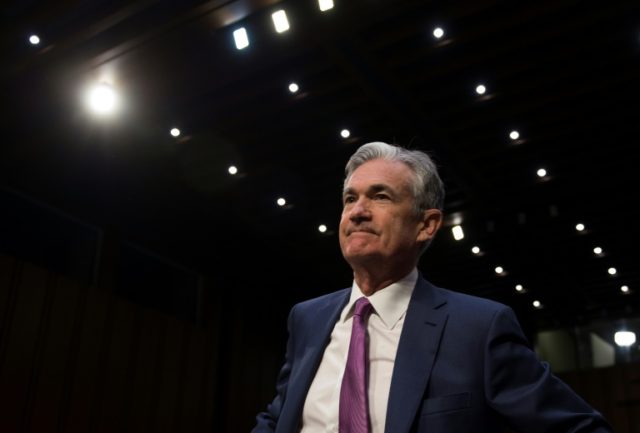

Federal Reserve Federal Reserve Chairman Jerome Powell defended the central bank’s strategy of gradually raising interest rates as a conservative course in an uncharted economy.

Powell, in a speech Friday kicking off the Kansas City Fed’s annual economic forum in Jackson Hole, Wyoming, described the economy as “strong” and said there were few signs that the economy risked overheating. He insisted that it was the Fed’s policy to support continued growth rather than attempt to slow down the economy.

“The economy is strong. Inflation is near our 2 percent objective, and most people who want a job are finding one,” Powell said “My colleagues and I are carefully monitoring incoming data, and we are setting policy to do what monetary policy can do to support continued growth, a strong labor market, and inflation near 2 percent.”

President Donald Trump has repeatedly criticized the Fed and Powell for raising rates, accusing the Fed of working against the administration’s goal of raising economic growth. Powell’s remarks appear to be a response to that criticism, as was widely expected. But the response was not an inflation hawk’s defense of slowing the economy to hold down inflation. Instead, Powell defended the Fed’s policy on the grounds that it would not undermine continued growth.

If hikes were to undermine growth, Powell indicated the Fed would change policy. The current path of gradual rate hikes would be continued only “if the strong growth in income and jobs continues.”

Powell acknowledged that the Fed is often at risk of “moving too fast and needlessly shortening the expansion, versus moving too slowly and risking a destabilizing overheating.”

“I see the current path of gradually raising interest rates as the FOMC’s approach to taking seriously both of these risks,” Powell said.

Powell is the first non-economist to head the Fed in generations. His speech reflected that, brimming with criticism of reliance on economic models that gauge current economic conditions based on assumptions about the “natural” or “neutral” rate of unemployment, interest rate, inflation, or economic growth.

At the Fed and elsewhere, analysts talk about these values so often that they have acquired shorthand names. For example, u* (pronounced “u star”) is the natural rate of unemployment, r* (“r star”) is the neutral real rate of interest, and Π* (“pi star”) is the inflation objective. According to the conventional thinking, policymakers should navigate by these stars.3 In that sense, they are very much akin to celestial stars.

“Navigating by the stars can sound straightforward. Guiding policy by the stars in practice, however, has been quite challenging of late because our best assessments of the location of the stars have been changing significantly,” Powell said.

In his speech, Powell described how these stars have unexpectedly and sometimes inexplicably shifted and how the stance of monetary policy is often far less certain than it seems based on those shifts.

“These assessments of the values of the stars are imprecise and subject to further revision. To return to the nautical metaphor, the FOMC has been navigating between the shoals of overheating and premature tightening with only a hazy view of what seem to be shifting navigational guides,” Powell said.

One example Powell cited was the Great Inflation period in the late 1960s and 1970s, which Powell said was due in part to policymakers focusing too narrowly on an imprecise measure of unemployment while ignoring the role expectations play in creating inflation. Powell pointed out that officials at the time believed the “natural rate” of unemployment was much lower than actual unemployment and far lower than it appears with hindsight. The stars had shifted by policymakers did not know it.

Two decades later, Powell said, the situation had reversed. Real time estimates of the natural rate of unemployment were now too high, so a mechanistic approach to monetary policy would have recommended a much tighter stance in the 1990s. But then-Fed chairman Alan Greenspan resisted calls for higher rates and inflation remained much lower than monetary hawks predicted.

“Once again, shifting stars help explain the performance of inflation, which many had seen as a puzzle,” Powell said.

Powell said this means monetary policy guides such as inflation and unemployment are far less certain than they may seem:

Experience has revealed two realities about the relation between inflation and unemployment… First, the stars are sometimes far from where we perceive them to be. In particular, we now know that the level of the unemployment rate relative to our real-time estimate of u* will sometimes be a misleading indicator of the state of the economy or of future inflation. Second, the reverse also seems to be true: Inflation may no longer be the first or best indicator of a tight labor market and rising pressures on resource utilization.

Given this uncertainty, Powell said, the Fed’s current cautious approach is the right one.

“[W]hen you are uncertain about the effects of your actions, you should move conservatively,” Powell said.

COMMENTS

Please let us know if you're having issues with commenting.