In an unprecedented and surprising move, the Federal Reserve announced on Wednesday that it will keep interest rates near zero and will purchase $85 billion in bonds every month until unemployment falls from its present 7.7% to 6.5%.

The new plan will maintain the $40 billion a month of mortgage-backed bond buying it began in September while adding another $45 billion in Treasuries.

Where will the cash to bankroll the $85 billion-a-month bond-buying binge come from? The Fed plans to expand its $2.8 trillion balance sheet.

The new round of so-called “stimulus” is meant to replace the soon to expire “Operation Twist” program that shoveled $45 billion a month into long-term Treasuries funded by the sale of short-term debt. Since that effort failed to create economic growth, and the Fed has no more short-term securities left to sell, the Wall Street Journal says the Fed will “effectively print more money” out of thin air to fund the scheme.

Why is the Fed foisting this newest round of “stimulus” on the American economy? Because economists predict that last quarter’s anemic 2.7% economic growth figure will slide down to a near lifeless 1.2% this quarter.

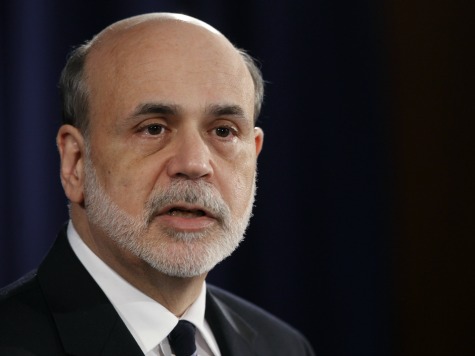

Fed Chairman Ben Bernanke believes printing and pumping billions of new dollars into the U.S. economy while holding interest rates near zero until joblessness falls (unless inflation exceeds 2.5%) will help interest rates remain low and will jump-start investment and job creation. But mortgage rates and other loan rates are already at historic lows, and job creators have signaled that they have few plans to boost hiring.

Since 2008, the Fed has more than tripled the size of its portfolio of assets to $2.861 trillion.

COMMENTS

Please let us know if you're having issues with commenting.