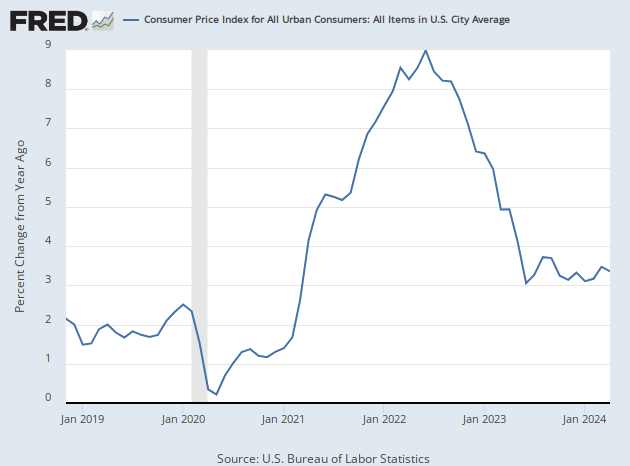

Inflation accelerated slightly in November, marking the thirty-second consecutive month with annual prices rising significantly faster than the two percent target seen as healthy by the Federal Reserve.

The consumer-price index, the Labor Department’s broad measurement of what consumers pay for goods and services, rose 3.1 in November from a year earlier, a slightly lower annual rate from October.

Consumer inflation hit its recent peak of 9.2 percent in June of 2022 and has since retreated as the Federal Reserve raised interest rates at a record pace and the Biden administration’s spending was reined in by lawmakers worried about extraordinarily large budget deficits.

Compared with the prior month, the consumer-price index rose 0.1 percent in November, up from the flat month-to-month reading in October. Economists had been expecting the Department of Labor to report another flat month for inflation.

President Biden suffers from very low approval ratings, driven by public dissatisfaction with high inflation and the administration’s leadership on economic issues. Attempts by the Biden administration to shift public opinion by claiming as achievements of “Bidenomics” that more benign developments in the economy, including the return of unemployment to levels last seen while Donald Trump was president, have largely backfired.

So-called core prices, which exclude volatile food and energy items, rose four percent compared with a year ago. From the previous month, core prices rose by an expected 0.3 percent, an acceleration from 0.2 percent in October.

Stocks and bonds have soared over the past month or so as investors decided that the Fed was not only done hiking interest rates but likely to cut in the first half of next year. The market is currently pricing in around four quarter-point rate cuts next year. Yields on 10-year Treasuries have fallen to around 4.20 percent, down by about 80 basis points from their recent high in mid-October. The S&P 500 recently hit 4,686, close to its all-time closing high of 4772 reached in October of 2021.

Stocks, bonds, and swaps linked to monetary policy were little changed after the consumer-price indexes for November were released on Tuesday, suggesting the data did little to change expectations for inflation or policy.

Energy prices declined sharply in November, falling 2.3 percent compared with October, the second straight decline. Compared with a year ago, energy prices are down 5.4 percent. Gasoline prices dropped six percent in the month, bringing the annual decline to 8.9 percent.

Services prices excluding energy-related services are up 5.5 percent compared with a year earlier. They rose 0.5 percent in November compared with the prior month, an acceleration from the 0.3 percent increase in October.

The prices of goods excluding food and energy were flat with a year earlier. They fell again in November from October, the sixth consecutive monthly decline. The prices of new vehicles declined 0.1 percent from the month, matching the prior month’s decline. Compared with a year ago, new car and truck prices are up 1.3 percent. Used car prices unexpectedly surged 1.3 percent compared with the prior month but remain 3.8 percent lower than they were a year ago, when the used car market was still under pressure from vehicle shortages linked to an insufficient supply of microchips.

COMMENTS

Please let us know if you're having issues with commenting.