Fukoku Mutual Life Insurance added some fuel to the discussion of jobs threatened by computers with its year-end announcement that nearly a third of its staff would be replaced by an artificial intelligence, eliminating 34 jobs and saving almost $2 million per year.

Japan’s The Mainichi explains how the new system will work:

The insurance firm will introduce an AI system based on IBM Japan Ltd.’s Watson, which according to IBM is a “cognitive technology that can think like a human,” and “can analyze and interpret all of your data, including unstructured text, images, audio and video.” The Watson-based system will be tasked with reading medical certificates written by doctors and other documents to collect information necessary for making payouts, such as medical histories, length of hospital stays, and surgical procedure names.

In addition to determining payment amounts, the system will also be able to check customers’ cases against their insurance contracts to find any special coverage clauses — a measure expected to prevent payment oversights. The type of payments the AI is expected to oversee at Fukoku Mutual totaled some 132,000 cases in fiscal 2015.

The move is not completely without precedent, as The Mainichi notes another life insurance company called Dai-ichi is already using a system based on Watson to process payment assessments, but it works alongside human operators, and there were no job cuts when it was installed. Nippon Life Insurance is using an A.I. system to recommend coverage plans for its customers, but again, the data is relayed to human sales staff, so the computer program enhanced human performance, rather than outright replacing people.

Presumably, the success of Dai-ichi’s program led Fukoku management to consider their bolder A.I. strategy, and if it works, other companies will consider replacing workers with computers. The Mainichi reports that another company, Japan Post Insurance, is set to begin a trial run with a Watson-based system in March.

As with the White House’s recent report on jobs threatened by “artificial intelligence,” the machines in question aren’t self-aware. The term is used somewhat loosely by pundits and analysts to describe computers that have grown sophisticated enough to handle decision-making tasks that formerly required human minds.

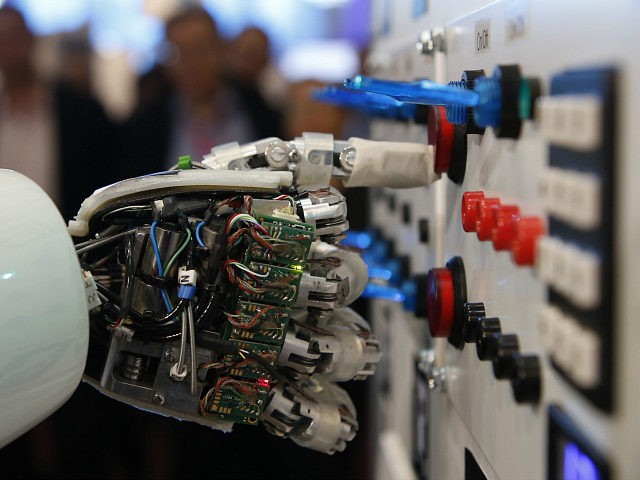

It is a second wave of automation, following the earlier revolution that replaced human industrial workers with robots, but now it is white-collar workers losing their jobs — and not just the trimming of staff that has come slowly and steadily as computers made office workers more productive over the past few decades, but major employment disruptions. Fukoku is handling its job cuts mostly through attrition, according to the Mainichi report, so the job losses will be gradual, but the bottom line is that 30 percent of staff being replaced by a computer system echoes the more dire scenarios of jobs “threatened” by artificial intelligence.

The process will be sped along not just by improved computer power, but also by increasing consumer acceptance of machines in roles formerly held by humans. Rising labor costs soaring past falling automation costs are also a factor. Yesterday, computers couldn’t do the job, customers did not want to deal with them, and they were too expensive. Tomorrow, they will be able to do everything, customers prefer them to often-cantankerous human workers, and the cost savings over human labor will make it hard to say no to automation.

COMMENTS

Please let us know if you're having issues with commenting.