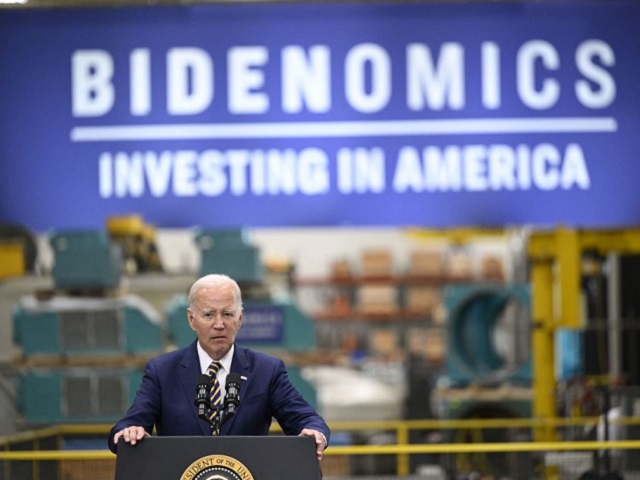

The already insane cost of purchasing a home has hit a new high, thanks to the ongoing horror show that is Bidenomics.

Findings from Redfin show the combination of steep mortgage rates and elevated home prices has pushed the median monthly housing payment to a record $2,775 – an 11% increase from the same time last year.

…

There are a number of driving forces behind the affordability crisis. Years of underbuilding fueled a shortage of homes in the country, a problem that was later exacerbated by the rapid rise in mortgage rates and expensive construction materials.

And let’s not forget another “driving force”: Joe Biden opening up our southern border to millions and millions of illegal immigrants who directly compete with citizens and legal immigrants for housing.

“Mortgage buyer Freddie Mac said Thursday that the average rate on a 30-year loan this week crossed the 7% threshold for the first time this year,” Fox News adds. “While that is down from a peak of 7.79% in the fall, it remains sharply higher than the pandemic-era lows of just 3%.”

BIDEN

To give you an idea of how this works, let’s say you take out a 30-year mortgage today for $300,000 at 7.1 percent…

Your monthly mortgage payment will be $2,100, and at the end of those 30 years, you will have paid back the $300,000 PLUS $426,000 in interest. Yes, thanks to Joe Biden, that $300,000 loan now costs you $726,000.

TRUMP

When former President Donald Trump left office in January 2021, the average 30-year mortgage rate was 2.65 percent, so using the Trump mortgage rate, let’s do the same math on the same $300,000…

Your monthly mortgage payment will be $1,208, and at the end of those 30 years, you will have paid back the $300,000 PLUS $135,000 in interest. So, under Trump, that same $300,000 mortgage costs just $435,0000.

NO MORE MEAN TWEETS

Thanks to Joe Biden, you are paying close to $900 more monthly on your mortgage AND, most importantly, paying nearly $290,000 more in interest over those 30 years.

Imagine how an extra $900 a month could improve your standard of living.

Imagine how that $290,000 Bidenomics is forcing you to flush down the toilet in interest payments could benefit your retirement savings or pay for college tuition.

Joe Biden is the only one at fault for these insane interest rates and the fact that it costs more to buy a home today than at any time in history.

JOE BIDEN CHOSE TO spend trillions of unnecessary federal dollars, which cheapened the dollar, created inflation, and more than doubled interest rates.

JOE BIDEN CHOSE TO kill domestic energy production, which increased the cost of the energy needed to produce, transport, and store almost every good and service, which translates to higher prices, which translates to inflation and higher interest rates.

JOE BIDEN CHOSE TO open the border and flood the country with millions and millions of illegal Democrats who compete for goods, services, energy, and housing—this increase in demand increases costs that create inflation and explode interest rates.

What’s more, as the report points out, there is a lack of churn in the housing market because potential sellers “who locked in a record-low mortgage rate of 3% or less … have been reluctant to sell, limiting supply further and leaving few options for eager would-be buyers.”

The fewer homes up for sale, the higher the demand for homes, which means higher costs.

The only good news is that these high-interest rates are great for those of us at a certain age who invest in CDs and the money market. We’re finally getting a decent return of five-plus percent.

The smartest thing wannabe homebuyers can do in this situation is the following…

- Stop voting for Democrats, dummies.

- Move to a red state.

- If possible, move to a small town where you can purchase a home and land cheaply.

- Purchase a home that needs a lot of work—these are even cheaper

- Do the renovations yourself.

- Pay your mortgage off as soon as possible. Put every extra dollar towards getting out from under. In the longterm, this will save you hundreds of thousands of dollars in interest payments.

How do I know this works? Because this is exactly what my wife and I did in February 1997 when mortgage rates were over seven percent. Neither of us made six-figures, but we still paid off our home in seven years. What we didn’t do was piss our money away on vacations, restaurants, new cars, or any other nonsense.

Debt is slavery.

Not owning your own home is serfdom.

Stop voting for Democrats.

John Nolte’s first and last novel, Borrowed Time, is winning five-star raves from everyday readers. You can read an excerpt here and an in-depth review here. Also available in hardcover on Kindle and Audiobook.

COMMENTS

Please let us know if you're having issues with commenting.