The Democrat-led city of Chicago has a new plan to try and make up the difference of a $28 billion pension deficit: take on another $10 billion in debt.

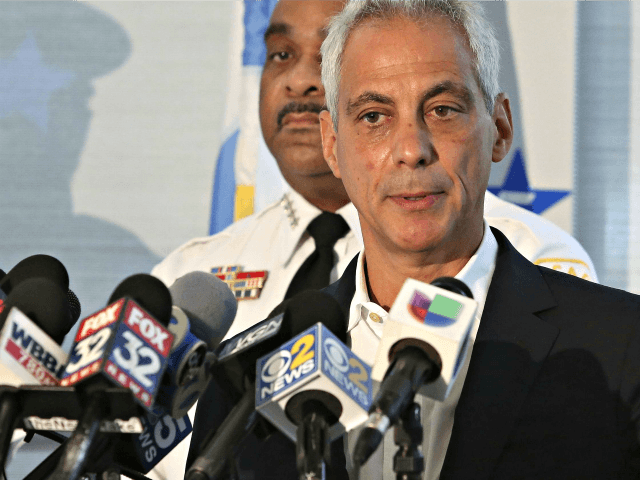

As the pension for Chicago’s municipal workers, including its police and firefighters, continues to spiral out of control, Democrat Mayor and former Barack Obama Chief of Staff Rahm Emanuel is launching a scheme to float an additional $10 billion taxable bond offering, according to Fox Business Network.

Even as Chicago’s bonds have already been rated at junk status, Mayor Emanuel imagines that the new round of bonds could be sold to willing buyers and will earn enough to surpass the city’s interest obligations on the debt.

If the plan is passed, it will become the biggest pension obligation bond ever issued by an American city.

Of course, if the money is borrowed against the bond and the bond does not sell well, it will mean billions more red ink added to the city’s ledgers. Worse, Chicago should already be forewarned about the ineffectuality of the idea since the scheme has failed for cities such as Detroit, Stockton, and San Bernardino, Fox Business reported.

Unlike other booming cities, Chicago may also find fewer takers for its next round of bonds. The city’s finances are famously horrendous, and Moody’s Investors Service rated Chicago’s offerings as junk bond status all the way back in May. Fitch Ratings also downgraded Chicago to “near junk bond” status in March.

On top of the $28 billion pension bomb slowly exploding under its feet, Chicago also faces a $114.2 million short fall in its 2018 budget.

Emanuel’s solution to that deficit is to slap on even higher taxes on a city that has become the only large American metropolis to lose population for three years running.

Follow Warner Todd Huston on Twitter @warnerthuston.

COMMENTS

Please let us know if you're having issues with commenting.