The top Republicans on the Senate Banking Committee called on the Treasury Department Tuesday to end the policy of designating non-bank financial companies as Too Big To Fail.

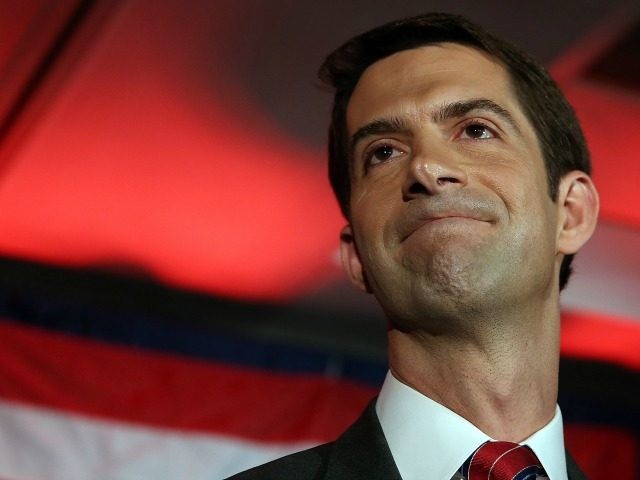

In a letter sent Tuesday, Senator Tom Cotton and nine other Republican Senators urged Treasury Secretary Steven Mnuchin to “use the all tools available” to reverse the Obama administration’s policy of having a federal council designate non-bank financial companies as “systemically important financial institutions,” a designation that brings with it stringent supervision by the Federal Reserve, new capital requirements, and costly regulatory burdens.

Critics of the policy claim that designating nonbank companies as SIFI’s is counterproductive because it creates the impression that were the companies to fail despite regulation, the government would act to bail them out. Instead of dismantling Too Big To Fail, SIFI designation actually reinforces it, critics charge.

“Among its many flaws, Dodd-Frank enshrined ‘Too Big To Fail’ as an official policy by creating a Federal council to designate nonbanks as ‘systemically important financial institutions.’ These designations offer large firms implicit taxpayer backing for future bailouts and result in massive new regulatory costs,” the group of Senators said in a statement Tuesday.

The Senators frame their letter as supporting the President Donald Trump’s Executive Order on financial regulation. It was signed by Senators Cotton, Pat Toomey, Richard Chelby, Mike Crapo, Mike Rounds, John Kennedy, Ben Sasse, David Perdue, Thom Tillis and Tim Scott.

The Dodd-Frank Act created a new financial regulatory body called the Financial Stability Oversight Council, an intergovernmental taskforce led by the Treasury Secretary, and gave it the power to designate financial companies as SIFIs. The council, known as FSOC, designated three large insurance companies–American International Group, Prudential Insurance, and MetLife–as SIFIs. Last year, a federal judge ruled that the designation of MetLife was “arbitrary and capricious,” describing FSOC’s process as “fatally flawed.”

The Obama administration appealed that ruling and the case was heard by the D.C. Circuit Court of Appeals last fall. Many expected the Trump administration would drop the appeal, letting the original ruling overturning the SIFI designation stand. The failure of the Trump administration to act has perplexed allies of the administration on Capitol Hill and in the insurance industry.

Although the letter from Senator Cotton and others doesn’t explicitly mention the MetLife case, it is undoubtedly an attempt to spur the administration to action on the matter.

“The FSOC’s process for designating non-bank systemically important financial institutions lacks transparency and accountability,” the letter states, echoing the language of the federal court’s decision overturning the MetLife designation.

“There have been high-level talks about this, yet nothing has happened. Hopefully this gets the administration off its keister,” said one person familiar with the background of the letter.

One concern is that if the administration does not act swiftly, the D.C. Circuit Court could issue a decision reversing the lower court. That would complicate efforts to reverse the designation of the insurance companies as SIFIS.

COMMENTS

Please let us know if you're having issues with commenting.