The Federal Reserve announced on Friday that it will buy short term debt of the U.S. government to maintain ample reserves in the banking system.

The surprise announcement followed an unusual and unscheduled, and previously undisclosed, meeting of the Federal Open Market Committee on October 4 via videoconference.

The Fed said it will start its new balance sheet expansion by buying around $60 billion of Treasury bills a month. It is hoped that the purchases, which swap reserves for Treasury bills, will relieve stress in the bank funding market.

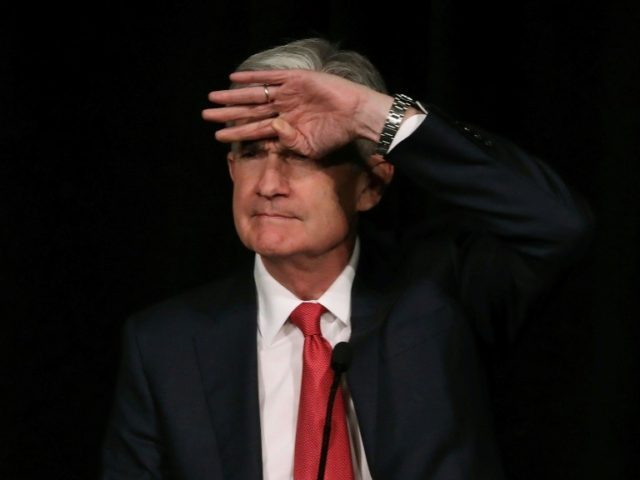

Earlier this week, Jerome Powell indicated that the Fed would start to expand its balance sheet but insisted the policy should not be considered a new phase of quantitative easing because it was not aimed at generally loosening the stance of monetary policy or boosting economic growth. Instead, Powell said, the new purchases would be undertaken for technical reasons relating to the bank funding market.

In addition, the Fed said it will conduct overnight repo operations at least through January.

On Thursday, bank regulators from the Fed announced that they would ease bank liquidity requirements. Although such a change has long been contemplated and is not directly tied to the recent tensions in the repo market, it could ease some of the conditions that led to that stress.

COMMENTS

Please let us know if you're having issues with commenting.