Happier Consumers Deck the Halls

The American consumer is rushing into the end of 2023 in high spirits—in part because they like how next year’s election is shaping up.

The University of Michigan’s index of consumer sentiment soared 13 percent in December. This was a sharp and sudden reversal after four months of declining sentiment.

Not only did the downturn end. The December surge reversed almost all of the decline in the second half of this year, bringing the index up to where it was in August.

This is not the way things were supposed to happen. After the economy grew at a breakneck pace in the third-quarter, American consumers were widely predicted to “run out of steam” in the fourth quarter. Our “excess savings” were supposed to finally be tapped out. Unemployment was climbing. Student loans were due again. Many of the long-reliable indicators were screaming outright recession or at least signaling a serious slowdown.

People were even wondering if the famous Sahm Rule recession indicator, which tells us that a recession is likely occurring when the three-month average unemployment rate drops a half a percentage point below its 12-month low, would be triggered by the November employment report. Instead, the unemployment rate fell to 3.7 percent. It has been below four percent for nearly two years, the longest stretch of unemployment below four percent in 54 years.

ICYMI: The overall unemployment rate in November edged down to 3.7%. It has been below 4% for nearly two years — the longest stretch of unemployment this low in 54 years. 📉 #JobsReport https://t.co/iFGR6uizeK pic.twitter.com/OJL9ThRCUE

— U.S. Department of Labor (@USDOL) December 11, 2023

Aside from a robust job market, declining inflation expectations were a big driver of improved consumer sentiment. As President Joe Biden’s poll numbers demonstrate very clearly, the American public despises high inflation. So when inflation expectations decline, consumer sentiment improves.

And inflation expectations certainly did decline in December. The average expected inflation in the year ahead dropped from 4.5 percent last month to 3.1 percent this month. The long-run expectations fell from 3.1 percent 2.8 percent, the second lowest reading since Bidenflation really got going back in the summer of 2021.

It’s Beginning to Look a Lot Like…Election Day

But it was not just inflation expectations and falling unemployment. As the director of the University of Michigan’s survey Joanne Hsu pointed out in her comments on the December preliminary results, a growing share of consumers are spontaneously mentioning the potential impact of next year’s elections.

“Sentiment for these consumers appears to incorporate expectations that the elections will likely yield results favorable to the economy,” Hsu said.

The implication is that the increase in sentiment is being driven in large part by Republicans and Trump supporters who are increasingly confident that they will win back control of the White House next year.

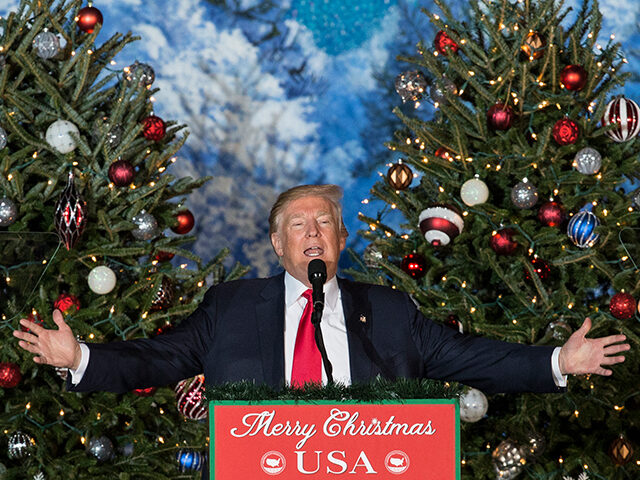

President Donald Trump gestures as First Lady Melania Trump smiles during the 95th annual National Christmas Tree Lighting ceremony in Washington, DC, on November 30, 2017. (NICHOLAS KAMM/AFP via Getty Images)

The underlying numbers support this. The index of consumer expectations jumped 16.9 percent in the December survey, much more than the 8.3 percent rise in the index of current conditions.

The driver of better expectations was not little old Saint Nick but Republican optimism. The expectations index for Democrats increased from 80.2 in November to 90.9, putting it around where it was during the summer. The expectations index for Republican consumers, however, mounted to the sky, rising 36.5 to 57.0, the highest they have been since Joe Biden took office in January of 2021.

Will Republicans Save Christmas?

With the bright red lights of Republican political hopes cutting through the foggy night of the Biden economy, it’s not too surprising to learn that consumers are dashing through the stores with their wallets open wider.

Gallup reports that the amount Americans estimate they’ll spend on Christmas or other holiday gifts this year rose more than $100 to $975, the highest in Gallups’ November measures of seasonal spending since 1999. More importantly, this is a significant increase from the $923 estimate in Gallups’ October poll.

“This is only the fifth time in the 18 years since 2006 that Gallup has asked the holiday spending question in both October and November that the average amount has increased between the two months. More typically, consumers’ spending estimate declines as the season progresses,” Gallup said.

Gallup explains the importance of this rise:

Last year at this time, U.S. holiday retail sales seemed poised to increase by between about 4% and 6%, according to Gallup’s modeling comparing its holiday spending estimate trends with actual holiday retail sales for each year. In fact, average November-December 2022 retail sales (not including autos and gas) increased by 6.2%.

The same modeling procedure applied to Americans’ restrained spending estimate this October suggested holiday sales would increase by about 4% — a relatively moderate rate of annual growth similar to the long-term average. Now, with consumers’ spending estimate rising to $975, it appears year-over-year holiday sales could grow by somewhere between 6% and 9%.

That would be all the more impressive because inflation is running much lower this year than last year. So, a much bigger part of the increase would be a real rise in spending and not just consumers struggling to keep up with higher prices.

COMMENTS

Please let us know if you're having issues with commenting.