CPI, CPI, CPI All the Way

The inflation report released Tuesday is unlikely to do much to support the idea that Bidenomics has been a boon for the American economy.

The consumer price index (CPI), the Department of Labor’s measure of what U.S. consumers pay for goods and services, climbed 0.1 percent on a monthly basis, an acceleration from the flat figure for October. This was good enough to bring down the annual increase to 3.1 percent.

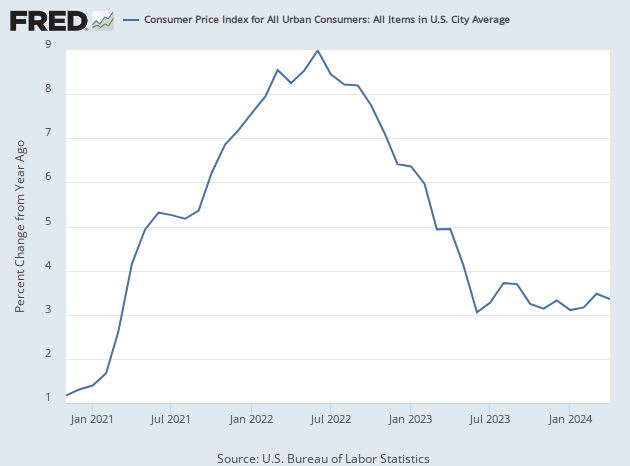

While Biden’s supporters and many in the establishment financial media—we apologize for the redundancy, but that is just the way the world is—enjoy pointing out that this is far below the 9 percent inflation hit in June 2022, it is worth noting that we’ve been here before. Inflation fell to 3.1 percent on an annual basis in June and spent the last four months higher.

If you chart out the annual inflation rate, it does not look like inflation is on a path to two percent or that those legendary lagged effects of monetary policy are taking hold. Instead, it looks like inflation fell rapidly from June of 2022 to June of 2023 and has since bumped along slightly higher than three percent. Not coincidentally, the last period of sustained sharp declines in inflation ended one month before the Federal Reserve’s final 2023 rate hike in July.

Dashing Through the Core…

Core inflation, which peaked in September of 2022 at 6.6 percent, has been much stickier. It has been gently falling since its peak, but lately the decline has become so gentle as to become almost unnoticeable. Twelve-month core CPI, which excludes food and energy prices, was up 4.01 percent in October and 3.99 percent in November. Both of which round out to four percent.

The monthly core CPI figures also showed acceleration. The core price index rose an ungrounded 0.28 percent compared with the previous month, up from October’s monthly rise of 0.22 percent. In September, the core index was up 0.32 percent. After rounding, November matches September, and October gets counted as one-tenth of a point lower.

If we look at averages to smooth out month-to-month volatility, it appears that core inflation has accelerated a bit. The most recent three months averages to 0.3 percent. The previous three months averages 0.2 percent.

In a One-Month Annualized Sleigh…

Another way of looking at inflation is to annualize the most recent figures, extrapolating the most recent data to cover 12 months. It’s another way of saying that if inflation ran at last month’s rate for a year, this is what it would look like.

The annualized rate for core CPI in November comes out to 3.5 percent, up from the annualized 2.8 percent a month earlier. The two months prior to those came in at 3.9 percent (September) and 3.4 percent (August).

One of the reasons economists and analysts often fail to understand why inflation is weighing so heavily on Americans is that they tend to focus on measures such as “six-month moving average inflation.” Those tend to be meaningless in terms of public sentiment because they do not track household price experience. There’s no one who is much happier about inflation when they find out that the annualized rate of core CPI is four-tenths of a point lower now than it was in August—in the unlikely circumstance that anyone discovers such information.

President Joe Biden walks through the Cross Hall of the White House prior to delivering a Christmas address on December 22, 2022, in Washington, DC. (Alex Wong/Getty Images)

A better measure of inflation’s impact on households is to look at how much prices have risen since inflation accelerated beyond the two percent levels the Federal Reserve considers sustainable and healthy over the long term. CPI first jumped above the Fed’s target in March of 2021. Since that time, the CPI is up 16.2 percent. Core prices are up 15 percent. A bit of back of the envelope math tells us that we’ve had around 11.6 percentage points of excess annual inflation—above what we would have had if inflation had remained at two percent—in the 32 months since inflation broke out.

Averaging All The Way!

When forecasting inflation, we like to look at the median and trimmed mean inflation. These both rose on a monthly basis. Median CPI, as calculated by the Cleveland Fed, accelerated from a 0.3 percent rise in October to 0.4 percent. Unrounded, the increase was from 0.31 percent to 0.43 percent. If we annualize the monthly figure we get a better sense of what this means for the rate of inflation: it comes to 5.3 percent, a sharp increase from the 3.9 percent last month.

The Cleveland Fed’s 16 percent trimmed mean inflation rose from 0.2 percent to o.3 percent in rounded figures. Unlike median CPI, however, rounding exaggerates the change. Unrounded, trimmed mean rose from 0.23 percent to 0.27 percent. Annualized, this comes in as a rise from a rate of 2.9 percent to 3.3 percent.

These average inflation metrics are good barometers of underlying inflation pressures. They suggest that inflation is unlikely to continue on a steady downward path to the Fed’s two percent target. In fact, there’s little to suggest that inflation will continue on a bumpy path to the target without additional monetary tightening.

Prior to the release of the inflation data, the market was pricing in around four rate cuts next year. The release did little to change that view. If Fed Chairman Jerome Powell thinks that is too aggressive, he’s gong to have to push back very hard at his press conference Wednesday. Somehow we doubt he’s in the mood to play the Grinch who Steals the Rate Cuts.

COMMENTS

Please let us know if you're having issues with commenting.