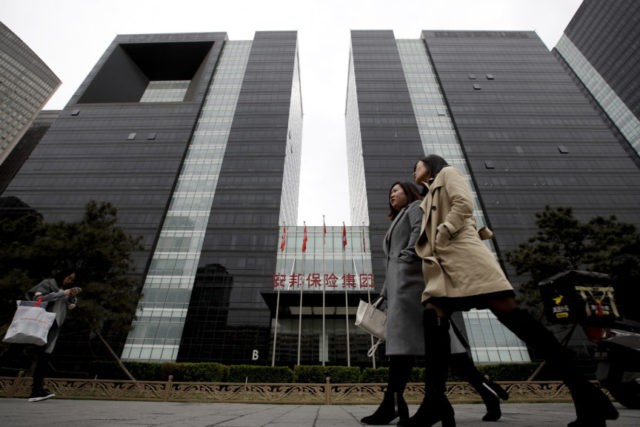

BEIJING (AP) — The troubled Chinese insurer that owns New York City’s Waldorf Hotel said Wednesday it is receiving a $9.6 billion bailout from a government-run fund.

Regulators seized control of Anbang Insurance Group in February after a global asset-buying spree raised questions about its stability. Its founder, Wu Xiaohui, went on trial last week on charges he defrauded investors and misused company money.

The case added to a string of scandals in China’s insurance industry. The industry’s former top regulator was charged in September with taking bribes and other insurers have been accused of reckless speculation in stocks and real estate.

The injection of money from the China Insurance Security Fund will help Anbang “maintain stable operations,” the privately owned insurer said on its website.

The injection of 60.8 billion yuan ($9.6 billion) will increase Anbang’s registered capital to 61.9 billion yuan ($9.8 billion), the company said. That would mean the government fund owns 98 percent of the company, wiping out most of the equity stake of Wu and other shareholders.

Anbang said it would look for strategic investors. That suggested they might be expected to buy out the government’s funds ownership.

The Communist Party has made reducing financial risk a priority this year after a surge in debt prompted rating agencies last year to cut Beijing’s credit rating for government borrowing.

Anbang is being run by a committee of officials from China’s insurance regulator, central bank and other agencies. They have said its obligations to policyholders and creditors are unaffected.

Wu founded Anbang in 2004 and, while rarely appearing in public, gained a reputation for aggressive expansion in a stodgy industry dominated by state-owned insurers.

The company grew to more than 30,000 employees with 35 million clients. It diversified into life insurance, banking, asset management, leasing and brokerage services.

Wu is accused of fraudulently raising 65 billion yuan ($10 billion) from investors and abusing his post to benefit himself. State television showed him confessing in a Shanghai court last week but no verdict has been announced.

Anbang discussed possibly investing in a Manhattan skyscraper owned by the family of U.S. President Donald Trump’s son-in-law and adviser, Jared Kushner. Those talks ended last year with no deal.

The negotiations with Kushner Cos. about 666 Fifth Ave. prompted members of the U.S. Congress to raise ethics concerns.

COMMENTS

Please let us know if you're having issues with commenting.