Top Trump administration officials indicated that while the president still backs repealing the Obamacare individual mandate, the administration would accept a tax reform package that left the mandate in place.

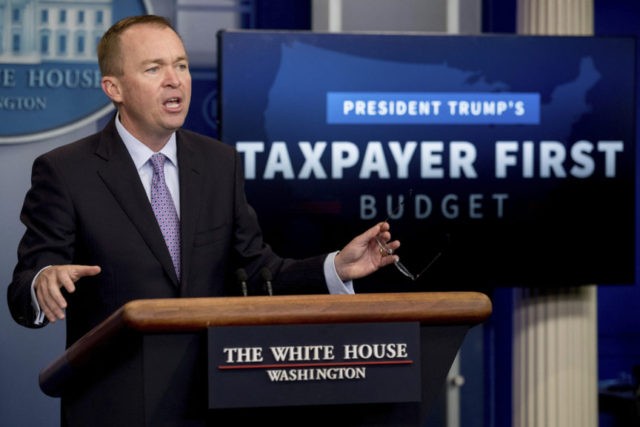

White House budget director Mick Mulvaney said Sunday the White House would be “okay” with dropping the repeal from the Senate plan. The House bill passed last week did not include the repeal of the mandate.

“If we can repeal part of Obamacare as part of a tax bill, and have a tax bill that is still a good tax bill that can pass, that’s great,” Mulvaney said in a CNN interview. “If it becomes an impediment to getting the best tax bill we can, then we’re okay with taking it out. So I think it is up to the House and the Senate to hammer out those details.”

Treasury Secretary Steve Mnuchin said on Fox that while President Trump doesn’t regard the mandate as a “bargaining chip” in the tax negotiations, the overall goal of passing tax reform would take priority.

“This is all about getting this passed in the Senate, that’s the objective,” Mnuchin said. “This isn’t a bargaining chip. The president thinks we should get rid of it. I think we should get rid of it.”

Mnuchin and Mulvaney were reacting to comments by Senator Susan Collins (R-Maine) who said she has concerns over repealing the mandate. On Sunday, she said in an interview with ABC that including the repeal in the Senate version was a big “mistake.”

“I hope it will be dropped,” she said.

Collins has also said she would favor cutting back the size of the corporate tax cut so that the rate would fall from 35 percent to 22 percent, instead of the 20 percent in the current House and Senate bill. She would then use the additional revenue to pay for keeping in place the deductions for state and local taxes.

Collins, however, has also said she still has objections to the mandate itself. She declined to say whether she would oppose the bill when it comes up for a vote in the Senate, likely after Thanksgiving.

COMMENTS

Please let us know if you're having issues with commenting.