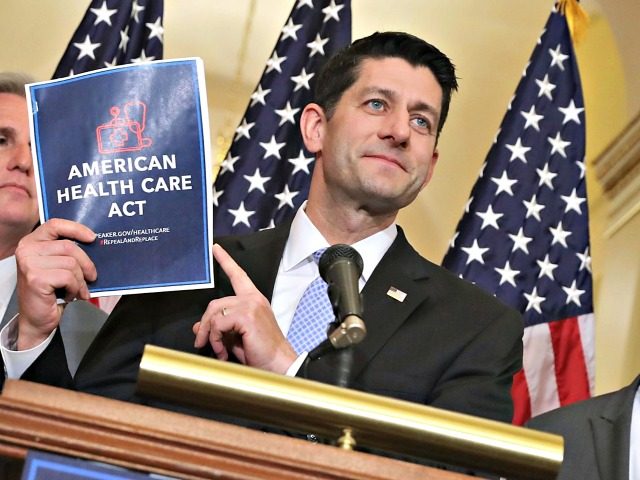

Speaker Ryan’s plan to repeal and replace Obamacare elicits calls of “Obamacare-lite” in some quarters.

Here are some of the larger reforms in the Ryan’s American Health Care Act:

Individual Mandate

Under Obamacare, individuals are required to purchase health insurance or pay a penalty. The Ryan plan replaces the individual mandate penalty with a penalty payable to the health insurance companies. Individuals who forgo health insurance for longer than 63 days face a 30 percent surcharge on their health insurance premiums. Since premiums are based on age, older Americans face a more expensive penalty for forgoing health insurance. The Ryan mandate’s penalty is based on age, not on income, so low-income Americans could be subject to a disproportionately higher penalty than wealthier Americans.

Employer Mandate

Obamacare required that employers with 50 or more full-time employees must provide health insurance to their employees and their dependents. The American Health Care Act repeals the employer mandate.

Taxes on ‘Cadillac’ Employer-Sponsored Health Plans

The Affordable Care Act taxed expensive health care plans provided by employers at 40 percent. Rather than repealing the Cadillac tax, Speaker Ryan’s plan delays the Cadillac tax until 2025.

Repeal of Various Taxes

Paul Ryan’s plan would repeal taxes on:

- Over-the-counter medications

- Health Savings Accounts

- A 2.3 percent tax on medical devices

- A .9 percent tax on Medicare

- A 10 percent sales tax on indoor tanning services.

- A 3.8 percent net investment tax on individuals, estates, and trusts above a certain threshold.

- Brand-name prescription medications

- Annual fees on certain pharmaceutical manufacturers

Refundable Tax Credits

The American Health Care Act creates refundable tax credits for individuals to purchase health insurance. The tax credits are adjusted by age:

- Under age 30: $2,000

• Between 30 and 39: $2,500

• Between 40 and 49: $3,000

• Between 50 and 59: $3,500

• Over age 60: $4,000

These credits are available for those making $75,000 or those who file jointly at $150,000, and the credit phases out by $100 for every $1,000 higher in income in these age brackets.

Raises Limits on Contributions to Health Savings Accounts

Health Savings Accounts allow individuals and families to pay for out of pocket costs medical costs. The American Health Care Act raises the annual contribution limit to $6,550 or $13,100 for family coverage.

Essential Health Benefits

Paul Ryan’s Obamacare replacement retains Obamacare’s essential health benefits. The essential health benefits provisions requires that insurers maintain a minimum level of coverage, including emergency services, prescription drugs, laboratory services, vision, and dental.

State Innovation Funds

The Ryan plan creates a $100 billion “Patient and State Stability Fund” that creates subsidies for states to provide care to high-risk individuals, stabilize private insurance premiums, promote aces to preventive services, and provide cost sharing subsidies.

Medicaid Expansion Reform

Medicaid expansion will be capped per capita in 2020.

Not in the Ryan Plan

- Selling insurance across state lines, a popular conservative reform that would reduce costs and increase competition in the insurance market.

- A Congressional Budget Office score, that would allow for Congress and the American people to know how much the Ryan plan will add to the deficit.

For a Conservative alternative to Speaker Ryan’s plan, see Senator Rand Paul’s plan here:

COMMENTS

Please let us know if you're having issues with commenting.