This morning’s key headlines from GenerationalDynamics.com

- Dept. of Justice announces civil lawsuit against S&P ratings

- Royal Bank of Scotland fined $612 million for Libor-rigging

- The moral bankruptcy of Libor-rigging traders

- Ron Baron, Baron Capital, doubles down on lying about stock valuations

Dept. of Justice announces civil lawsuit against S&P ratings

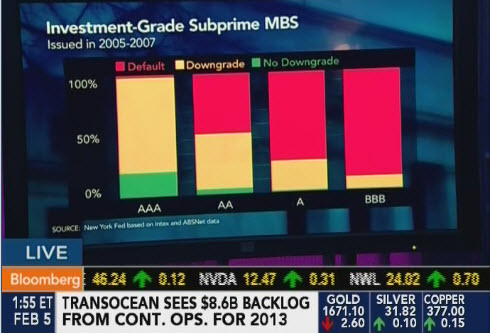

Results of investment-grade subprime mortgage-backed securities issued in 2005-2007 (Bloomberg)

As we’ve been saying for a long time, the Obama administration hasadamantly refused to even investigate, let alone prosecute, Americanbankers for the financial crisis, even where there’s massive evidenceof fraud. (See “Financial Crisis Inquiry hearings provide ‘smoking gun’ evidence of widespread criminal fraud” from 2010.) I’ve described two reasons forthis: One is that Generation-Xers, having had bad experiences with thecriminal justice system in the 1980s, are unwilling to prosecute otherGen-Xers; the second is that the Obama administration benefitedgreatly through criminal activities of bankers because of campaigncontributions.

Now the tide seems to be turning. It’s becoming overwhelmingly clearthat the crimes of Gen-Xers were so egregious that blaming Boomers nolonger makes sense in many cases. And the presidential campaign isover, so there’ll be no more political contributions for a whileanyway.

On Wednesday, the Justice Dept. filed a civil lawsuit chargingStandard & Poors Financial Services with effectively colluding withbanks to give invalid AAA ratings to synthetic securities backed bysubprime mortgages. According to e-mail messages, S&P knew as earlyas 2004 that their models were wrong, but they kept the invalid modelsanyway so that they could continue issuing AAA ratings. (See“A primer on financial engineering and structured finance” from 2008.)

The result of this fraud was disastrous, as shown by the chart above,which shows the default rate of investment grade subprimemortgage-backed securities issued in 2005-2007. AAA rated securitieswere downgraded (equivalent to a default) 80% of the time, even thoughthe ratings models assume that an AAA default rate of less than 0.1%.Even BBB rated securities are supposed to downgrade or default only 1%of the time, but 100% of them failed. USA Today and Dept. of Justice and Text of lawsuit (PDF)

Royal Bank of Scotland fined $612 million for Libor-rigging

Libor (London Interbank Offered Rate) is the benchmark interest rateused in the pricing of some 1/3 of $1 quadrillion in financialinstruments worldwide, so even a small change in the Libor rate canaffect trillion of dollars in securities. There are about 20 banks inEurope and N. America that compare rates every day to come up with theLibor index for that day. What was revealed last year was thatbankers at Barclays were purposely rigging Libor rates in order tocontrol the values of securities that they bought and sold, in orderto make vast profits. The bankers setting Libor rates at the 20 banksknew each other and did favors for each other — raising or loweringLibor rates by small amounts so that they could all profit — inwhat is being called the biggest financial fraud of all time.

For example, an e-mail message from one UBS to a trader in 2008says:

“I need you to keep it [Libor] as low as possible. Ifyou do that … I’ll pay you, you know, $50,000, $100,000 …whatever you want … I’m a man of my word.”

According to former Fed Chairman Alan Greenspan:

“Through all of my experience, what I nevercontemplated was that there were bankers who would purposelymisrepresent facts to banking authorities. You were honor boundto report accurately, and it never entered my mind that, asidefrom a fringe element, it would be otherwise. I waswrong.”

Greenspan is part of the Silent generation that survived the GreatDepression and World War II. The reason that he was wrong is becausehe never dreamed that Generation-X would be so much more lackingin ethics and morals than his own generation.

On Wednesday, the Royal Bank of Scotland (RBS) was fined $612 millionfor “widespread misconduct” in the same Libor scandal. One RBSemployee jokingly texted: “I’m like a whores’ drawers. I’ll sendlunch around for everybody.” The RBS traders were so stupid that theycontinued rigging Libor even after the investigation had started.Guardian (London) and Bloomberg

The moral bankruptcy of Libor-rigging traders

The stupidity, depravity and debauchery of the Libor-rigging tradersis so egregious, that the public may actually be catching on to whathappened. According to the Economist:

“They were said to be among the most talented of theirgeneration, recruited after exhaustive interviews and gruelinginternships. They worked at firms prepared to spend small fortunesto attract and retain them lest they take their skillselsewhere. Yet the moral bankruptcy of traders implicated in therigging of the London Interbank Offered Rate (LIBOR), one of theworld’s most important interest rates, is matched only by theincompetence with which they covered their tracks.

Take traders at the Royal Bank of Scotland (RBS), who left a trailof evidence in a trove of e-mails and audio recordings detailinghow they set about trying to manipulate LIBOR, even after theyknew investigators were looking into the issue. “We’re just notallowed to have those conversations over Bloomberg anymore,” saidone trader, laughingly, in a call to another who a little earlierhad asked in writing for a rigged rate. “Its [sic] just amazinghow libor fixing can make you that much money,” was the verdict ofanother trader. …

The scandal has also hardened the views of regulators andpoliticians.”

If the views of regulators and politicians are really becomingprosecutions. The Economist

Ron Baron, Baron Capital, doubles down on lying about stock valuations

Ron Baron, Baron Capital (CNBC)

The Libor-rigging scandal is only a small part of the sickness that’scontrolling Washington and Wall Street. Lying and fraud are the norm.I’ve repeated named names of so-called “experts” who lie openly aboutstock valuations. (See, for example, “14-Apr-12 World View — Wharton School’s Jeremy Siegel is lying about stock valuations” from earlier this year.) In today’sworld, respectable people are gangsters, and gangsters are treated asrespectable people. One of those people whom I quoted lying was Ron Baron, chairman and CEO ofBaron Capital. That was about a year ago.

Well, this week Baron was back on CNBC leaving me breathlessas he blurted one ridiculous statement after another. Here’swhat he said (my transcription):

“14,000 is where we were in the Dow Jones [IndustrialAverage] in 2007, so it’s been flat for five years. If you goback further than that to 1999, you’ll see that for the last 13years, it happens to be the worst period in the financial historyof the united states. The market is up 20-30%, companies havegone up in earnings 2 1/2 times. the reason that has happened wasbecause we started off in 1999 at 32 times earnings, we’re now at13 times earnings. So if you go back 100 years, 200 years, 50years, the stock market normally trades between 10 and 20 times[earnings], and the median is 15 1/2. You’re now 13, it was 32 -that’s the highest it’s ever been. So the market is now at anattractive level, compared to its median for a very long period oftime. …

We’ve been through civil wars, we’ve been through world wars,we’ve been through depressions, deflations, inflations, and yetthe stock market has grown 7% a year for 100 years, 200 years, andso do I think it’s gonna change over the next 20 years or 30years, no. And just every now and then you go through theseperiods of time where not much happens it happened – I started mycareer in 1970, between 1966 and 1982, the stock market tradedbetween 1000 and 600, and then in March of 1982, we started BaronCapital, the Dow is 880, and in August of that year, went to 1000,and went on the way to 14000. What I think is the same sortathing is gonna happen in the next 10 years maybe 20 years.Everyone who works in my firm and they’re gonna have the sameopportunities that I had in the 1980s and 1990s – they’re about tohave it.”

This is absolutely breathtaking in its erroneousness, since manyof the figures are lies.

- He says that the P/E ratio in 1999 was 32. That’s absolutely right, and by quoting that figure, he’s proving that he’s using the standard definition of the S&P 500 Price/Earnings ratio (using “one year reported earnings,” not “future forward fantasy earnings.”)

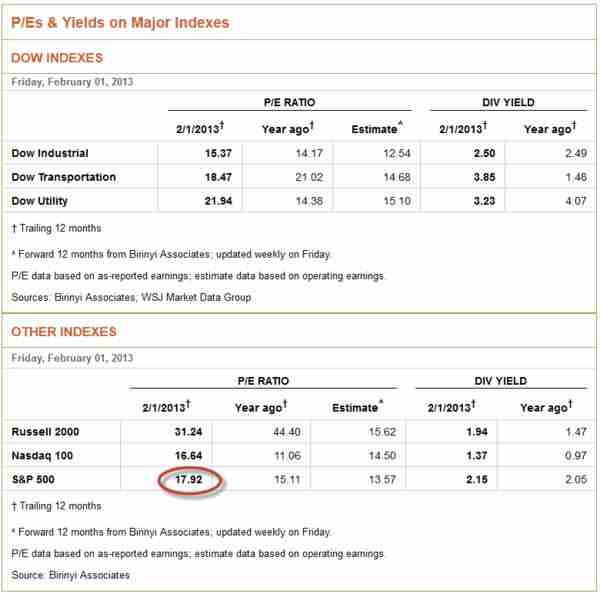

- He says that the P/E ratio is now 13. That’s a lie. According to the Wall Street Journal last week, the current P/E ratio is 17.92.

WSJ P/E ratio, Friday, February 1, 2013 - He says that it was 32 in 1999 and that was the “highest it’s ever been.” No, the highest it’s ever been was in 2008, when it went over 100.

- He says that the historical median P/E ratio is 15 1/2. No, that’s a lie. It’s 14.

- He says that the market grows by 7% per year. No, that’s another lie. I did that computation on my Dow Jones historical page, and the market grows by 4.5% per year, including inflation.

- He says that the current P/E ratio is 13, and concludes that the market is underpriced, same as in 1982. No, that’s another lie. In 1982, it was at 6.79, which is very low. Today it’s at 17.92, which is far above the historical average.

- So he says that stock market will grow in the next 10 years the way it did in the years after 1982. That’s a calamitous miscalculation. As I’ve written many times, the P/E ratio has been well above average continuously since 1995, and by the Law of Mean Reversion, the market will crash to below Dow 3000, as the P/E ratio returns to its 1982 level. (See “1-Jan-13 World View — 2013 Forecast: Financial Crisis and China Threat”)

So what should we make of this breathtaking display of stupidity? IsRon Baron just another debauched Libor-rigging crook who thinks it’sfun to defraud anyone for his own personal gain? Or is he so stupidthat he’s unable to do long division, and is unable to figure out howto divide price by earnings to get the P/E ratio? Well, Dear Reader,whether it’s crook or stupidity, this is not a person you should trustyour money with.

You have to remember, Dear Reader, that the Libor-rigging scandal wasnot some unique circumstance. It’s characteristic of the entirefinancial and political culture today, in Washington and on WallStreet, where massive fraud and screwing people is perfectly OK if youcan get away with it. And we’ve all barely begun to pay the price.

Permanent web link to this article

Receive daily World View columns by e-mail

COMMENTS

Please let us know if you're having issues with commenting.