China set an official 2024 target for GDP growth of around five percent in the “government work report” presented to the National People’s Congress (NPC) by Premier Li Qiang on Tuesday morning. The 2024 target was substantially the same as 2023’s reported GDP growth of 5.2 percent.

China’s state-run Global Times touted Li’s report as proof that “China’s economy will still be one of the fastest-growing major economies and the biggest contributor to global growth.”

“This is a relatively high target, which shows that the central government has relatively high confidence,” economist Wan Zhe of Beijing Normal University said.

The Global Times noted the International Monetary Fund (IMF) predicted 4.2 percent growth for China in its World Economic Outlook report in January, which would be substantially lower than 2023’s claimed growth or Li Qiang’s 2024 prediction but still higher than the average global growth rate of 3.1 percent for advanced economies.

The Chinese Communist paper asserted:

While the Chinese economy faces challenges and risks amid a global economic downturn and an increasingly complex geo-economic landscape, Chinese policymakers still have plenty of policy tools at their disposal to tackle those challenges and ensure stable growth.

The projection of five percent GDP growth was enough to add 7.2 percent to China’s military budget, which the Global Times predictably portrayed as a “reasonable” and “restrained” force for world peace — especially when compared to the “aggressive defense spending hike by countries like the US and Japan.”

The editors further complained about countries like the Philippines and Australia causing problems for China under the American military umbrella. China is especially vexed at the Philippines at the moment for pushing back against Beijing’s excessive territorial claims in the South China Sea.

A Chinese Coast Guard ship uses water canons on a Philippine Coast Guard ship near the Philippine-occupied Second Thomas Shoal, South China Sea, on August 5, 2023. (Philippine Coast Guard via AP)

“China can easily raise its military expenditure more radically thanks to the country’s comprehensive development, and the fact that it is not doing so reflects the restraint in the setting of defense budget,” the Global Times wrote, dismissing all criticism of China’s military buildup as “smears” and “hype.”

According to Chinese “experts,” most of Beijing’s military funding is spent on “training missions, the development and production of modern weapons and development, the support of military reform and the welfare of military personnel.”

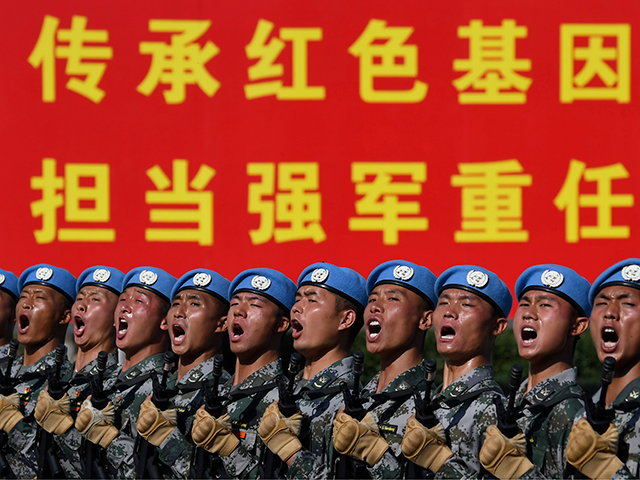

Chinese soldiers practice marching in formation ahead of a military parade to celebrate the seventieth anniversary of the founding of the People’s Republic of China on September 25, 2019, in Beijing, China. (Naohiko Hatta – Pool/Getty Images)

China’s crisis-riddled property market remains a potential disaster that could derail plans for GDP growth. On Monday, China’s biggest insurance companies sounded alarms about yet another heavily indebted developer, China Vanke Company.

“At least two Beijing-based insurers that farm out annuity investments told their external portfolio managers late last week to closely monitor Vanke’s credit risks,” Bloomberg News reported on Monday.

The two real-estate companies most commonly cited as deep concerns are China Evergrande and Country Garden, both of which are sitting on atomic bombs of unpaid debt and devalued assets that could push the entire Chinese economy into a tailspin.

The Evergrande Group headquarters logo is seen in Shenzhen in southern China’s Guangdong province on September 24, 2021. (AP Photo/Ng Han Guan, File)

Vanke is China’s second-best-selling developer, and it was the last titan on Evergrande or Country Garden’s scale that seemed reasonably healthy, so the sudden caution about its debts from insurance companies was bound to spur some investor anxiety.

“Vanke’s shares were down as much as 4.1% in Hong Kong, after dropping to a record low Monday. Its 3.975% dollar note slumped 1.7 cents to 46 cents on the dollar, set for the lowest since October,” Bloomberg reported, finding the news a little inconvenient for the Chinese Communist Party as it sought to project optimism at the NPC meeting.

COMMENTS

Please let us know if you're having issues with commenting.