The bad news is that Thursday’s April producer price inflation figures showed that inflation had not cooled by as much as expected, just as the consumer price inflation figures had a day earlier.

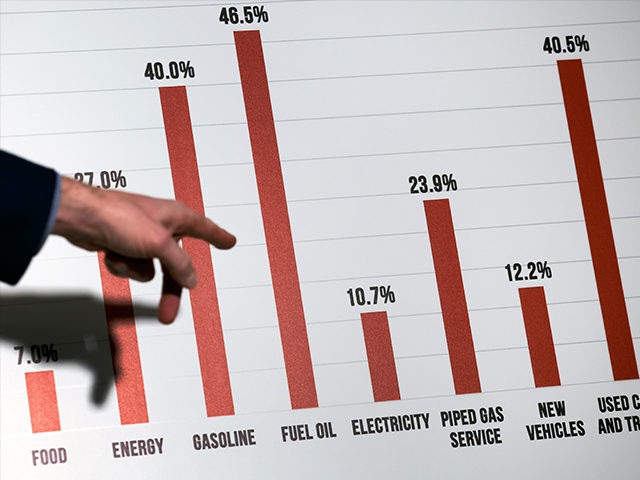

The worse news is that by some measures inflation did not cool at all. In fact, in some of the metrics most salient to Americans, inflation picked up in April.

The Department of Labor’s Producer Price Index (PPI) indicated that prices of goods and services produced by U.S. businesses were up 11 percent compared with last year. That is the fifth consecutive month of double-digit annual price gains picked up by this gauge. Economists had forecast an even steeper decline to 10.7 percent.

In an unusual twist, the annual number came in worse than expected even though the monthly number was right on target at 0.5 percent. How could the year-over-year number register higher if the month-over-month number was on target? The answer is that the March figures were revised upward, indicating that inflation was already stronger than expected. March’s gain over February originally reported at 1.4 percent now stands at 1.6 percent. The February report was revised up from a 0.9 percent gain to 1.1 percent.

The upward revisions compound. A $1,000 widget that goes through the unrevised inflation figures comes out at $1,028.24, a three-month gain of 2.82 percent. The revised figures bring the price up to $1,032.32, a 3.23 cumulative three-month gain. That’s a little more than a 0.4 percent difference, which is why we wound up with 11 percent instead of 10.7 percent despite the as-expected monthly figure. To put it slightly differently, yes, prices rose by 0.5 percent, but they rose off a higher base, which means that prices are actually higher than forecast.

Now might be a good time to explain what the Producer Price Index (PPI) is and how it differs from its more famous cousin, the Consumer Price Index (CPI). Both are measures of the average price changes of a large basket of goods and services. The CPI measures prices from the perspective of consumers. That means it excludes sales to government or to businesses for product inputs and capital investment. It also includes imports and sales taxes, which are paid for by consumers, but not exports, which are not paid for by U.S. consumers.

The PPI, on the other hand, measures prices from the perspective of businesses. It seeks to capture the price changes in all the products sold by U.S. businesses to anyone anywhere, including foreigners buying exports, government purchases, and capital investment.

The PPI allows us to break down the headline number into components. Looking at the one-year changes through April 2022, we discover that the prices of government purchased goods–minus food and energy–rose 10.4 percent. Prices of exported goods–minus food and energy–rose 12.5 percent, while prices of sales to the domestic private sector—consumers and businesses—were up 8.6 percent. The overall number was 10 percent. This tells us that big government payments are still playing a role in pushing inflation up, as is rising demand for U.S. exports from the recovering economies of Europe and elsewhere.

The monthly private sector figure for prices of core goods—minus food and energy—shows no slowdown in inflation at all. Prices rose 0.9 percent in April just as they did in March. The annual figure of 8.6 is an acceleration from 8.1 percent in the prior month. If we break that down even further, however, we see that core consumer goods prices accelerated from a 0.7 percent monthly gain in March to 0.8 percent in April. The year-over-year figure jumped from 7.7 percent in March to eight percent in April.

Of course, food and energy are important—perhaps the most important—parts of inflation for many households. If we add those back in, the private sector is facing 15.6 percent annual inflation. This is up from 15.3 percent in March and has been rising every month this year. This is why even if the headlines say inflation is decelerating, the American public are likely to sense that prices are still rising far too rapidly.

COMMENTS

Please let us know if you're having issues with commenting.