20 billion from working and middle class Americans with new funding for increased Internal Revenue Service (IRS) audits, the Congressional Budget Office (CBO) estimates.

Voters say federal bureaucracies are too large and only concerned with their own political interests, a Convention of States Action/Trafalgar Group survey released prior to the Senate’s passage of the $700 billion “Inflation Reduction” bill — which devotes billions to hire a fleet of new Internal Revenue Service (IRS) agents to target middle class Americans — found.

Senate Democrats, on a party-line vote, rejected an amendment to their “Inflation Reduction Act” that would ban Internal Revenue Service (IRS) funds from being used to go after working and middle-class Americans with audits and tax hikes.

Reps. Jim Jordan (R-OH) and James Comer (R-KY) on Monday decried President Joe Biden’s “unlawful” $45 billion scheme to expand Obamacare.

Black Lives Matter leadership allegedly purchased a $6 million luxury mansion with cash in Southern California using donation money, according to a report from New York Magazine.

The IRS will begin requiring taxpayers to use facial recognition to check their account online or get a transcript online.

The Moline-Coal Valley School District defended its decision to allow an “After School Satan Club” for children in grades one through five.

President Joe Biden and Democrats are hoping to squeeze an extra $200 billion in tax revenue out of American taxpayers by mostly targeting working and middle class households with Internal Revenue Service (IRS) audits.

The White House on Tuesday questioned the accuracy of the Congressional Budget Office ahead of a looming ruling on the House version of President Joe Biden’s Build Back Better bill.

President Joe Biden’s $1.75 trillion Build Back Better Act supersizes IRS audit enforcement by $78 billion.

House Republican Leader Kevin McCarthy (R-CA) and other House Republicans said Thursday that President Joe Biden wants to “weaponize” the Internal Revenue Service (IRS) against the American people.