Democrats are scrambling Wednesday to invent fresh methods of leveraging the IRS against Americans. A wealth tax and 15 percent global minimum tax are under consideration, along with a provision that allows the IRS to spy on American bank accounts.

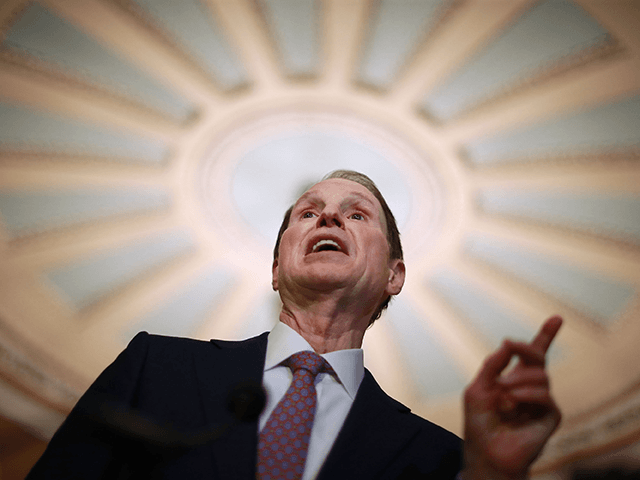

The first tax Democrats are weighing is a 15 percent corporate minimum, which would reportedly burden 200 companies with “profits” above $1 billion. Sens. Ron Wyden (D-OR), Elizabeth Warren (D-MA), and Angus King (I-ME) have proposed the measure. Apparently Sens. Joe Manchin (D-WV) and Kyrsten Sinema (D-AZ) approve of the plan.

(L-R) Sen. Elizabeth Warren (D-MA), Sen. Ron Wyden (D-OR) and Sen. Angus King (I-ME) speak to reporters about a corporate minimum tax plan at the U.S. Capitol October 26, 2021 in Washington, DC. (Photo by Drew Angerer/Getty Images)

“The trio said the Joint Tax Committee had estimated it could raise up to $300 billion to $400 billion over a decade, but no formal scoring was issued,” Punchbowl News reported. Wyden said his 107-page plan “would ensure billionaires pay tax every year, just like working Americans. No working person in America thinks it’s right that they pay their taxes and billionaires don’t.”

The second tax Democrats are considering is a wealth tax on assets that go up in value but have not been sold. For instance, if the value of a stock goes up, tax payers would pay a percentage of the increased value to the IRS. If the tax scheme is not enacted, some Democrats estimate the IRS will not be able to collect an extra $250 billion.

U.S. Senator Kyrsten Sinema speaks at the at the hearing on Type 1 Diabetes at the Dirksen Senate Office Building on July 10, 2019 in Washington, DC. (Photo by Jemal Countess/Getty Images for JDRF)

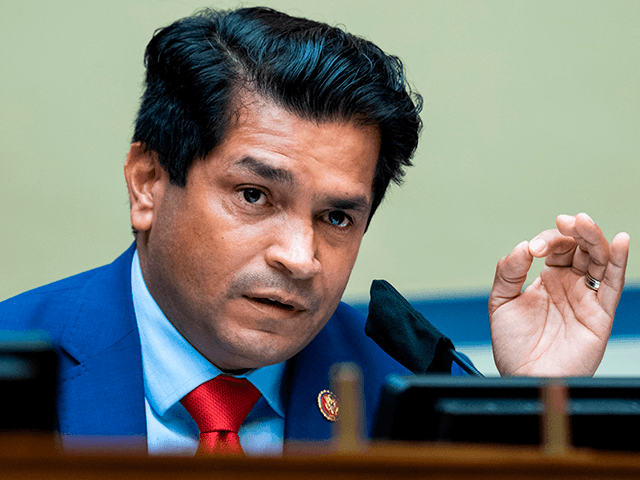

This plan has also been introduced by Wyden. It is opposed by Rep. Nancy Pelosi (D-CA), Sinema, and a few House Democrats. Rep. Jimmy Gomez (D-CA) told Politico Playbook on Tuesday the wealth tax has frustrated him as a waste of time. “The Senate needs to start saying yes or no on issues and stop fucking talking,” Gomez stated.

Rep. Jimmy Gomez, D-Calif., questions Postmaster General Louis DeJoy during a House Oversight and Reform Committee hearing on Capitol Hill in Washington, DC, on August 24, 2020. (Photo by TOM WILLIAMS/POOL/AFP via Getty Images)

House Budget Chair John Yarmuth (D-KY) stated he does not like the plan because it does not tax Americans enough. “I don’t think it’s a reliable offset. So I have concerns about that,” Yarmuth said.

House Budget Committee Chairman John Yarmuth, D-Ky., pauses for reporters after meeting with the House Democratic Caucus and Biden administration officials to discuss progress on an infrastructure bill, at the Capitol in Washington, Tuesday, June 15, 2021. (AP Photo/J. Scott Applewhite)

Democrats are also considering allowing the IRS more investigatory powers to spy on transactions over $600. Primarily due to public outrage, the plan to permit the IRS to calculate “total amount of money going in and out of an account in a given year” has fallen flat. Democrats have since raised the threshold $600 amount to $10,000.

Manchin opposes the idea, however, telling the Economic Club of Washington, DC, that allowing the IRS to spy on transactions is “messed up.”

“Do you understand how messed up that is?” Manchin reportedly conveyed to the president. “This cannot happen. It’s screwed up.”

“I think that one’s going to be gone,” Manchin added.

Follow Wendell Husebø on Twitter @WendellHusebø

COMMENTS

Please let us know if you're having issues with commenting.