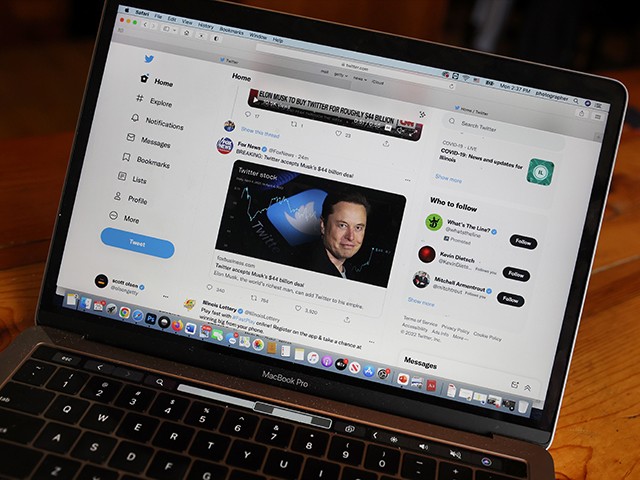

Recent reports claim that Tesla CEO Elon Musk is in talks with large investment firms and high-net-worth individuals to back his $44 billion Twitter acquisition. Musk could be attempting to bring in additional outside money to lower the portion of his own personal fortune at stake in the acquisition of the social media platform.

NBC News reports that Tesla CEO Elon Musk is in negotiations with large investment firms and high net-worth individuals to take on more financing for his $44 billion purchase of the social media platform Twitter, reducing the amount of his own wealth attached to the deal. Musk, who is currently the world’s richest person, is worth $245 billion.

But most of Musk’s wealth is attached to his shares in Tesla. Last week, Musk revealed that the had sold $8.5 billion worth of Tesla stock following his agreement to purchase Twitter. Musk has committed to investing $21 billion in the purchase of Twitter, a sum that new financing from outside investors could reduce.

Musk agreed to pay the $21 billion in cash alongside a margin loan secured against his Tesla shares. The banks involved in the deal agreed last month to provide $13 billion in loans based on Twitter’s business reportedly rejected the idea of offering more debt to Musk for the purchase of the company due to the social media platform’s limited cash flow.

Musk has further pledged Tesla shares to banks in order to secure a $12.5 billion margin loan based on new investor interest in financing the deal. Musk is reportedly in talks with private investors such as equity firms, hedge funds, and high-net-worth individuals in an effort to secure preferred equity financing for the deal.

Preferred equity would pay a fixed dividend from Twitter, similar to how a bond or loan pays regular interest but would appreciate in line with the equity value of Twitter. Among the equity firms speaking to Musk are Apollo Global Management and Ares Management, according to inside sources.

Recently leaked internal communications between Twitter employees reveal that many are panicked and angry about Tesla CEO Elon Musk’s takeover of the company.

Read more at NBC News here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan or contact via secure email at the address lucasnolan@protonmail.com

COMMENTS

Please let us know if you're having issues with commenting.