Twenty years after the United States invested blood and treasure in liberating Iraq from the rule of Saddam Hussein, China is attempting to lock up control of Iraq’s oilfields.

The Western intervention in Iraq was denounced by critics as a “war for oil,” but in the end, the great authoritarian menace of the 21st Century is close to taking control of Iraq’s energy resources.

Reuters reported on Tuesday that Iraq’s oil ministry has repelled three attempts by Chinese firms to gain control of the country’s petroleum resources. If China had succeeded, it might well have triggered an “exodus of international oil majors” that would leave Iraq open to a more extensive takeover by Beijing:

Since the start of 2021, plans by Russia’s Lukoil (LKOH.MM) and U.S. oil major Exxon Mobil (XOM.N) to sell stakes in major fields to Chinese state-backed firms have hit the buffers after interventions from Iraq’s oil ministry, according to Iraqi oil officials and industry executives.

Selling a stake to a state-run Chinese company was also one of several options being considered by Britain’s BP (BP.L), but officials persuaded it to stay in Iraq for now, people familiar with the matter said.

China is Iraq’s top investor and Baghdad was the biggest beneficiary last year of Beijing’s Belt and Road initiative, receiving $10.5 billion in financing for infrastructure projects including a power plant and an airport.

Iraqi officials told Reuters they also prevented Chinese state-backed firms from buying shares in major oilfields from Exxon and BP last year. If those deals had gone through, China would have gained control over nearly half of Iraq’s crude oil production.

The Iraqi officials said they desired a stronger relationship with China to balance Iran’s regional influence, and they certainly value those Belt and Road billions as Iraq rebuilds from its war with the Islamic State, but they are apprehensive about the loss of other foreign investment that would result if Iraq was viewed as Chinese property.

“We don’t want the Iraqi energy sector to be labeled as a China-led energy sector and this attitude is agreed by government and the oil ministry,” one official said.

In this Jan. 12, 2017 photo, laborers walk down a path in the Nihran Bin Omar field north of Basra, Iraq, 340 miles (550 kilometers) southeast of Baghdad. (AP Photo/Nabil al-Jurani)

Even with these big takeover deals blocked in 2021 and 2022, China still has a strong position in Iraqi oil, having “won most energy deals and contracts awarded over the past four years.”

Chinese state firms have secured a “dominant position” by undercutting the profit margins desired by most other investors. Baghdad may not be able to keep Beijing at bay for long, as analysts told Reuters the Western push for “green energy” is making it harder for Iraq to offer the kind of deals that would attract anyone but rapacious China.

China moved aggressively into the Middle East last year as American regional influence waned, to the surprise of analysts who expected Beijing to buy more influence in Southeast Asia. In addition to throwing $10.5 billion in Belt and Road Initiative (BRI) money at Iraq, China’s current five-year plan envisions more than doubling construct contracts in Middle Eastern and Arab countries.

President Joe Biden’s disastrous withdrawal from Afghanistan looks like a major inflection point, as China moved quickly to grab Afghanistan’s mineral resources, and leaders across the region began seeing Beijing as an alternative to the declining American superpower.

China was already well-positioned in Iraq as a major buyer of its oil and provider of infrastructure money, while U.S. and European investors are skittish about doing business in a politically unstable, violence-prone country. Former Iraqi Prime Minister Adel Abdul Mahdi promised a “quantum leap” in relations between Baghdad and Beijing in 2019; halfway through 2022, a growing number of Iraqi officials are worried about how much leverage China is securing over their government with its huge infrastructure loans and sweetheart oil deals.

Turkey’s TRT World in April explained the Turkish government appears nervous about China’s growing influence in Iraq and Iran, even as the Turks anticipate a big payoff from the BRI corridor China is building across the Middle East:

China’s closeness to Iran and their alliance in Iraq will have negative repercussions on Turkey’s political and economic relations with Iraq. Notably, while Tehran seeks to exert China as a balancing factor against the US in Iraq, it may also want to use China’s investment strategy as a balancing factor against Turkey’s influence in the KRG [Kurdistan Regional Government].

Taking Geng Shuang’s, China’s deputy permanent representative to the UN, call last December for Ankara to “respect for sovereignty” regarding its military operations within Iraqi territory, it may mean that China’s influence over Iraq goes beyond economic and geopolitical domination. It is quite clear that this situation is in Iran’s favor. However, in the short term, it is unlikely that even a powerful actor like Beijing could affect the indispensability of Ankara, which is the key country in marketing the energy of the KRG to the world, and its gateway to the West.

The Jerusalem Post noted that Iraq is absorbing a growing share of China’s dwindling BRI spending, a clear signal of Iraq’s importance to the “chain” of influence China is building across the Middle East – and perhaps of Beijing’s growing frustration with the erratic Iranians.

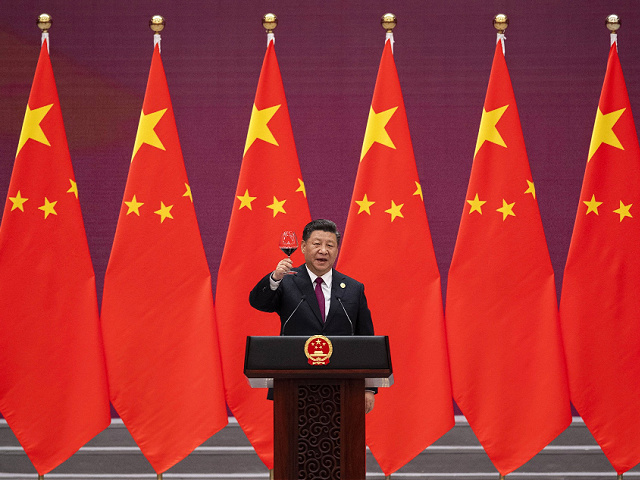

Chinese President Xi Jinping raises his glass and proposes a toast during the welcome banquet for visiting leaders attending the Belt and Road Forum at the Great Hall of the People, Friday, April 26, 2019. (Nicolas Asfouri/Pool Photo via AP)

“The Chinese have always found it extremely difficult to do business with Iran and there is a lot of unpublicized tension in Iran-China relations,” Clarice Witte of the Sino-Israel Global Network and Academic Leadership (SIGNAL) told the Jerusalem Post.

“Due to China’s dependence on Saudi and Gulf energy, they feel it’s important to cultivate another significant source of oil. Iraq is a very young market that needs to grow, needs everything and has a way to pay for it (unlike Syria which has limited oil reserves and Lebanon which has none). When you think about it, Iraq is the ideal venue for China in the Middle East,” Witte said.

Witte made the interesting point that America’s ostentatiously selfless nation-building programs make it seem like a less reliable partner to many Middle Eastern leaders than shrewd, ambitious, and bluntly nationalist China.

“After watching the U.S. behavior in the Middle East over the last few years, the reality sank in that the U.S. cannot necessarily be counted on. America wants to give, but not to do. It gives money, but it doesn’t go and improve the situation of the locals. That’s why we have Chinese everywhere – because the Americans don’t do the work anymore,” she said.

COMMENTS

Please let us know if you're having issues with commenting.