Breitbart Business Digest: A September Rate Cut Would Trigger Political Vengeance

A Fed rate cut on the eve of the election would inevitably be seen as a partisan political gift to incumbent Joe Biden and would invite backlash from Republicans.

A Fed rate cut on the eve of the election would inevitably be seen as a partisan political gift to incumbent Joe Biden and would invite backlash from Republicans.

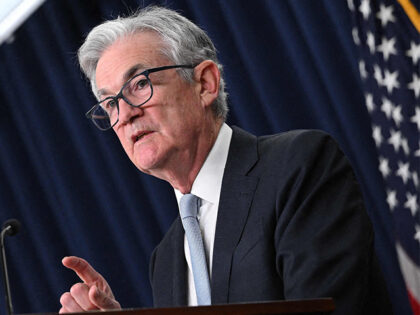

The U.S. government’s use of immigration raises inflation pressures in some parts of the economy, but also reduces it in other parts of the economy, Federal Reserve Chair Jerome Powell told Sen. JD. Vance (R-OH).

Federal Reserve Chair Jerome Powell explicitly refused to offer forward guidance about interest rate policy in his Capitol Hill testimony this week, which we think is an indication that a rate cut in September is unlikely.

Sen. J.D. Vance (R-OH) grilled Federal Reserve Chair Jerome Powell on the impact that mass immigration has on driving up housing prices while, at the same time, reducing wages for working and middle class Americans.

Powell is working from home while he deals with his second bout of Covid.

The Fed chair does not see a rate hike coming but he acknowledged that recent setbacks on inflation mean the current rate policy will last for longer than anticipated.

Jerome Powell spoke today from our nation’s capital and indicated what we all know to be true: The Fed has no business cutting rates at this time.

The potential that the Fed’s next move is up instead of down is arguably the most underpriced risk in the market.

The job of rebuilding the collapsed Francis Scott Key Bridge in Baltimore is going to take a lot longer than many people initially thought—and cost a lot more money.

The latest dispatch from the Federal Reserve left the expected path of interest rates over the next year unchanged. Yet it hinted at a potentially tumultuous shift beneath the calm facade, a shift to a higher rate of interest over the long term.

Perhaps some of the courage of the patron saint of Ireland will inspire our central bankers.

Fed Chair Jerome Powell pointedly declined to defend the establishment view that immigration is a boon for the economy and more immigration even better.

Super core inflation exploded higher in January.

The decision of the Fed to start cutting interest rates bears a strong resemblance to the decision to marry. It can be reversed but only with a great deal of awkwardness, some economic difficulty, and often a reputational cost.

The Bond Market Is Like a Dog Walking on Two Legs We have it on the authority of James Boswell that in the summer of 1763 Samuel Johnson said that “a woman’s preaching is like a dog’s walking on his

Federal Reserve Chair Jerome Powell admitted that he was wrong to expect inflation would be transitory when it started to rise three years ago. Powell said that “in the fourth quarter of ’21, it became clear that inflation was not

Jerome Powell’s No Cut Thunderbolt Groucho Marx famously said he would not join any club that would have him. What happens, however, when the club joins you? We have been arguing since early December that economic growth was too strong

The Fed Fights Back The Federal Reserve delivered a shock on Wednesday by announcing that it does not anticipate cutting rates until it gets more confident that inflation is moving toward two percent. “The Committee does not expect it will

Will the Fed defend the position it staked out in December or capitulate to the view of bond traders?

An election year rate cut followed by a rise in inflation and then a new hiking cycle would cement the view that the Federal Reserve acted on political motives.

The Breitbart Business Digest had the opportunity to sit down for an exclusive interview with a tanned, rested, and jovial Donald Trump at Mar-a-Lago last week for more than two hours. The conversation repeatedly returned on the state of the U.S. economy and his predictions for this election year.

The Federal Reserve Chairman’s silence is an implicit endorsement of the market’s view that we’re headed for five or six rate cuts next year.

New York Federal Reserve President John Williams said Friday that rate cuts are not a topic of discussion for the central bank.

The markets are delighted that they heard Powell say, as he drove out of sight, “Rates cuts for all—and to all a good night.”

We doubted Fed Chairman Jerome Powell was going to play the Grinch at his press conference today, but we did not expect him to play interest rate Santa Claus.

The Federal Reserve left interest rates at 5.25 to 5.5 percent.

Jerome Powell probably did not mean to trigger a significant easing of financial conditions on Friday, but that’s exactly what he did.

The market immediately priced in much larger odds of a cut in March and May.

Federal Reserve Chair Jerome Powell demonstrated zero patience for a group of climate change protesters disrupting his speech on Thursday.

The Federal Reserve is falling behind the curve again.

The Federal Reserve is planning on staying “patient” at this week’s meeting of the Federal Open Market Committee.

Joe Biden position’s on inflation is directly at odds with Fed Chairman Jerome Powell, which could lead to fierce conflict between the two men next year if persistent inflation forces Powell to hike interest rates higher.

The Federal Reserve is not buying the optimism about the economy that the White House has been marketing under the brand Bidenomics.

Federal Reserve Chair Jerome Powell’s remarks today gave plenty of reason to believe that the Fed will not hike rates at its November 1 meeting.

Powell sent a message that the Fed’s next “move” will be a long pause in interest rate changes.

The Federal Reserve appears to expect the softest of landings next year.

You have to wonder if Jerome Powell is a bit frustrated that the unbridled enthusiasm of the stock market this week.

There’s a clash coming between the Federal Reserve and the Biden administration.

The Fed chairman warned that rate hikes may not be over and rejected the idea of raising the central bank’s inflation target.

During a portion of an interview aired on Thursday’s broadcast of the Fox Business Network’s “Kudlow,” 2024 Republican presidential candidate former President Donald Trump said that if he is elected president, he would not renominate Federal Reserve Chair Jay Powell