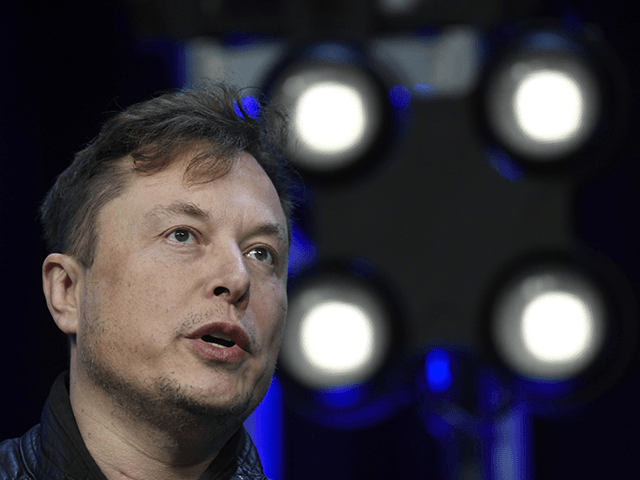

Tesla CEO Elon Musk’s $44 billion acquisition of Twitter may come at a large discount or be abandoned entirely due to the number of estimated bot accounts on the platform. Wedbush analyst Daniel Ives believes there is a 60 percent chance Musk walks away from the deal entirely, and a 40 percent chance the deal closes at a significantly lower price.

Business Insider reports that Tesla CEO Elon Musk’s $44 billion acquisition of Twitter is still on hold as Musk continues to investigate the number of bot or fake accounts on the platform. Last weekend, Musk called Twitter’s lack of transparency around how it calculated the number of bots on its platform “very suspicious,” and agreed with a comment that suggested if 25 percent of users on Twitter were bots, the deal to purchase the social media network should cost 25 percent less.

Absolutely

— Elon Musk (@elonmusk) May 21, 2022

Twitter has estimated that around 5 percent of its 229 million daily active users are automated bots, but others have claimed the number is much higher. Dan Brahmy, CEO of the Israeli tech company Cyabra, told Reuters that the number was likely closer to 13.7 percent. Musk has claimed he thinks the number of bots is closer to 20 percent.

Mark Weinstein, the founder of social network MeWe with 20 million users, told Business Insider that advertisers invest money in Twitter assuming they are marketing to humans. If millions of users are not humans but instead bots then the company should be worth less, he said.

“If it was proven that 25% of the [users] were actually bots, then advertisers would demand a lower rate, if Twitter was unable to filter them out,” Weinstein said. He added that he believes a fairer price for Twitter would be around $23 billion.

“There’s clearly an argument that his offer is inflated,” Weinstein said. “And it maybe should be adjusted to reflect the [user] revenue reality and the calculation for value based on that.”

Wedbush analyst Daniel Ives recently said that the $54.20 per share offer for Twitter was “out the window” as scrutiny over bots increased, but if Musk renegotiates the price he could be forced to pay a $1 billion break fee.

“We believe it’s currently a 60% chance that Musk tries to walk and use this spam account issue as the scapegoat to get out of the deal and a 40% chance Twitter’s board and Musk come to a new deal price over the coming weeks,” Ives said.

Read more at Business Insider here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship. Follow him on Twitter @LucasNolan or contact via secure email at the address lucasnolan@protonmail.com

COMMENTS

Please let us know if you're having issues with commenting.