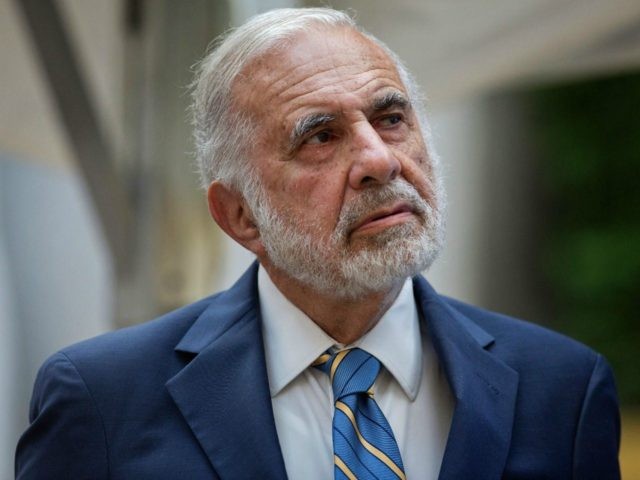

After shaking down Apple Inc. to buy back a huge amount of shares over the last three years, activist investor Carl Icahn pocketed over $2 billion and sold his entire stock holdings.

According to the Securities & Exchange Commission, Icahn Industries owned 45.8 million shares worth about $4.84 billion at the end of 2015. Although the price is down about 9 percent since the end of the year to $93.74 per share, Icahn claims to have made a $2 billion profit trading in Apple stock.

Icahn’s trading activity in the stock is not publicly known, but he appears to have bought his initial Apple position in 2013 at around $60 a share. He then went on a highly public and unrelenting tirade to force the company to buy back huge amounts of stock. The campaign included Icahn publishing a public letter to Apple CEO Tim Cook on May 18, 2015, claiming the stock of Apple was worth $240 a share.

In the extraordinary letter, Icahn asked Cook to: “Help us convince the board that this is not a choice between investing in growth and share repurchases. As our model forecasts, despite more than 30% growth in R&D annually through FY 2017 to $13.5 billion (up from $1.8 billion in FY 2010) and your updated capital return program, Apple’s net cash position (currently the largest of any company in history) will continue to build on the balance sheet.”

Apple — over the nine quarters from September 30, 2013, to the end of 2015 that Icahn was a shareholder — dutifully spent $87.2 billion to buy back a stunning 760 million shares at an average price of about $115. As a result, the outstanding capitalization of the company plunged by 12.1 percent from 6.3 billion to 5.54 billion shares outstanding.

The unprecedented company buybacks and Icahn’s letter of confidence helped the stock hit $132.54 on May 18, 2015 — more than twice what Icahn is believed to have paid for his original stock position.

Icahn told the London Guardian that he sold Apple’s stock because he is concerned that China’s authoritarian regime might be erecting barriers to trade:

“You can’t go into that business unless you’re like Samsung which is really like a country backing it,” Icahn told CNBC. “A lot of people tried, a lot of people failed … In China, for instance, they will come in and make it very difficult for Apple to sell there.” He added, “They’re basically in some senses I would say, perhaps benevolent but a benevolent dictatorship. I don’t know if benevolent is the right word.”

Icahn said CEO Tim Cook “seemed sort of sad” when he told him about selling the shares. Icahn still thinks “Apple is a ‘great company’ and Tim Cook is ‘doing a great job.'”

COMMENTS

Please let us know if you're having issues with commenting.