Amid ongoing concerns about a crisis in the commercial real estate market, the funds that previously bailed out beleaguered office co-working startup WeWork are reportedly exploring bankruptcy options for the company.

For a monthly or daily fee, WeWork allows its customers to use office space in its various locations around the world, offering either shared working spaces or private offices.

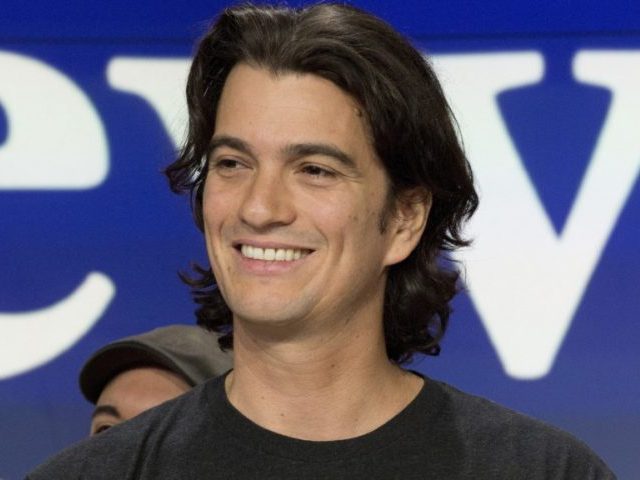

While the company has significantly high annual revenues — $3.245 billion in 2022 — it has been fraught with controversy. Its disclosure of $47 billion of future lease obligations in 2019 amid a failed attempt to go public led to a storm of concern and criticism from investors and analysts. The antics of infamous CEO Adam Neumann added fuel to the fire.

Now, there are growing concerns about the company’s prospects for survival amid a slump in the commercial real estate market. WeWork’s creditors are now considering Chapter 11 bankruptcy for the company.

Via the Wall Street Journal:

After WeWork raised doubts about its ability to stay in business a few weeks ago, fund managers including BlackRock, King Street Capital and Brigade Capital are holding preliminary talks about the company’s restructuring options and indicated that they would support a plan for WeWork to file for chapter 11 bankruptcy, the people said.

The fund managers have become some of WeWork’s most important investors after they lent $1.2 billion in new debt to the company in March, accounting for about 50% of the company’s long-term debt, according to public filings.

WeWork’s interim chief, David Tolley, said in an interview that the company is seeking to avoid filing for chapter 11 by negotiating with landlords and reducing its cost of rent.

Once the most valuable tech startup in the world, with a staggering $47 billion valuation, WeWork currently has $205 million in cash on hand, per securities filings, after spending $530 million in the first six months of 2023.

Allum Bokhari is the senior technology correspondent at Breitbart News. He is the author of #DELETED: Big Tech’s Battle to Erase the Trump Movement and Steal The Election. Follow him on Twitter @AllumBokhari.

COMMENTS

Please let us know if you're having issues with commenting.