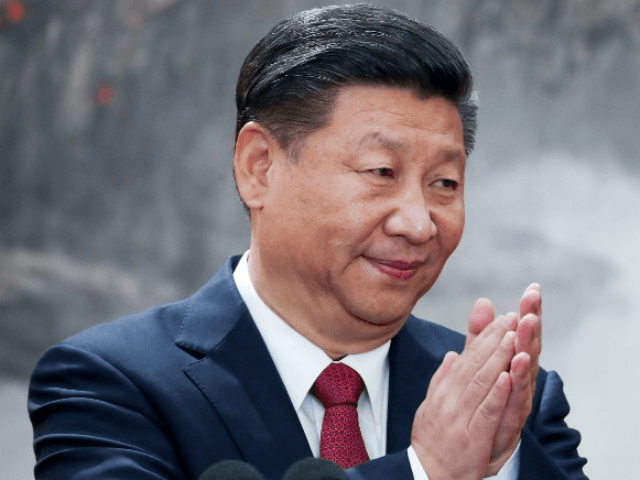

When Chinese President Xi Jinping unexpectedly toured a rare earth mining facility following the announcement of U.S. sanctions on Huawei, the message was unmistakable: China is prepared to use its domination of raw materials used in virtually all high-tech manufacturing to gain leverage in the trade dispute.

China is the largest supplier of rare earth materials that are used in everything from mobile phones to nuclear power to guided missiles. Xi’s visit highlighted the fact that just as Chinese companies such as Huawei and ZTE require U.S. technology for their products, U.S. technology and national security manufacturers rely on Chinese rare earths.

“Of course it makes sense that Xi would use a rare earth mine to demonstrate their ultimate power in the battle for global domination of high technology manufacturing,” said Michael Silver, chairman and CEO of American Elements, who has called on the Trump administration to develop a strategy to combat Chinese domination of rare earths.

If China were to curtail or even cut off rare earth exports to the U.S., the effects could be similar to the oil crisis of the 1970s. Rare earth prices in the U.S. would soar and manufacturers could face shortages and delays. Think gas lines but for high tech manufacturers.

“Rare-earth metals are essential for producing most technological equipment. It is impossible to build a car without cerium, a smartphone without europium, a guided missile without neodymium,” Silver wrote in a recent Wall Street Journal op-ed.

China has used its near-monopoly power over rare earths in international disputes before. In 2010, amid a dispute over contested islands in the East China Sea, China cut off rare exports to Japan. Japan quickly released a Chinese ship captain it had detained, a move described by the New York Times as “a humiliating retreat in a Pacific test of wills.”

China could even act to cut off U.S. companies inside of China from access to rare earths. In recent years, largely at the behest of the Chinese government, many U.S.-based manufacturers have moved production of machinery and electronics into China. China facilitated this by charging the rest of the world higher prices for rare earths than domestic manufacturers paid, a tactic eventually ruled unfair by the World Trade Organization.

The Trump administration has acted in other areas to prevent the U.S. from becoming dangerously dependent on foreign sources for materials deemed necessary for U.S. national security. Last year, the U.S. imposed tariffs on imported steel and aluminum to protect the viability of the U.S. metals industry. And it is considering doing the same for imported autos following a Commerce Department study concluded this year.

The challenge is that the feared collapse of the domestic industry and dependence on imports that prompted the metals tariffs has already happened in rare earths.

The U.S. was once the world’s largest producer of rare earth materials. By 1999, more than 90 percent of the rare earth materials used by U.S. industry came from deposits in China. Over the last decade, rare earths miners across the U.S. and the rest of the world folded, unable to compete with China’s predatory pricing schemes. Today, China produces 96 percent of rare earth elements used globally even though under one-third of the globe’s rare earth deposits are in China.

The U.S. imported around $160 million worth of rare earths last year, most of it from China. That figure does not include the price of finished goods and intermediate products that include rare earths.

Chinese officials have downplayed Xi’s rare earth facility visit, even while state media has played up the threat. But even if China officially prefers not to openly tout its leverage over the U.S. when it comes to rare earths, it is clear Xi wields a big stick.

COMMENTS

Please let us know if you're having issues with commenting.