When the housing bubble of the first decade of the twenty-first century burst, there was widespread agreement that one of the culprits was mortgages that required little or no money down.

Bad ideas, of course, never really die. They just fade away for a time, waiting in the shadows to emerge again, like the mysterious necromancer in J.R.R. Tolkien’s Lord of the Rings trilogy who is revealed after centuries to be none other than Sauron.

The dark lord of no-money-down mortgages emerged this week in the form of a new home loan program from Bank of America that will not only offer buyers in predominantly black and Hispanic neighborhoods in selected cities mortgages with no money down, it will actually offer them a grant of $10,000 to $15,000 of equity in their homes. There will be no closing costs, no mortgage insurance required, and no minimum credit scores.

Many Americans assumed these were permanently a thing of the past. After the calamity of the 2008 housing bubble and the financial crisis, Congress and bank regulators sought to rein in exotic mortgages and require banks to hold on to risk for mortgages with low down payments.

In fact, low down payment mortgages never really went away. The Federal Housing Administration continued programs that permitted low and no-money-down mortgages. Fannie Mae and Freddie Mac launched new programs to allow buyers to put as little as three percent down. According to a 2019 study prepared for the Center for Household Financial Stability at the Federal Reserve Bank of St. Louis, the post-financial crisis share of conventional 30-year purchase loans requiring ten percent down or less rose from five percent in 2010 to 35 percent.

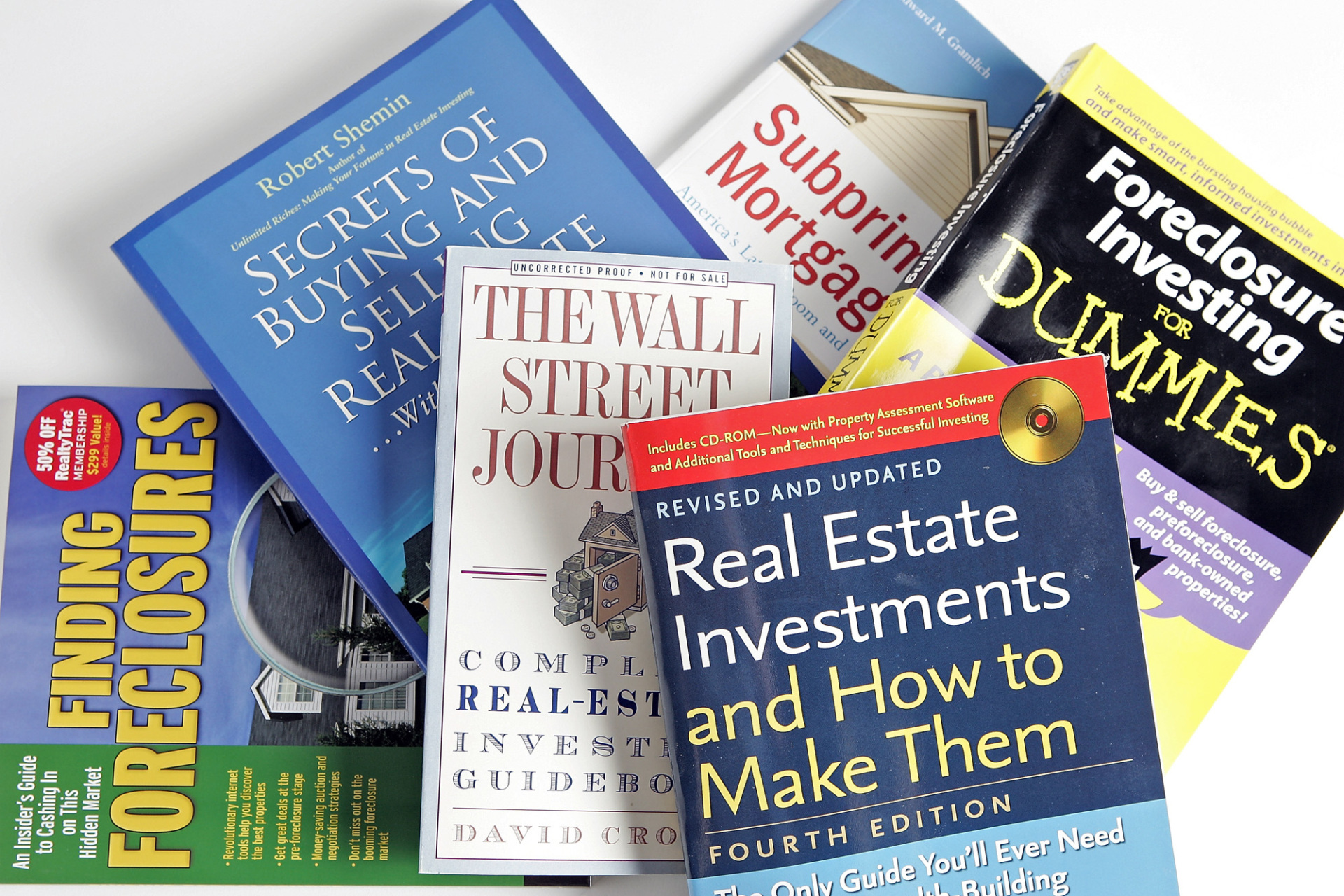

Books on foreclosures from July 2007, before the financial crash. (Stuart Cahill/MediaNews Group/Boston Herald via Getty Images)

Over the years, the consensus view of low or no down payment mortgages has become more nuanced. A 2017 study by the Department of Housing and Urban Development, for example, found that lower proportional down payments are indeed associated with higher rates of delinquency and default. But it also found that compensating tradeoffs—such as requiring higher credit scores and lower debt-to-income rations—can offset that increased risk.

Lenders and self-styled housing advocates have forged an alliance to push for rules that allow them to lend to buyers without requiring a down payment. Now they have an ally in the White House. The Biden administration has been pushing for looser lending practices that it says will close the racial home ownership gap. Earlier this year the Federal Housing Finance Agency, which controls Fannie Mae and Freddie Mac, recommended down payment assistance, lower mortgage insurance premiums, and a credit reporting system that counts rent payment history for first time buyers. It also urged banks to make use of “special purpose credit programs.”

Don’t bother reading the official interagency description of a “special purpose credit program.” It’s an indecipherable word-salad. But we have a better idea of what it means now that the Bank of America program has been announced.

The Bank of America program doubles down on risk by coupling no down payment with exotic and untested risk measures that replace credit scores. Instead of a history of paying debts, borrowers will be qualified by their history of paying utility bills, car payments, and rent payments. Those are unproven as measures of the willingness and ability to avoid default on a mortgage even in good times. They certainly have not been tested in a downturn.

The program purports to create home equity with a grant, but buyers will still lack any skin-in-the-game. Studies of mortgages made to buyers whose equity comes from outside show that they tend to default less often when the money comes from friends and family. That’s easy to understand. Borrowers do not want to waste the hard-earned money put up by people close to them. When the money comes from an outside source—a nonprofit or government—it has little to no de-risking effect. It might count as equity on paper, but it does not operate as equity psychologically.

Joni Lynn, 57, a homeowner in a KB Home development in Buckeye, Arizona, breaks down while discussing the jumbo adjustable rate loan she was given by Countrywide KB, during a press conference outside of KB Home headquarters in Los Angeles, CA, on August 7, 2008. (Mel Melcon/Los Angeles Times via Getty Images)

Now is a particularly bad time to launch this program. Even in a benign credit environment, it would be very likely that home values would drop in the next few years after the massive home price appreciation of the last few years. Of course, this is not a benign credit environment. The Fed is hiking interest rates to restrictive levels. The housing market has already fallen into a recession, according to builders and realtors. Sales, housing starts, and construction spending are down, and prices are likely to follow. The Fed is very likely going to have to increase unemployment over the next year and perhaps beyond to contain inflation, making it likely that some of the people borrowing now when unemployment is ultra-low will find themselves out of a job in the not-too-distant future.

When home prices are falling, no-money-down borrowers quickly find they are underwater on their mortgages. As a result, they cannot sell their homes to pay off the mortgage. This leads to default and foreclosure—and losses for the bank that has to sell the house for less than it was owed on the mortgage. What’s more, borrowers who put no cash down for their home and discover it is worth less than what they owe will find it attractive to “just walk away” from their home.

So why launch it now? Not only are home sales down, so are mortgage applications. Banks desperately want to increase mortgage originations and need to find new classes of borrowers. People without money for down payments have not been buying all that many houses lately, so there is likely some pent-up demand. Bank of America, you might recall, wound up purchasing toxic mortgage lender Countrywide—whose founder and chief executive Angelo Mozilo once described requiring down payments as “nonsense”—in January of 2008. The spirit of Countrywide has apparently been lurking there all these years, like the necromancer of Middle Earth.

A Countrywide sign is removed to reveal a new Bank of America sign on a bank in Woodland Hills, CA, on April 24, 2009. (Brian Vander Brug/Los Angeles Times via Getty Images)

“Homeownership strengthens our communities and can help individuals and families to build wealth over time,” said AJ Barkley, head of neighborhood and community lending for Bank of America. “Our Community Affordable Loan Solution will help make the dream of sustained homeownership attainable for more Black and Hispanic families, and it is part of our broader commitment to the communities that we serve.”

Does that ring a bell? Here’s what George W. Bush said in Atlanta, George, in 2002: “Too many American families, too many minorities do not own a home. There is a homeownership gap in America. The difference between Anglo America and African American and Hispanic homeownership is too big. And we’ve got to focus the attention on this Nation to address this.”

“The only way we can have a better society,” Mozillo said in 2004, “is to make sure those who don’t have a house have the opportunity to get one.”

But buying a home without a down payment only looks like homeownership. The financial analyst Josh Rosner had it right when he said: “A home without equity is just a rental with debt.”

COMMENTS

Please let us know if you're having issues with commenting.