Gov. Jerry Brown and State Treasurer John Chiang plan to tap California’s government payroll accounts to make long-term subsidized loans to the state’s public pension plan in a scheme that hasn’t been tried since it bankrupted Orange County in 1994.

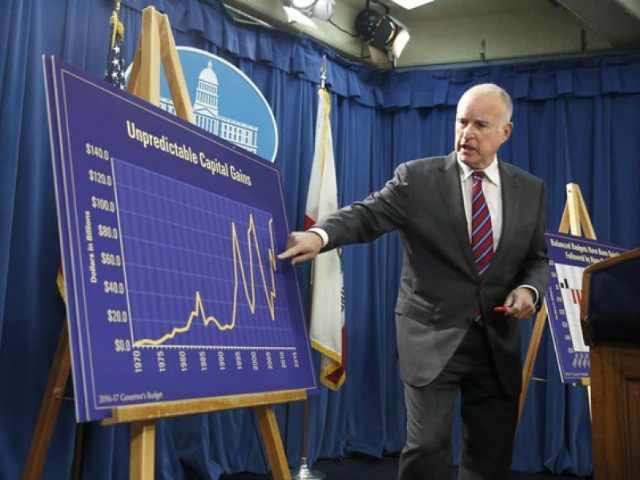

Breitbart News recently reported that although Gov. Brown’s 2017-2018 May Budget Revision trumpeted that California will collect an extra $2.5 billion in capital gains taxes, the same data revealed that sales taxes, which are considered the best measure of the health of the state’s economy, “were revised down by $1.2 billion, reflecting weak cash receipts.”

Deep in the 91-page budget report, Brown also revealed that last year’s 22 percent jump to $279 billion for the retiree pension and lifetime healthcare liabilities will force the state’s annual pension plan contributions to almost double from $5.8 billion this year to $9.2 billion by FY 2023-24.

Brown warned that deteriorating tax trends and mushrooming pension payments put California at risk of suffering a catastrophic $20 billion deficit in a “moderate recession.”

But according to the Los Angeles Times, Brown apparently has convinced State Treasurer and fellow Democrat John Chiang to bail out a big piece of the state’s rising pension costs for the next 12 years by making a $6 billion loan at a highly-subsidized interest rate from the Treasury’s $76.5 Billion “Pooled Money Investment Account” (PMIA).

The PMIA has traditionally served as a money-market fund for the state’s general fund, agencies, counties, and cities to invest short-term cash, including payroll accounts. According to the PMIA’s September 2016 audit, the fund earns only a 0.88 percent current yield, because it provides overnight cash liquidity to depositors by investing in U.S. Treasurys and agencies, plus high-quality repurchase agreements, certificates of deposit, and commercial paper with an average maturity of 185 days (about 6 months).

The last time a state or local treasurer running a government money market fund participated in this type of “borrowing short and lending long” scheme was Orange County’s Bob Citron.

The OC Treasurer was celebrated as a genius by local political leaders for making almost $1.3 billion in excess profits over an 9-year period by investing $7 billion of county and local government short term and payroll cash in longer term 5-year U.S. Treasury Bonds. Unfortunately, Citron’s fund suffered a $2.3 billion loss in 1994 and “the OC” filed the largest Chapter 9 municipal bankruptcy in history.

The resulting scandal and huge loss of taxpayers’ funds caused the Securities & Exchange Commission to adopt Rule 33-7320, which severely restricts money-market mutual funds from leveraging principal risk by “borrowing short and lending long.”

But under U.S. constitutional state sovereignty, the SEC has no jurisdiction over any funds managed by the Treasurer of the State of California.

Treasurer Chiang claims he supports the pension loan, because the CalPERS pension plan will pay his PMIA the more favorable yield of a 2-year Treasury Note, currently yielding 1.21 percent. But that means the PMIA is being asked to make a highly subsidized loan, since the current yield on an equivalent 12-year California General Obligation bond is 2.23 percent, or about 85 percent higher.

COMMENTS

Please let us know if you're having issues with commenting.