Breitbart Business Digest: An Anti-Tariff Paper Accidentally Makes the Case for Trump’s Tariffs

A new academic paper attempting to defend the conventional wisdom against Trump’s tariffs unwittingly made the case for them.

A new academic paper attempting to defend the conventional wisdom against Trump’s tariffs unwittingly made the case for them.

The Democrats are once again a party of Gloomdogglers. It’s hard to know how much of their pessimism about the economy is simply partisanship or genuine gloominess.

You would not know it from the gloom-ridden headlines of the financial media, but Americans are feeling a bit better about their personal finances than they were a year ago.

It’s A Wrap: The Life And Times Of A Tariff Price Hike Myth Welcome back to Friday. This is the Breitbart Business Digest Friday Wrap, our weekly survey of news from the economy, Wall Street, Main Street, Washington, D.C., and

The Free Traders Have It Backwards: America Doesn’t Need the World for Quality The next time you order a pint of hazy double IPA, you can thank the diversity, dynamism, and competitiveness of the American economy. Scott Burns of Texas

While the government shutdown has captured the attention of the denizens of the nation’s capital, the actual financial capital and labor of the U.S. is likely to proceed as if nothing much has changed.

Pop singer and donut enthusiast Ariana Grande wants to know if Trump voters think their personal finances have improved under Trump’s policies. Here is what the data shows.

For decades, American companies made a straightforward calculation: They would share their technology with Chinese partners in exchange for access to the world’s largest consumer market and its low-cost labor.

The prices of goods affected by tariffs fell in August, crushing the hopes of everyone at the Cato Institute.

A bipartisan who’s who of the economic establishment has fired a fusillade of foolscap at the Supreme Court, insisting that President Trump must not be allowed to remove Fed Governor Lisa Cook.

We should remove the tax burden that is keeping older Americans locked into their homes and younger Americans locked out.

U.S. pharmaceutical giant Bristol Myers Squibb announced Monday its new flagship drug will launch at the same price overseas in the UK as in the U.S., a precedent-breaking move reflecting President Donald Trump’s push to end higher drug costs for Americans.

Trump’s critics insisted tariffs would be the spark that lit a global trade war. But the trade war never arrived.

The fight over Lisa Cook’s seat on the Board of Governors of the Federal Reserve turns on a deceptively simple question: does a Fed governor have a property right in exercising their power over monetary policy?

American businesses shouldn’t be locked into 1970s-era regulatory uniformity on the frequency of their earnings reports.

The D.C. Circuit Court of Appeals handed Federal Reserve Governor Lisa Cook a temporary victory against President Trump. Here’s why the Supreme Court will likely reverse this.

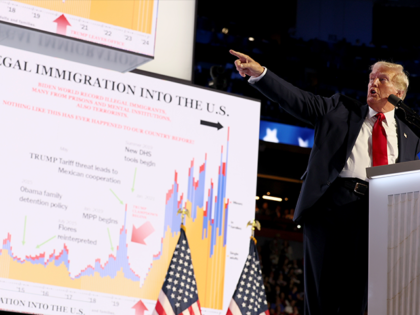

The Trump administration’s immigration restrictions are set to deliver roughly $700 in additional annual income to the typical American household by 2028.

Welcome to the inaugural Friday Wrap, our weekly survey of the economy, Wall Street, Silicon Valley, and the bureaucrats who pretend they can read the future by staring at spreadsheets.

Once again, the consumer price index has failed to deliver the tariff-inflation spiral that economists and the media have promised.

The August producer price report delivered yet another blow to the doomsayers who predicted President Donald Trump’s tariffs would ignite inflation.

For two years in a row, the cheerleaders of Bidenomics assured us that any discontent was in our heads—a trick of bad vibes and social media. It turns out the voters were right, and the official statistics were wrong.

Trump’s immigration enforcement has delivered something rare in American politics: a policy that does exactly what its supporters promised.

The most important development for reading employment data isn’t coming from the Bureau of Labor Statistics. It’s coming from immigration policy.

Countries pursue mercantilist policies not because they’re naturally better at producing certain goods, but because they want to maintain consumption deficits while America absorbs their excess production.

This week saw a series of unprecedented events that may signal the end of the form of central bank independence as we have known it for more than a century.

Lisa Cook, who was confirmed as a Governor of the Federal Reserve in 2022, wants a federal judge to do something no court has attempted in the Fed’s 112-year history: define what “for cause” means when a president tries to fire a Fed governor.

Measured against the history, the text, and the institutional logic, the legal ground in the Lisa Cook dispute tilts toward presidential discretion, not judicial oversight of central bank staffing.

Federal Reserve Governor Lisa Cook’s attempt to overturn her removal faces long odds.

The Trump administration’s decision to take a ten percent stake in Intel is not socialism. It’s a financing innovation designed to overcome Wall Street’s allergy to capital investment.

Harvard economist Claudia Goldin opened the Fed’s Jackson Hole symposium with a paper linking low fertility in advanced economies to men who don’t do their share of housework.

America’s factories are humming, demand is solid, and prices are rising alongside precautionary inventories. The Fed’s theory inflation “lag theory” doesn’t explain this.

By the time Federal Reserve Chairman Jerome Powell climbs the stage at Jackson Hole this Friday, the familiar choreography will be missing one element: consensus.

A new working paper asks what would have happened if the country had heeded Pat Buchanan’s warnings about unchecked globalization and adopted his trade policies sooner.

President Donald Trump’s tariff policy is about a lot more than raising import duties. This is the new “deal economy”—less about rates, more about commitments.

Economics has always wrestled with the limits of what can be known. The recent disproof of a famous mathematical conjecture has made those limits even sharper.

When, if ever, should a country impose tariffs? A working paper by economists Oleg Itskhoki and Dmitry Mukhin provides an answer that is both surprising and vindicating of the Trump administration’s trade agenda.

The legal case for Trump’s use of tariffs under IEEPA isn’t some novelty. It’s an originalist argument grounded in history, precedent, and the plain structure of constitutional power.

A new academic paper, published by three trade economists using microdata from China, shows that tariffs don’t have to raise prices. Sometimes, they bring them down.

President Donald Trump this week said he is planning to impose a 100 percent tariff on imported computer chips unless manufacturers are also investing in U.S. production.

The Fed needs someone at the helm who understands how growth happens, where policy fails, and why incentives matter more than slogans. That’s Scott Bessent.