Bostic Says Fed Should Wait Until November or December To Cut Rates

The Atlanta Fed said inflation is falling much more slowly than expected, so the Fed will probably not cut rates until the end of the year.

The Atlanta Fed said inflation is falling much more slowly than expected, so the Fed will probably not cut rates until the end of the year.

The Fed’s benchmark rate is now the highest it has been since 2007.

The Fed’s biggest hike since 1994.

A week ago, the Fed Funds futures market implied a 4 percent chance of a 75 basis point hike. Now it implies a 90 percent chance.

The Fed pivots from pumping up employment to removing accommodation.

The Fed left its key interest rate target and bond buying program unchanged at the end of its two-day meeting Wednesday. But the projections of Fed officials show that they see more inflation and more growth by the end of the year than they did at the end of their March meeting.

Back in June the Fed’s median forecast was for the economy to shrink 6.5 percent. Now it sees only a 3.7 percent contraction.

The Fed said it will continue bond purchases at least at the current rate, around $1 trillion a year.

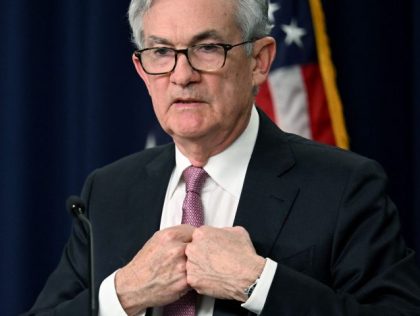

Powell added that the Fed is “very carefully monitoring the situation.”

Employment, household spending, and business investment have made solid gains, according to the Federal Reserve.

Fed rate raise signals cautious optimism about economic stability.

Far from worrying that the economy is in danger of overheating, the minutes make it clear that Fed officials see the risks to economic growth as “tilted to the downside.”

U.S. stocks crashed 2.5 percent on Friday, September 9 as Wall Street woke up to the risk of “Two Bumps and a Stumble” — i.e. when it takes two interest rate hikes to generate a market reaction.

With the appointment of Neel Kashkari as President of the Federal Reserve Bank of Minneapolis, former Goldman Sachs executives will hold 4 of the 5 Fed Presidents’ seats on the powerful Federal Open Markets Committee that controls U.S. interests rates.