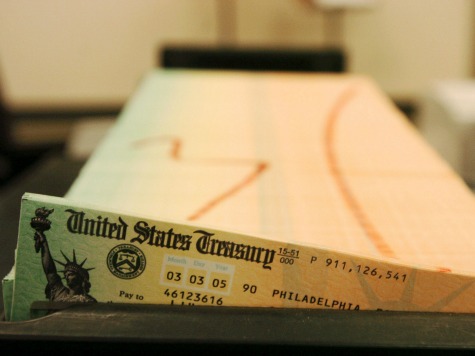

On Friday, Medicare’s and Social Security’s trustees revealed the trust funds for the two programs will become insolvent by 2026 and 2033, respectively.

According to The Hill, the annual report found Social Security will only be able to deliver three-quarters of the promised benefits after 2033. To make matters more urgent, “the trust fund that pays disability benefits through Social Security is headed for insolvency in 2016 and will only be able to pay out 80 percent of benefits after that date.”

The report for Medicare found Medicare’s trust fund will be insolvent “two years later than previously estimated.” The Obama administration tried to spin the report’s estimates as a victory for Obamacare, which they claimed was a fiscally responsible bill in the long term.

“Lawmakers should address the financial challenges facing Social Security and Medicare as soon as possible,” the report said, according to The Hill. “Taking action sooner rather than later will leave more options and more time available to phase in changes to that the public has adequate time to prepare.”

A spokesperson for House Budget Committee Chairman Paul Ryan said the reports emphasize how “Medicare and Social Security are in great danger” and action must be taken now “so we can keep our promises to current seniors and future retirees.”

As is always the case with Social Security and Medicare, there will be heated debates about how to ensure both programs become solvent.

??The trustees report was signed by Health and Human Services Secretary Kathleen Sebelius, Acting Labor Secretary Seth Harris, Acting Social Security Commissioner Carolyn Colvin, Treasury Secretary Jack Law and public trustees Charles Blahous and Robert Reischauer.

AARP has already criticized the Obama administration for including the chained consumer price index for Social Security payments in its budget. Other senior groups have suggested lifting the “cap on payroll taxes to increase funding for Social Security, as workers currently do not pay the payroll taxes on income over $113,700.”

Republicans have proposed “an increase in the retirement age or means-testing of Social Security benefits,” but the House GOP leadership has been “silent” about concrete proposals to fix the program.

Furthermore, as The Hill notes, “deficit hawks are pushing for lower retirement benefits and higher insurance premiums for seniors” while Democrats instead want more tax increases.

COMMENTS

Please let us know if you're having issues with commenting.