Against the wishes of 70 percent of Americans, 80-year-old Joe Biden announced today that he will seek another term as President of the United States. This is Biden’s second time running for president in the 80s. He also ran for president in 1988.

There are countless reasons why the vast majority of Americans don’t want four more years of Biden. His administration has been the most radical in modern American history, with trillions of dollars in reckless spending that has led to Bidenflation and caused two consecutive years of falling real wages and living standards.

There’s another reason every small business owner, freelancer, gig worker, independent contractor, or employee who tries to make a few bucks in a side hustle should oppose Biden’s renomination. His administration is siccing the IRS on them.

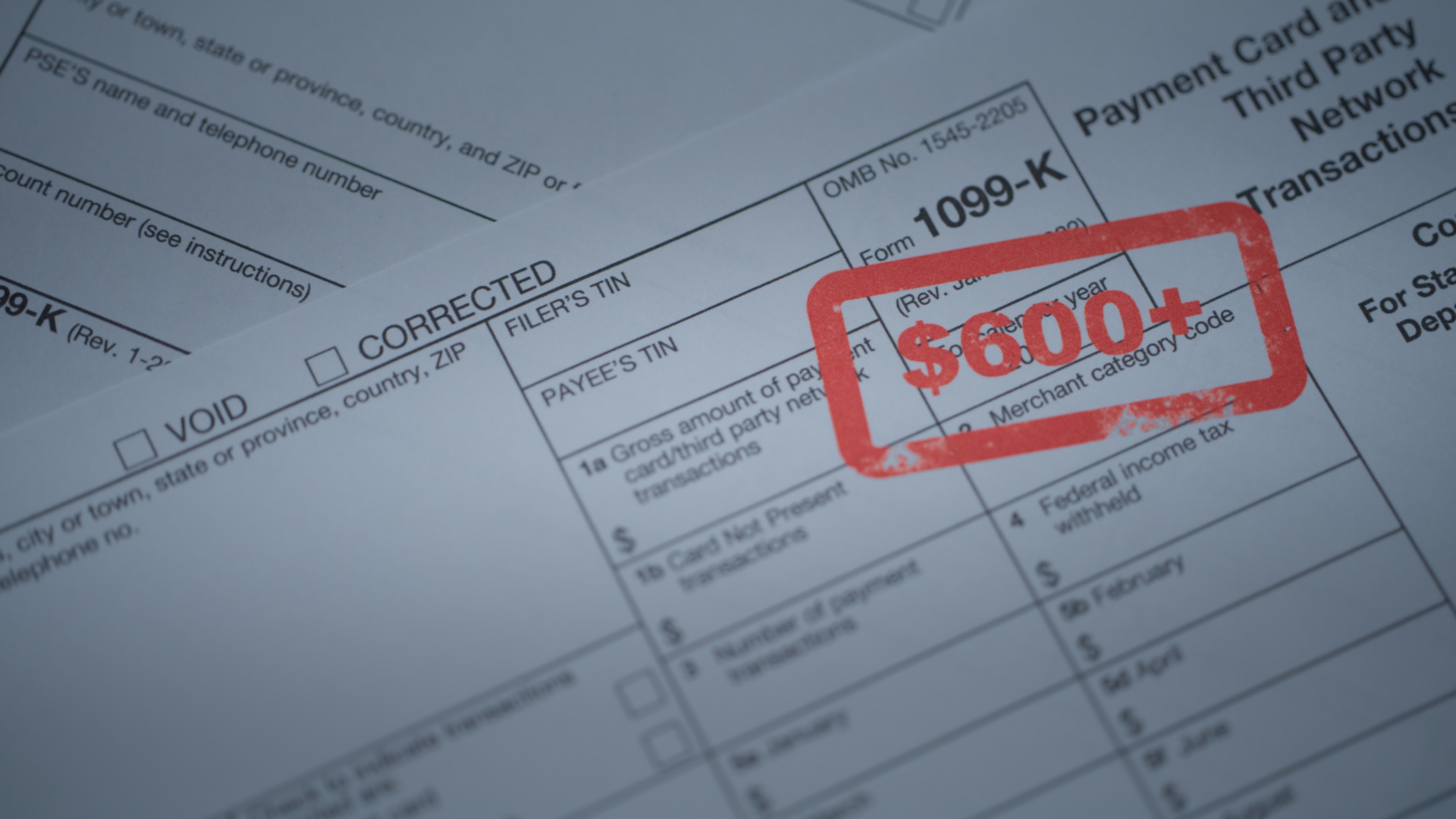

In the $1.9 trillion American Rescue Plan, passed in March 2021 on partisan lines, Democrats lowered the income reporting threshold for third-party payment processors such as Venmo, Cash App, Zelle, and PayPal to a mere $600. Then in last year’s misnamed Inflation Reduction Act, which also passed without a single Republican vote, Democrats doubled the size of the IRS by hiring 87,000 new agents to audit compliance with this new standard.

After a one-year delay, this $600 threshold took effect this year, meaning that come January, ordinary Americans will be hit with a slew of Form 1099-Ks for basic transactions they didn’t know they had to pay tax on. When the surprise tax bill is ultimately due, Americans should blame Biden and the Democrats.

(iStock/Getty Images)

The supersized IRS will make life miserable for small businesses and ordinary Americans. Corporations and wealthy folks will be largely unaffected because they have accountants and tax lawyers on staff who ensure they comply with all the rules.

Hairdressers, estheticians, handymen, subcontractors, hot dog carts, and your kids’ sports coaches will be most affected by this new rule. Even the ice cream stands and sunglass vendors that Biden uses to cosplay as a moderate will be hit hard. The expanded IRS will scrutinize these 1099 forms to ensure you reported the $600 you made from your yard sale or selling your old iPhone on Craigslist.

Your personal transactions will also be caught up in this reporting dragnet. Just imagine the hassle of getting a 1099 from Venmo on January 2, 2024, showing that you’ve received $15,000 in taxable income from your roommate. The IRS doesn’t know those funds were for your roommate’s share of the rent and utilities. And you’ll have no way of telling them short of entering the Kafkaesque nightmare of the IRS bureaucracy.

Same story for the poor sap who sold you his floor seats to the John Mayer concert via Zelle. Or your niece who got a few thousand dollars from family members to help pay for her wedding. Or your neighbor, to whom you gave several hundred dollars to split the cost of a new fence. Americans are accumulating a deluge of tax forms that will hit mailboxes in just over eight months.

House Republicans’ Limit, Save, Grow Act, scheduled to be voted on soon, would reverse the IRS funding needed to hire 87,000 new agents and enforce this $600 threshold. It’s one of many reasons why House Republicans should swiftly pass it.

Biden’s reelection announcement video released today is divisive fear-mongering, painting conservatives as book-banning, vote-suppressing radicals. It’s desperation from a desperate president. Ordinary Americans and small businesses who want moderate leadership won’t be fooled by Biden this time around. Their fistful of 1099s coming soon won’t let them forget.

Alfredo Ortiz is president and CEO of Job Creators Network and the author of The Real Race Revolutionaries: How Minority Entrepreneurship Can Overcome America’s Racial and Economic Divides.

COMMENTS

Please let us know if you're having issues with commenting.