CARACAS, Venezuela – China, through its major development finance institutions (DFIs), has not lent any more money to Venezuela since 2016, according to a recent report by the Inter-American Dialogue think tank and the Boston University Global Development Policy Center.

Under its socialist regime, Venezuela has endured the total collapse of its economy, making it a risky candidate for loans. The regime does, however, maintain warm ties with China, as a fellow Marxist dictatorship, in public and previously had a long record of borrowing from Beijing.

The report, titled “At a Crossroads: Chinese Development Finance to Latin America and the Caribbean, 2022,” analyzed the financial movements of the major DFIs: China Development Bank (CDB) and China Export-Import Bank (Eximbank) with respect to Latin American and Caribbean countries.

CBD and Eximbank combined issued $136 billion in loans to countries in the region between 2005 and 2022. Argentina, Brazil, Ecuador, and Venezuela were the top four recipients of the loan funds.

The report’s data show that although Venezuela has been the recipient of 44 percent of China’s loan financing in the region since 2005, Chinese lending to Venezuela completely ceased in 2016, noting “deteriorating economic conditions” in the country.

File/In this May 20, 2109 photo, Venezuela’s President Nicolas Maduro flashes a hand-heart symbol to supporters in Caracas, Venezuela. Maduro said he is inviting China’s Huawei to help set up a 4G network in Venezuela. (AP Photo/Ariana Cubillos)

Venezuela – which was the first country in South America to sign a “strategic development partnership” agreement with China, finalized by late socialist dictator Hugo Chávez in 2001 – was among the first countries in the region that needed to negotiate adjustments of the terms of its loans to China.

“China sought to address the country’s repayment problems by offering grace periods on principal payments and extending the life of at least one loan,” the report stated.

In the past decade, Venezuela has gone through the collapse of its once-celebrated socialist system, leaving it facing a severe economic, political, and societal crisis featuring a hyperinflation spiral that reached 1 million percent by 2018. The crisis created an exodus of an estimated 7.2 million — one-quarter of its entire population — people as of March and counting.

The Maduro regime has not publicly disclosed the total of its debt to China, estimated at $20 billion in 2019. Venezuela’s socialist regime, during the rule of late dictator Hugo Chávez, borrowed more than $50 billion from China in oil-for-loan deals, which prompted current socialist dictator Nicolás Maduro negotiate a one-year grace period with China in 2016 — the same year Chinese DFI lending to the South American nation stopped, according to the report. Reports in 2018 showed that Chinese banks had not provided the ailing socialist regime with any loan funding throughout 2017.

Reports published in August revealed that the Maduro regime had been shipping millions of its sanctioned oil barrels to China via Chinese state-owned defense firms since 2020 to offset its remaining debts to the Asian nation.

Socialist mismanagement and rampant corruption have worsened the cash-starved situation of the Maduro regime. A report published by the Associated Press on Friday states that, based on internal documents obtained from the state-owned Petróleos de Venezuela (PDVSA) oil company, more than $20 billion in oil shipment proceeds have “vanished” from state coffers through trades made through deals between the Maduro regime and mostly unknown shell trading companies.

The “disappearance” of billions of PDVSA revenue prompted Maduro to launch an “anti-corruption” purge in March that has so far resulted in the resignation of now-former Oil Minister Tareck El Aissami — accused by the United States of drug trafficking, long believed to hold ties with the terrorist organization Hezbollah – and the arrest and financial dismantlement of his key allies.

Many believe the purge to not be a fight against “corruption,” but rather, the result of a behind-the-scenes conflict among the leaders of the ruling United Socialist Party of Venezuela that seeks to eliminate anyone that could potentially challenge Maduro’s leadership of the country,

The Inter-American Dialogue’s report stated that CDB and Eximbank loans to the region suffered a “precipitous decline” between 2015 and 2020, having ceased altogether in 2020 due to the Chinese coronavirus pandemic and due to China “reconsidering” the functions and areas of focus of its development banks.

“Though pursuing new lending opportunities in [Latin America and the Caribbean], China’s DFIs have also spent considerable time in recent years renegotiating the terms of existing agreements with the region,” the report read.

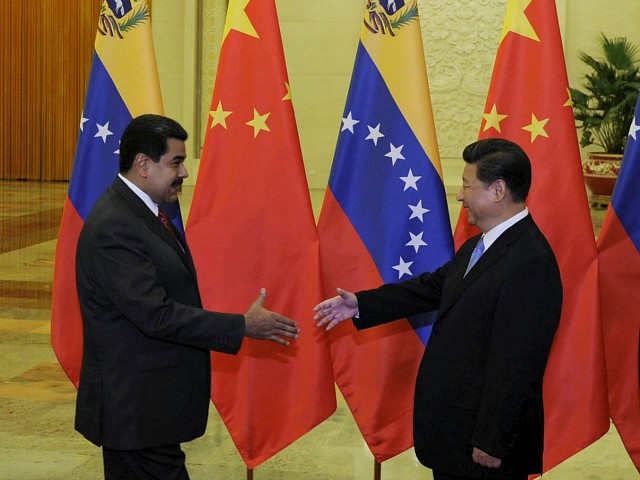

File/Chinese President Xi Jinping (R) shakes hands with Venezuela’s President Nicolas Maduro before their meeting at the Great Hall of the People September 1, 2015 in Beijing, China. (Parker Song-Pool/Getty Images)

The think tank remarks that China’s DFIs issued $813 million in 2022, which represents an “uptick” in financial activity and a “possible indication of renewed interest” in China’s financial engagement on certain types of projects.

The Inter-American Dialogue report noted that while China’s DFIs are no longer issuing “multi-billion-dollar, oil-backed loans that once characterized Chinese financial engagement with the region,” both CBD and Eximbank remain active in the region, and the think tank expects that a small amount lending to Latin American and Caribbean countries will occur in 2023.

“Total combined Chinese finance to the region is unlikely to ever approximate the previous peaks of policy bank lending,” the think tank expressed. “However, the combined effect of Chinese policy bank activity, co-financing initiatives, commercial bank finance, private equity investment, and other forms of engagement will ensure a sizable Chinese financial presence in the region for years to come.”

Another report published last week by researchers from the World Bank, the Harvard Kennedy School, research lab AidData, and the Kiel Institute for the World Economy showed that China had spent $240 billion between 2000 and 2021 to “rescue” countries that have struggled to repay predator Belt and Road Initiative (BRI) loans back to China in an effort to save its own banks through higher interest “rescue” packages.

Christian K. Caruzo is a Venezuelan writer and documents life under socialism. You can follow him on Twitter here.

COMMENTS

Please let us know if you're having issues with commenting.