Job openings unexpectedly rose in September, defying efforts by the Federal Reserve to cool off demand for labor in hopes of taming inflation.

The number of available positions jumped to 10.7 million from a revised 10.3 million a month earlier, the Labor Department said Tuesday in its Job Openings and Labor Turnover Survey, or JOLTS. Economists had expected the figure to drop below 10 million for the first time since June of 2021.

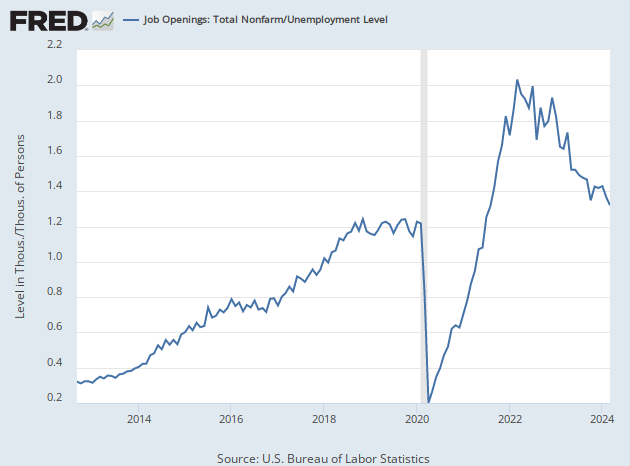

This brings the ratio of job vacancies to unemployed people back up to nearly 1.9 to one, close to the all time high hit in March. Many economists, including influential policy advisers and officials at the Federal Reserve, consider this a key ratio for measuring the tightness of the labor market. An extremely tight labor market is seen as fueling inflation by pushing up wages. In August, this had fallen to 1.7 percent, feeding hopes that the labor market might be rebalancing.

The major stock indexes, which had been headed higher in early morning trading, all turned negative following the release of the data. Investors fear the strength of the stock market will summon forth a more aggressive policy response from the Fed.

The labor market has proved far more resilient against monetary policy pressure than expected. The Fed has raised the bottom of its 25-basis point-wide target rate from zero to three percent, a breakneck pace of hikes. It is widely expected to raise its target range to 3.75 to four percent at the conclusion of its two-day meeting on Wednesday.

Fed officials, including chairman Jerome Powell, have said that they hope to bring down the vacancy ratio to prevent inflation from becoming entrenched in the economy. The consensus view is that when inflation expectations become unanchored from the Fed’s target of two percent, workers demand higher wages to compensate for higher expected inflation. Others say that expectations matter less than actual experience with inflation and workers demand higher wages when their quality of life is reduced by higher prices.

Powell has said that if demand for labor can be brought down, the tightness of the labor market could be relieved without the need for significantly higher unemployment. Tuesday’s JOLTS report, however, indicates that demand for labor remains red hot.

Hotels, restaurants, health-care providers, and transportation companies were the key sources of growth in openings, the report showed.

Despite the rise in openings, the total number of people hired in the month fell to 6.1 million from 6.3 million, the lowest level in 15 months. This could reflect businesses having trouble finding workers with the appropriate skills.

The number of people quitting their job dipped to 4.1 million but remains incredibly high by historical standards. This was the 15th consecutive month in which four million or more people have quit their jobs. Quits tend to rise when people expect they can easily find a better job. Job switchers have seen much greater payraises in the post-pandemic period than people who stayed at their job. The quits rate held steady at 2.7 percent. The decline in quits may mean that employers are working harder to keep employees from leaving.

COMMENTS

Please let us know if you're having issues with commenting.