Business conditions in Texas deteriorated sharply this month as the country remains in the grip of high inflation, a survey conducted by the Dallas Federal Reserve Bank showed Tuesday.

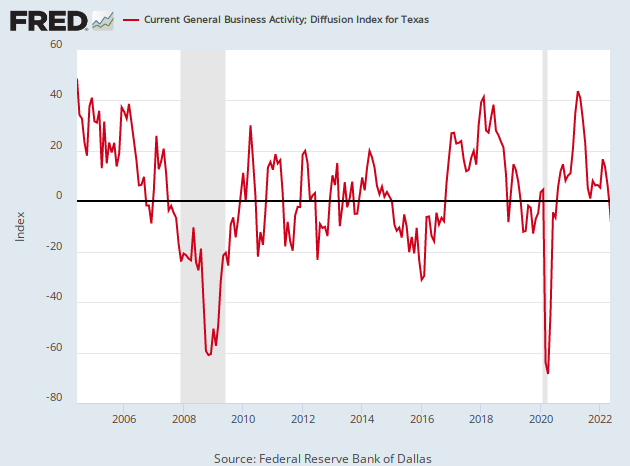

The Dallas Fed’s general business activity index, which measures manufacturers’ perceptions of broad economic conditions, dropped below zero, to a minus 7.3 for May. This is the first negative reading for the index since July of 2020.

The company outlook index gauge fell further negative from -5.5 to -10.0. The outlook uncertainty index held at the elevated level of 26.5.

Texas is the second biggest state in the U.S. when measured by economic output.

The Dallas Fed’s survey follows negative readings from the Federal Reserve banks of New York and Richmond. The Philadelphia Fed’s index managed to just barely hang on to a positive reading. Results from the Kansas City Fed indicated that manufacturing continued to expand but at a slower pace than expected.

Inflation indicators in the Dallas Fed show that price levels are still rising sharply. The raw materials prices index held steady at 61.8—more than twice its average of 27.8. The finished goods prices index was also largely unchanged at a highly elevated reading of 41.8. The wages and benefits index came in at 50.5, similar to April and markedly higher than its 20.2 average.

The survey’s demand indicators declined. The new orders index fell nine points to 3.2. The growth rate of orders index plunged 18 points and turned negative at minus 5.3. Both readings are at their lowest levels in about two years.

The capacity utilization and shipments indexes moved up. The production index, a key measure of state manufacturing conditions, rose from 10.8 to 18.8, signaling an acceleration in growth from April.

COMMENTS

Please let us know if you're having issues with commenting.