The bipartisan Legislative Analysts’ Office has announced that California’s 2015-16 personal income tax collection has fallen from a huge surplus to a $147 million deficit. The cause appears to be plummeting Silicon Valley capital gains and weakening tech employment.

The quick reversal of fortunes for the state budget is disturbing, since the California State Controller reported that personal income tax collections through December had been at a $1.276 billion surplus.

With a hot tech stock market through June of last year, California realized about $4 billion in “extra” one-time capital gains tax revenues for the 2014-15 fiscal year.

California politicians used to spend windfalls on the middle class. But since Brown was elected in 2010, the state’s middle class has shrunk from 46.7 to 43.5 percent of the population. Average incomes by 2013 had fallen by $5,255, and those spending at least 30 percent of income on housing leaped by 20 percent to 44 percent of state residents.

For the 2015-16 budget, the Governor and Legislature agreed to save $575 million for a “rainy day fund” and spend the balance on pet policies and projects. $380 million will be mailed out as checks to the working poor, for example.

The Legislative Analyst’s Office (LAO) has reported that Silicon Valley’s economic growth in 2015 was impressive, with jobs in the information sector up 10.2 percent, and the tech-heavy professional, scientific, and technical services sector’s also seeing 10 percent gains.

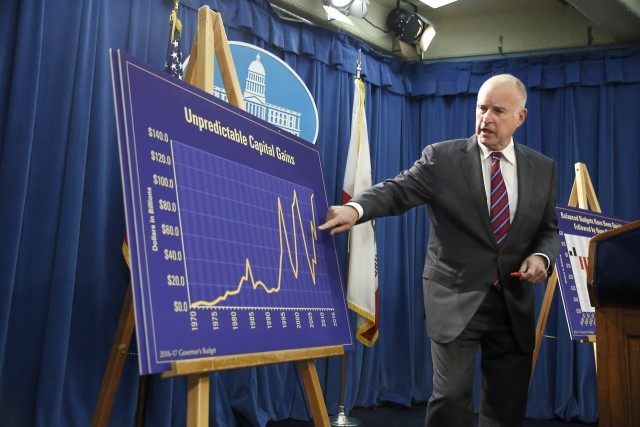

But with a “structural deficit” relying on $16 billion in capital gains taxes to balance the budget, Breitbart News warned last June, “California will be as broke as Greece if the stock market ever tanks again.”

Two months later, the stock market plunged by 20 percent. Despite a year-end rally, the stock market suffered one its worst Januarys in recent history, with a decline of about 5.5 percent for the Dow Jones industrial average, and losses of almost 8 percent in the Nasdaq index, which is loaded with technology and biotechnology stocks.

Breitbart News reported February 4 that U.S. corporate layoffs in January had surged 218 percent from the prior month to 75,114. That was the highest level of after-Christmas downsizing since the brutal 241,749 at the depths of the 2009 Global Financial Crisis.

In a disturbing trend for the State of California, computer and telecommunications sectors were the third and fourth largest sectors for corporate layoffs ,with a combined 14,374 job cuts.

Like gamblers on a hot streak that seem to lose all sense of reality, and who double-up their bets against high odds, California’s Governor Brown and the Democrat-controlled legislature have doubled down spending on the welfare.

With most of the money already spent, the LAO’s report should serve as a wake-up-call that another big drop for Silicon Valley could quickly cause another California State Budget Crisis.

COMMENTS

Please let us know if you're having issues with commenting.