Amid many signs that the U.S. economy may not have contracted as much as expected given the fevered rate of Fed rate hikes, U.S. wholesale inventories continued to expand in July but at a slower pace.

That could indicate cooling demand. Several large retailers have indicated they are bringing down their own inventories in light of changing consumer demand, which likely has caused wholesale merchants to pull back as well.

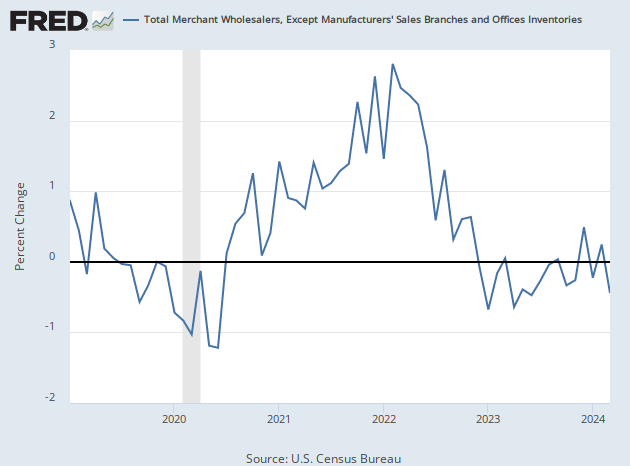

Inventories of U.S. merchant wholesalers rose 0.6 percent in July on month, the Commerce Department said Wednesday. That was below the preliminary estimate for an increase of 0.8 percent. Wall Street had expected inventories to grow at the pace reported in the preliminary report.

The pace of wholesale inventory expansion has been slowing since February, when they climbed 2.8 percent compared with the previous month. In June, wholesale inventories rose 1.8 percent.

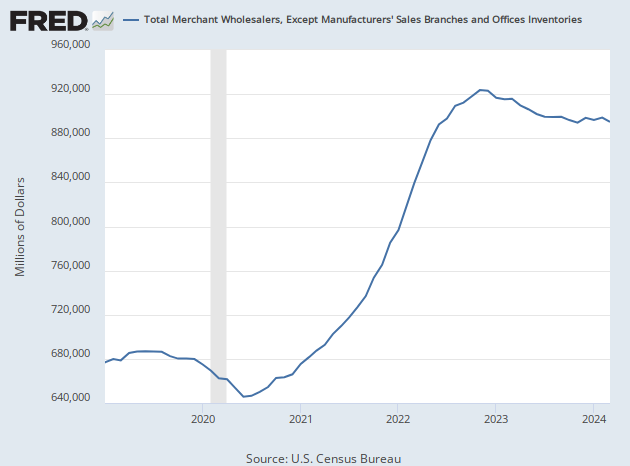

Despite the slowdown in the pace of inventory building by wholesalers, total inventories have continued to expand. Total inventories were up 25.1 percent from the revised July 2021 level.

Inventories—both at the wholesale and retail level—are a key component of gross domestic product (GDP) and the business cycle. GDP is equal to final sales plus net inventory investment, which means the change in GDP must reflect changes in sales, inventories, or both. Accelerating inventory growth tends to reflect economic optimism and directly adds to the calculation of GDP growth. A slowing pace of inventory growth lowers GDP growth, even if inventories are growing in absolute terms. Alan Blinder, a former Governor of the Federal Reserve System, once said “the business cycle, to a surprisingly large degree, is an inventory cycle.”

The two quarterly contractions in the first half of this year were in part caused by slowing inventory growth. In the first quarter, inventories subtracted 0.8 percent and in the second quarter inventories subtracted 1.83 percentage points from GDP. Strong consumer spending, however, kept GDP from falling by all that much. In the second quarter, it fell by just 0.6 percent.

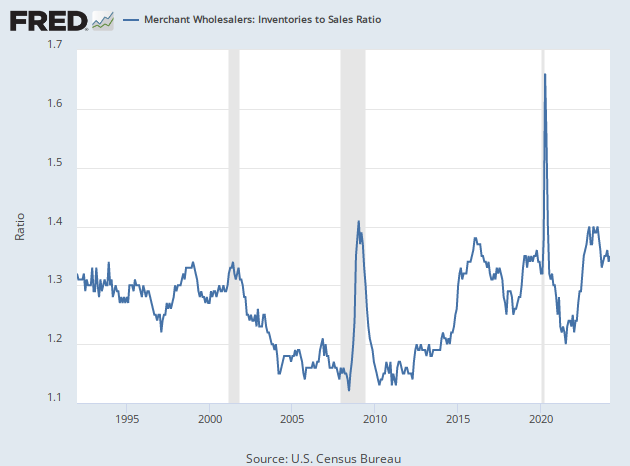

The ratio of wholesale inventories to sales—a key barometer of economic health—inched up to 1.29, up from 1.26 the previous month. In July 2021, the ratio was 1.19. A high inventory-to-sales ratio is often a leading indicator of a downturn as it can encourage manufacturers to pullback on production because consumer demand is weaker than expected. Current levels, however, are near the long-term average.

Durable goods wholesale inventory levels rose 1.0 percent in July, down from the 2.2 percent pace registered in June. Most categories of durable goods inventories rose for the month, including cars and machinery, albeit at a slower pace than the prior month. Lumber inventories declined by one percent and the inventory to sales ratio declined from 1.65 to 1.60, both likely reflecting a slowdown in the home building sector.

Nondurable goods inventories fell 0.1 percent. There were larger declines in drugs, farm products, and petroleum.

The figures are adjusted seasonally but not for inflation.

COMMENTS

Please let us know if you're having issues with commenting.