Did May even happen? It sure felt like a month of tumult and action for markets, but we cannot help noticing that stocks ended up just about where they started this month. The S&P 500 moved around half a percentage point lower from the first trading day in May through the last. The Dow Jones Industrial Average moved two-tenths of a percentage point.

Some evidence can be found in the oil market that the world did not actually stand still in May. West Texas Intermediate moved from around $105 to $115, despite the Biden administration’s policy of using the Strategic Petroleum Reserve to attempt to hold down prices. The price of gasoline set at least half a dozen record highs in the back half of the month. The folks over at AAA say that this may actually have been the calm before the storm. Now that the summer driving season has begun, oil and gas prices are likely to rise even more.

That will undoubtedly make Americans even less confident in the economy and the Biden presidency. The latest poll on economic sentiment from Gallup showed that just one percent of Americans think the economy is excellent. Only another 13 percent say it is good, down from 20 percent in April. Thirty-nine percent say things are “only fair” and a staggering 46 percent say economic conditions are “poor.” Hope is fading fast: 77 percent say they expect things will get worse. Just 20 percent think things will get better by the end of the year.

Gallup likes to ask the public to name the most important problem facing the U.S. without prompting them for their choices. For decades, only about one percent of people answered inflation. Now that is up to 18 percent. Twelve percent mention the economy more generally. The only issue receiving more attention: political leadership.

It’s very clear that people really loathe inflation with a rare intensity. It is able to drag down their view of the whole economy even though unemployment is at multi-decade lows and a majority of people tell the pollsters from the Conference Board’s consumer sentiment survey that jobs are plentiful. Why is inflation so powerful? The simplest answer is that it is unavoidable and universal. It is a drain on nearly everyone’s bank account, whereas even really terrible unemployment only directly ensnares one in five Americas. It’s not like you can take some time off or go back to school to avoid high prices.

A survey from the Trafalgar Group released Tuesday showed that nearly 60 percent of Americans say that Biden’s policies are a leading contributor to inflation. Among Republicans, 87.9 percent pin the blame on Biden. Among independents, 61.1 percent do. Even among Democrats, one-third blame Biden’s policies and spending. (Fifty-five percent of the Democrats blame Putin’s war.)

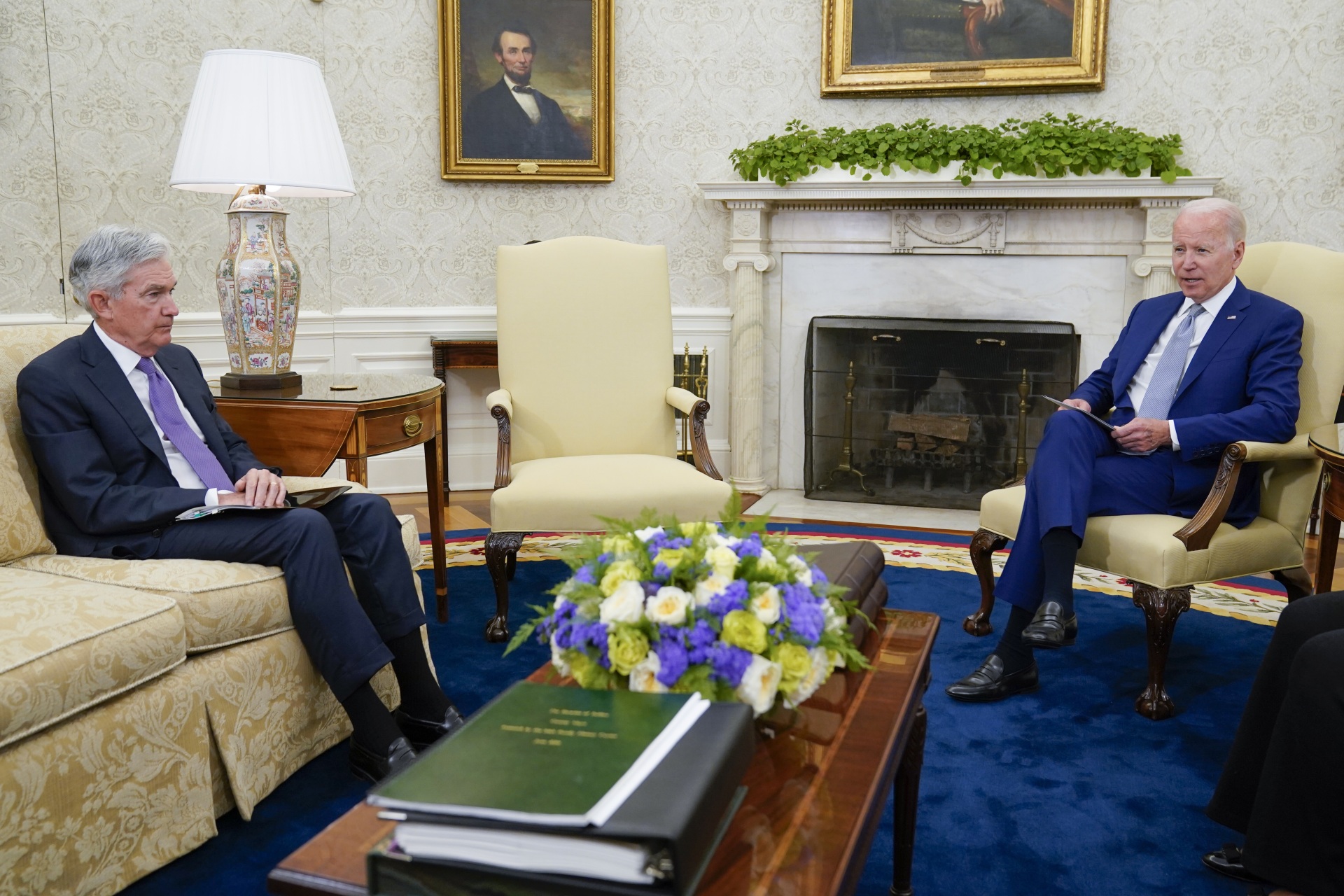

President Joe Biden meets with Federal Reserve Chairman Jerome Powell in the Oval Office of the White House on May 31, 2022. (AP Photo/Evan Vucci)

The Biden administration is aware that inflation is a serious political problem for the Democrats, and so it is trying once again to shift the blame elsewhere. The corporate greed story was basically mocked to death by even left-leaning economists and analysts. The Putin Price Hike narrative persuaded a majority of Democrats but no one else. Now it looks like Federal Reserve Chairman Jerome Powell may be the next fall guy.

“Chair Powell and other leaders of the Fed have noted at this moment they have a laser focus on addressing inflation, just like I am,” Biden said in remarks to reporters as he sat down with Powell. It sounded friendly enough on paper, but Powell has been around long enough that he probably knows what’s coming. In any case, Powell has got at least four more years as Fed chair and is probably confident that Biden has fewer than that as president ahead of him.

COMMENTS

Please let us know if you're having issues with commenting.