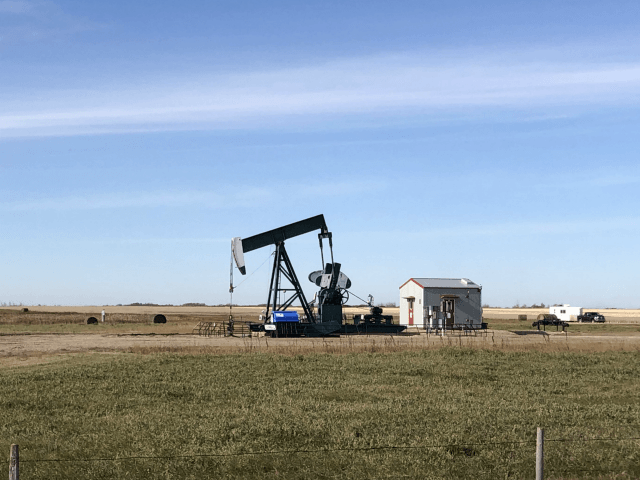

The number of oil rigs operating in the U.S. declined by two to 574, according to oil services giant Baker Hughes.

Oil prices have risen to the highest level since the end of March, due in part because of a decline in U.S. oil inventories and an expected boost in demand for gasoline as the U.S. heads into summer. The average price for a gallon of gasoline hit an all-time high of $4.60 on Thursday.

Crude inventories fell by 3.4 million barrels in the week ended May 13, defying forecasts for a build in the oil supply Gasoline stocks fell by 4.8 million barrels, much larger than the 100,000 barrel decline expected. Last week, crude inventories fell by 2.4 million barrels and gasoline by 5.1 million. The supply contraction occurred despite a five million barrel release from the Strategic Petroleum Reserve.

The decline appears to be due to a fall in the number of offshore Louisiana rigs. The rig count in Louisianna, counting both natural gas and oil, fell by three. Texas and Oklahoma added one rig each, although it is not clear in the data if these were oil or natural gas.

Canada added total of 15 oil rigs in the week.

The Biden administration has said it wants more domestic oil production but until recently it was refusing to auction new leases for federal land. Even as the administration announced the move, however, it made clear that it had contempt for fossil fuel companies and regarded them as dangers to the public good.

The administration also hiked tax on oil and natural gas revenues from leased lands significantly, from around 12.5 percent to 18.75 percent, an unprecedented hike. No president in 100 years has undertaken such an increase.

A number of Biden’s nominees have expressed antagonism toward the fossil fuel industry, discouraging investment in the sector by making it clear what the Democratic Party’s view of it is. Last year, Biden nominated to the Federal Reserve’s top bank supervisory post a former Fed official, Sarah Bloom Raskin, who advocated using regulations to discourage banks from investing in fossil fuels. He also nominated leftwing radical academic Saule Omarova, who has also called for using bank regulation to stop investment in fossil fuels, to the Office of Comptroller of the Currency. Both nominations were defeated when moderate Democrats in the Senate balked.

Perhaps most importantly, large institutions have poured money into so-called sustainable funds that looked to environmental, social, and governance factors when making investment decisions. These funds shun fossil fuel investing. According to Deliote’s Center for Financial Services, professionally managed assets with ESG mandates swelled to $46 trillion globally in 2021, representing nearly 40 percent of all assets under management. The result of this is that it has become incredibly hard to raise funds for expanding fossil fuel production. So even oil prices above $100 a barrel are not attracting capital into the sector.

In a recent episode of Bloomberg’s Odd Lots Podcast, Goldman Sachs’ top commodities strategist describes ESG investing as “a blunt instrument that is reducing capital flows into a very critical sector.”

OPEC+ will meet next week and is expected to stick to its plan to raise its output target for July by just 432,000 barrels per day, rejecting calls from the U.S. and European nations for faster increases.

COMMENTS

Please let us know if you're having issues with commenting.