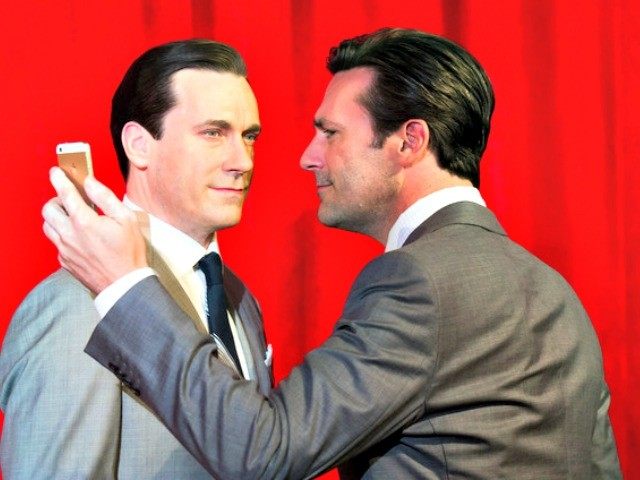

Henry Ford is credited as saying “I knew that only half my advertising worked, but the trouble is that I do not know which half.” Today, with 30 percent of advertising already going digital, Silicon Valley geeks commanding databases are terrorizing Madison Avenue’s Mad Men.

Procter & Gamble Co., for example, as the world’s largest advertiser, plans to slash spending with deep cuts in the number of advertising agencies it works with in a quest to save $500 million in fees paid to the outside firms that pitch its 40 brands with sales over $1billion.

The nation’s top 10 marketers spent $15.34 billion on traditional media and online display advertising in 2014, down 4.2% from a year earlier. Research firm Kantar Media told the Wall Street Journal that among that elite group, P&G made the deepest cuts by slashing its spending 14.4% from $3.08 billion to $2.64 billion.

Kantar Media’s September ad expenditure report showed that four of the five biggest advertisers–including Proctor & Gamble, General Motors, AT&T and Comcast–averaged double digit cut-backs over the last nine months.

Only three of the top 10 marketers– Berkshire Hathaway, Pfizer and Verizon– spent more on advertising in 2014, according to Kantar. Total spending on traditional advertising and online display was up 0.7% to $141.2 billion for the year.

P&G’s measured ad spending declined every quarter of 2014. The biggest cutbacks were in magazines and internet display advertising, according to Kantar. Chief Financial Officer Jon Moeller told the Journal that 30 percent of the company’s “working media” is now digital, as P&G has made new investments to improve its marketing efficiency.

“We continue to drive marketing productivity through an optimized mix, driven by new, more efficient digital media,” Mr. Moeller stated on the company’s year-end earnings call with Wall Street analysts. “We have quietly strengthened and invested in all of our digital capabilities, including mobile, search and social, with a wide range of partners.”

P&G’s move to rip dollars out of Madison Avenue firms follows similar moves by top-ten consumer product behemoths such as Coca-Cola, Unilever, L’Oréal, S.C. Johnson and Visa, which have announced they are evaluating dumping some of their ad agencies.

Kantar said that companies with nearly $20 billion in annual media spending power have some part of their agency business under evaluation as they deal with slowing worldwide GDP growth to concentrate on improving their internal profit margins.

With ad dollars shrinking, big agency giants are being forced to consider consolidations.

Publicis Groupe SA and Omnicom Group Inc. tried to tie that knot in a $35 billion merger. The bulge-bracket merger would have created the world’s largest ad company by revenue. The firms’ subsidiaries–including BBDO, Saatchi & Saatchi, DDB, Leo Burnett and TBWA as well as public-relations firms including FleishmanHillard and Ketchum, and digital ad agencies DigitasLBi and Razorfish–would have come under a common umbrella.

The hook-up was announced with great fanfare as a strategy to leapfrog deep-pocketed Silicon Valley giants like Google and Facebook, which have used consumer habits data-mining to undermine Madison Avenue’s supposed expertise and media buying power. But the deal billed as a “merger of equals” cratered as executives battled over position and power, while tax liabilities and regulatory approvals added real costs.

P&G said the company intends to exit 100 brands to focus on the 65 biggest and most profitable–such as Tide, Pampers, Crest, Gillett and Head & Shoulders. Because it has so many brands, P&G contracted with hundreds of different ad agencies all over the world to help it manage everything from ad campaigns and events to package design and product launches, public relations and displays in Costco and other retailers.

P&G said its cuts will take place over the next two years. P&G does not disclose how much it spends on agencies, but former employees told the Journal that the company used to spend about 15 percent of its advertising budget on fees.

The glory days of Mad Men in Saville Row-tailored suits strolling down Madison Avenue has been increasingly replaced by Silicon Valley geeks on skateboards that own the digital tools and databases that are key to capturing customer eyeballs.

COMMENTS

Please let us know if you're having issues with commenting.