China’s State Administration for Market Regulation (SAMR) released the final version of its new antitrust rules on Sunday, evidently concluding a debate within the Chinese Communist Party (CCP) over how China’s high-flying technology titans should be reined in.

The final draft of the rules places heavy new restrictions on firms like Alibaba, but the rules are not as stifling as they could have been.

The South China Morning Post (SCMP) quoted relatively optimistic analysts who described the new antitrust regulations as “less of a containment policy and more like guidance,” as You Yunting of the Shanghai Debund Law Firm put it.

One of the most heavy-handed proposed changes, stricken from the final draft, would have given SAMR extremely broad latitude to label large tech firms as “monopolies” and break them up with antitrust actions. However, the list of practices subject to antitrust regulation was expanded considerably:

The guidelines issued by the State Council Antitrust Committee, which are expected to serve as a manual for China’s antitrust regulators when looking at internet companies, prohibit platforms from forcing merchants to pick one platform as their exclusive distribution channel, and from using price discrimination based on big data analysis, according to a statement published by SAMR on Sunday.

The “picking one from two” practice constitutes an abuse of market dominance by restricting transactions, according to the guidelines, and could include tactics such as blocking or limiting traffic to merchants, as well as subsidising users with discounts and other incentives.

The new rules will also ban platforms from exchanging user information or using data and algorithms to fix prices, and from creating barriers for others to make transactions. Internet platforms, which SAMR defines as businesses that use technology to enable interaction between bilateral or multilateral parties under specific rules, are “more concealed” in their monopolistic practices compared to traditional industries, the antitrust regulator said in a statement.

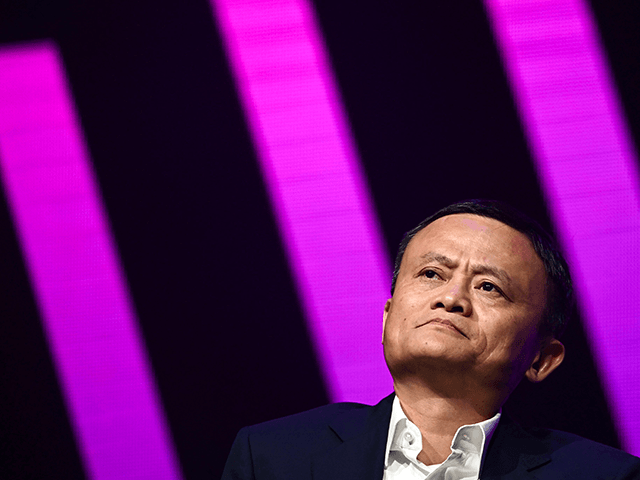

“Picking one from two” was a major element of the antitrust investigation launched into Alibaba, the e-commerce giant founded by Jack Ma (pictured), the billionaire whose sassy criticism of hidebound Chinese regulators provoked the crackdown on big tech firms, especially his own. The idea is that a big Internet platform can force retail clients to advertise with it exclusively by threatening to damage their business if they deal with competitors, for example by throttling traffic to the offending merchant’s website.

Several major Chinese retail operations accused Alibaba of abusing its market dominance in this fashion, while other e-commerce companies have accused each other of creating an environment in which retailers are afraid to do business with more than one platform for fear of alienating their major Internet service provider and provoking reprisals. Large companies outside the e-commerce industry have also been accused of using their market dominance to force exclusive deals on their customers.

“The behavior is more concealed, the use of data, algorithms, platform rules and so on make it more difficult to discover and determine what are monopoly agreements,” SAMR said when introducing its new regulations.

Bloomberg News noted the hefty package of new antitrust rules was finalized in just three months. The Shanghai event where Jack Ma angered the Chinese Communist Party (CCP) was held in October.

Bloomberg suggested that, in addition to tightening political control over Ma and other outspoken moguls, the CCP might have been spurred to swift action by the growing number of Chinese mega-corporations that have been suing each other for engaging in monopolistic practices.

The SCMP noted that while many cases are pending and several warnings have been issued by regulatory agencies, Chinese courts have yet to hand down a clear antitrust ruling against a major technology company.

COMMENTS

Please let us know if you're having issues with commenting.