Plans to release the text of a tax reform bill on Wednesday were delayed Tuesday night with a new goal of releasing the Republican bill on Thursday.

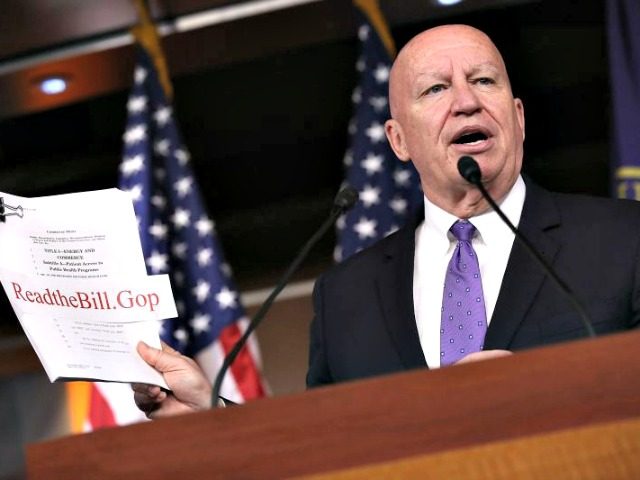

Late Tuesday, House Ways and Means Committee Chairman Kevin Brady (R-TX) released the following statement in regards to the delay:

Ways and Means Committee Members met tonight to discuss the work we are doing on pro-growth tax reform. In consultation with President Trump and our leadership team, we have decided to release the bill text on Thursday. We are pleased with the progress we are making and we remain on schedule to take action and approve a bill at our Committee beginning next week.

Republicans in the House, Brady, and Trump Administration officials have repeatedly assured Americans that they plan to pass a massive tax reform bill into law by the end of 2017. Tax reform has been one of the Trump Administration’s top priorities.

The decision to delay release of the bill at a 9:00 a.m. press conference on Wednesday came after Ways and Means Committee members spent all day Tuesday trying to resolve final disagreements on the bill, according to Politico. Senior staff also spent all night on Monday working on the bill with the intention to do the same Tuesday night.

Details of the bill have been dangled for months, with built-up releases of tax reform plans from the House and the Trump Administration only revealing frameworks of what tax reform is intended to produce. While the Trump Administration framework for tax reform had earlier laid out a 15 percent corporate tax rate, that eventually creeped up to 20 percent with pressure from House Republican Leadership.

After House Majority Leader Paul Ryan briefed some conservative leaders, Politico reported leaked details that are said to have been finalized. Those details included the 20 percent corporate tax rate and retaining a top tax rate of 39.6 percent; however, the income level which this rate will hit remained unclear. That bracket may move up from $750,000 to $1 million. The estate “death” tax repeal may be phased out over time rather than an immediate end.

According to the Politico report, the proposed cut in State and Local Tax (SALT) deductions may be one of the sticking points that led to delay of the bill text’s release. Preventing wealthy individuals from taking the 25 percent small business “pass through” rate and treatment of 401(k) plans may also be among the issues causing delay.

Follow Michelle Moons on Twitter @MichelleDiana

COMMENTS

Please let us know if you're having issues with commenting.