The Bidenomics Summer Gambit Goes Bust

If Joe Biden was hoping this would be a hot Bidenomics summer, he has got to be feeling pretty disappointed right now.

The best way to think about the Bidenomics push from the White House is as a bet on a strengthening economy and cooling inflation. In some ways, this was an outlandish gambit because the odds were always against what Wall Street has been calling “immaculate disinflation.“ The most likely outcomes were that inflation would remain persistently high or the economy would significantly slow down.

Most economists saw the latter outcome—sluggish growth or even an outright recession—as the most likely. A few analysts—including the folks who bring you Breitbart Business Digest—argued that we were most likely to see high inflation paired with an economy that would continue to grow at a pace that Federal Reserve officials describe as “above trend.”

The trouble for Biden was that neither of these outcomes looked particularly pleasant in terms of the 2024 election. If the economy fell into a recession in the second half of this year or early next year, Biden would be making a plea for another four years amid rising unemployment. If inflation stayed hot, Biden would look ineffectual on what poll after poll shows to be the top issue for voters.

So, the Biden gambit was to shoot the moon: bet on the improbable outcome and claim credit for it. It was never likely to pay off, but there was little downside because if the economy did not improve, Biden was likely to suffer in November. Might as well try for the maximum upside.

The Economy Did “Immaculately Disinflate” a Bit

Earlier this summer, the improbable outcome was looking increasingly less improbable. Inflation made a big climb down, helped in part by the fact that prices rose so much last year that the year-over-year numbers were always going to look flattering. The economy actually accelerated from the first quarter’s two percent rate of growth to the second quarter’s 2.1 percent rate. Now it looks as if the economy could grow at a better than three percent rate in the third quarter.

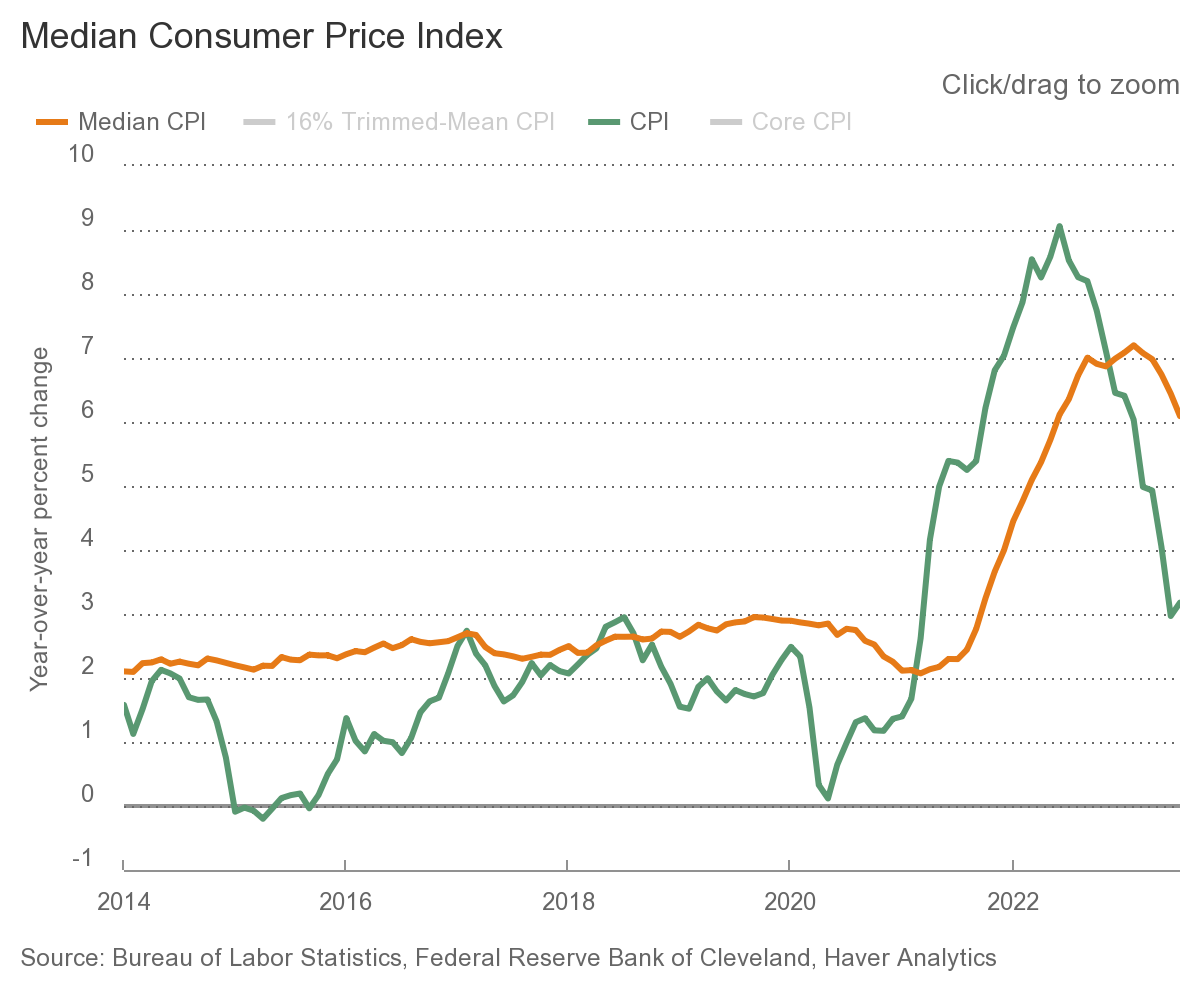

However, there have been signs that the inflation story was not as benevolent as it appeared to be. Underlying inflation, for example, has remained even more persistent than headline inflation. While the headline consumer price index (CPI) peaked at 9.06 percent in June of last year, median CPI did not peak until February of this year. Where headline CPI fell all the way from nine percent down to around three percent in June of this year, median CPI has only declined from February’s seven percent to July’s 6.1 percent.

Looking at the month-to-month changes in median CPI, we see that there has been no downward trend at all. After registering 0.6 percent in February, median CPI clocked in at 0.4 percent for four months in a row. It fell in July down to a more moderate 0.2 percent but is likely to climb again when the August numbers are released later this week.

Inflation, in other words, has proven stickier than most economists expected or the Biden administration hoped.

Increasing Public Pessimism

The public clearly views Bidenomics as a flop. On Monday, the Federal Reserve Bank of New York released the results from its monthly survey of consumer expectations. This showed that consumers are increasingly pessimistic about the labor market and household finances. On inflation, the public’s views were largely unchanged.

The share of the public that says it expects their own household financial situation to be “much better” a year from now slipped from 3.9 percent in July to 3.5 percent in August. The share expecting things to be “somewhat better” dropped from 25.4 percent to 20.3 percent, a significant slide.

Those expecting their household financial situation to be about the same climbed from 44.1 to 46.9 percent. Those expecting things to be somewhat worse fell from 27.7 percent to 24.9 percent (a thin silver lining for Biden), but those expecting things to get much worse climbed to 4.4 percent from 3.9 percent.

The New York Fed’s survey also asks consumers to compare how they are now to a year ago. The share saying things have gotten much better dipped from 3.3 percent to 3.1 percent. The share saying things are “somewhat better” fell to 14.9 percent from 18.2 percent. The share saying they expect no change rose to 41.9 percent from 38.7 percent.

In the retrospective question, there was a dip in the “somewhat worse” response: from 32.7 percent to 29.5 percent. Unfortunately for Biden, all of that change is explained by those moving down into the category of people who say things are much worse now than a year ago. This rose from 7.1 percent to 10.6 percent from July to August.

A recent poll by the Wall Street Journal found that around three in five voters disapprove of Biden’s handling of the economy. Sixty-three percent say they do not like how Biden has handled the issue of inflation.

Of course, the last hand in the game has not been dealt. There’s still a chance that the Bidenomics bet pays off. But from the perspective of September 2023, that still looks like a long shot.

COMMENTS

Please let us know if you're having issues with commenting.