Unemployment Claims Revised Much Higher

The March jobs numbers that will be reported out of the Department of Labor on Friday may be some of the most consequential of the post-pandemic era.

Economists have forecast that employers added around 238,000 jobs last month, according to Econoday. The range of forecasts, however, is large, running from 155,000 to 275,000, an indication of uncertainty that has surrounded so much economic data in recent years.

It’s not just uncertainty about the forecasts. There’s also uncertainty about the previously reported data. Last week, we highlighted some large revisions to the money supply, as measured by M2. Most importantly, instead of peaking back in March, as the data had indicated last year and the first two months of this year, the data revised in March showed that the money supply peaked in July. Since changes in monetary aggregates are thought to affect the economy with long lags, this has implications for how long high inflation is likely to persist.

On Thursday, the Department of Labor revised its estimates for unemployment benefit claims going back several years. The government had switched its method of seasonal adjustment during the pandemic to avoid over-estimating unemployment claims when they surged. The data released on Thursday maintain the revised calculation method for the first year of the pandemic but switches back to the traditional method for claims reporting after June 2021.

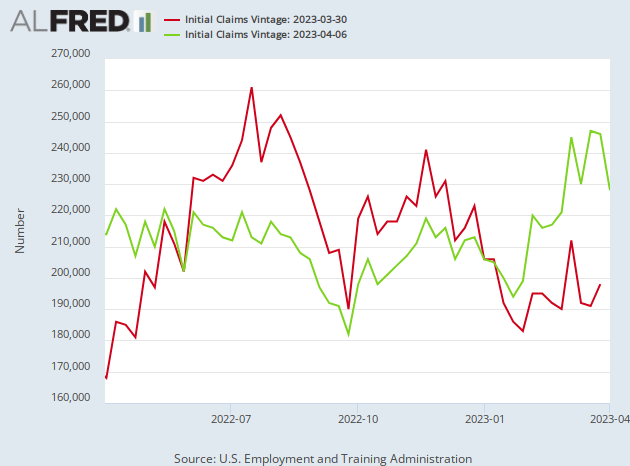

The results of the change can be seen in the chart below. The red line shows the initial claims before this week’s revisions, and the green line shows the claims after the revisions.

As you can see, the revised figures indicate that the government was overestimating claims for unemployment benefits last year by quite a lot. This year, however, the government appears to have been underestimating claims. Where the earlier data showed that claims had almost never gone above 200,000 this year, the new data show that claims have been consistently above that level since February.

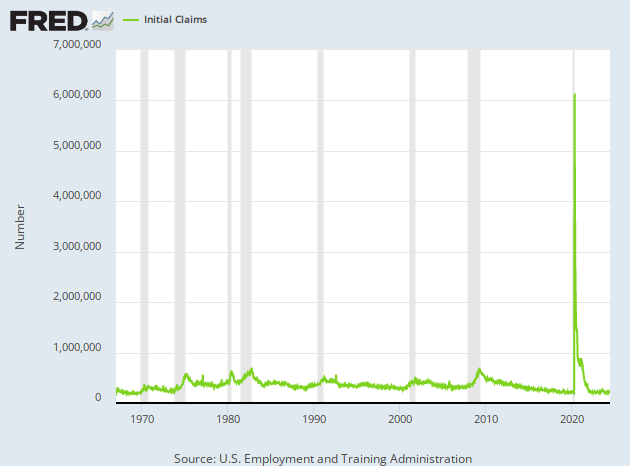

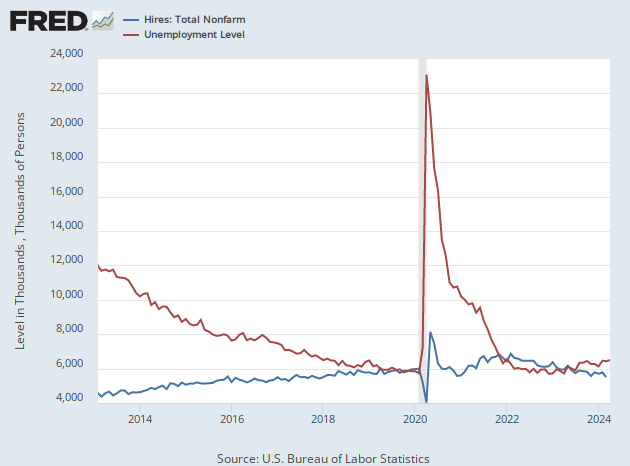

Note that even the revised levels are not elevated by historical standards. As the chart below indicates, they actually look quite normal compared with the prepandemic period and are on the low side compared with the prevalent levels in the longer term.

In some ways, the upward revisions to this year’s claims estimates are reassuring. Many companies have announced layoffs in recent months, and it was becoming a bit of a mystery why claims were not rising. The low-level of claims also suggested that the Federal Reserve’s rate hikes were doing less to soften demand for workers than anticipated. The new claims show at least some softening, even if the labor market remains quite tight.

Mixed Messages from JOLTS

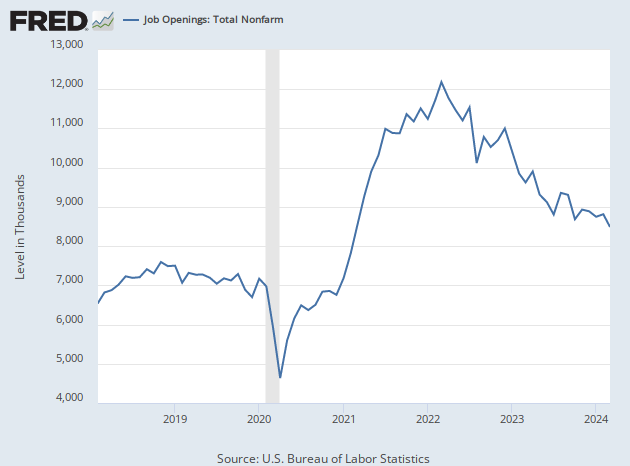

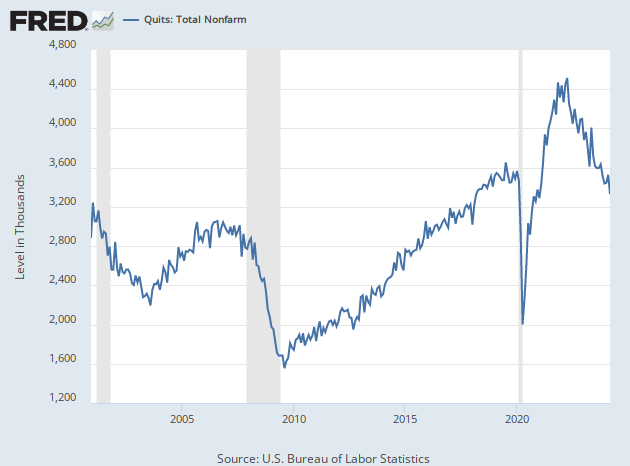

This week’s Job Openings and Labor Turnover (JOLTS) survey, which measures vacancies as of the final day of February, sent mixed signals. The number of job openings declined for the second month in a row, but remains extremely high by historical standards. The number of quits, however, actually moved up in February, something that usually indicates a high level of perceived demand for workers.

It’s often easier to appreciate this in charts rather than just reading the figures. Here are the openings going back five years:

Here are quits going back five years:

Total nonfarm hires were more or less unchanged in February, suggesting that demand for labor remains quite high. One way of thinking about the imbalance between demand for labor and the supply is to measure the level of unemployment against the level of hiring. Until the year after the pandemic, there tended to be more people unemployed than were hired in any given month. In fact, usually there was a large pool of unemployed people compared with total hires. Since the start of 2022, however, hires have been above the number of unemployed people.

What Will Jobs Mean for the Fed?

Of course, the major reason tomorrow’s jobs numbers have the potential to be so consequential is their expected influence on the Fed. These will be the last jobs numbers the Fed will see before its meeting on May 2-3. If the report comes in strong, it may be seen as forcing the Fed to hike interest rates again. A soft number would likely be seen as paving the way for a pause.

The fed funds futures market currently gives about even odds for a hike or a pause at the May meeting. We expect this is an underestimation of the odds that the the Fed will hike. Even a somewhat weaker-than-expected jobs number might still result in a hike because the Fed wants to move the market away from the conviction that cuts are coming later this year. Pausing at the next meeting would likely have the opposite effect, encouraging investors to expect cuts. What’s more, the Fed might look through weakness as resulting from the bank turmoil that struck mid-month—something that Fed officials view as largely in the rearview mirror.

Programming note: Breitbart Business Digest will be off for Good Friday and returning next week.

COMMENTS

Please let us know if you're having issues with commenting.