Get Ready for a Bidenomic ‘Victory’ Over Inflation

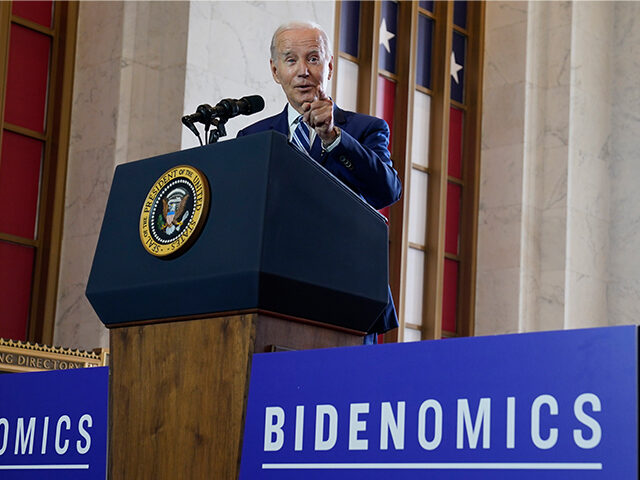

We expect President Joe Biden will take another misbegotten victory lap on inflation tomorrow.

The White House has declared triumph over inflation countless times over the past eighteen months or so. It started declaring inflation had been defeated almost as soon as it started admitting that inflation was a problem. As we’ve said before, this is an attempt to replace genuine statecraft with wishcraft.

Here was how we explained the term back when the Biden administration sought to conquer inflation with an inflationary spending bill called the Inflation Reduction Act:

We’ve used the phrase wishcraft in the past to describe the Biden administration’s preferred public policy stance. Time and again, the administration has behaved as if it believed that it can bend reality by uttering the right combination of words, like the children in J.K. Rowling’s novels. The White House inflation rally was like a huge wishcraft festival, with all the president’s cabal chanting that they had won a great victory over inflation.

President Joe Biden, Vice President Kamala Harris, the First Lady and Second Gentleman, House Speaker Nancy Pelosi (D-CA), and Senate Majority Leader Chuck Schumer (D-NY) attend a celebration of the Inflation Reduction Act on the South Lawn of the White House on September 13, 2022. (Nathan Posner/Anadolu Agency via Getty Images)

The hook for the latest wishcraft episode will be the release of the Labor Department’s consumer price index on Wednesday. The year-over-year price increase is expected to come down to 3.1 percent from four percent the prior month. Wall Street is so confident in the coming decline that the range of forecasts in the Econoday survey is from just 3.0 percent to 3.2 percent.

The Biden administration’s own term for wishcraft is Bidenomics. So, we expect they will attribute the decline in inflation to this ugly new catchphrase.

Headline Inflation Likely Fell in June

It’s easy to be skeptical about Wall Street’s inflation forecasts. Analysts have consistently underestimated the rate and persistence of inflation since it got kicked into high gear—by reckless fiscal stimulus and imprudent monetary accommodation—in the early months of the Biden presidency. Last September, we explained the source of these serial errors in underestimating inflation:

Their models are still pegged to the lowflation decades that preceded the pandemic. Many of them became convinced that accommodative monetary policy no longer had the power to increase inflation, even if coupled with fiscal stimulus. They saw the Phillips Curve as flat, meaning there was no real trade-off between low unemployment and low inflation. Only serious supply shocks could cause sustained inflation. So when inflation hit, they decided it was all a supply-side issue that would be quickly resolved. Inflation, almost by definition, had to be transitory.

We are not optimistic about the mental agility of economists following the August shock of inflation. Unfortunately, it may be a while before economists recognize the current inflation crisis has been largely the result of too much deficit spending accommodated by too loose of a monetary policy. The wisdom of such an old-fashioned notion may prevail one day. But when that day may be, we cannot say.

This time, however, Wall Street might not be that far off. The Federal Reserve Bank of Cleveland’s Inflation Now model has year-over-year inflation falling to 3.22 percent in June, just a tick above the Wall Street estimate.

Note that while the year-over-year headline inflation figures tend to get the most attention, they are—by definition—primarily a story of what has happened rather than what is happening. They are not good guides to what will happen.

The Wall Street forecast for month-over-month inflation is for an acceleration from 0.1 percent in May to 0.3 percent in June. The Cleveland Fed has the monthly figure picking up to 0.42 percent. This is reminiscent of last summer, when the month-to-month figure jumped from zero in July back up to 0.4 in September. In short, although the year-over-year numbers will look like an improvement, this is largely reflecting disinflation from months ago. The newest monthly figures will likely show inflation is running at a lower rate than it was but not necessarily trending down.

The other problem the Biden administration will likely face in wanting to claim victory over inflation is that core inflation—which excludes volatile food and energy prices—is still very high. On a year-over-year basis, Wall Street sees core price increases falling to five percent from 5.3 percent a month ago. On a month-to-month basis, core prices are expected to show some deceleration but not much—from 0.4 percent in May to 0.3 percent in June.

The Cleveland Fed’s nowcast for monthly core is 0.43 percent, which is no progress at all. Year-0ver-year is nowcast at 5.11 percent, 20 basis points lower than the May read.

An Inflation Headfake?

The biggest risk of declaring the defeat of inflation, however, is that inflation may be set to rise again. Jim Bianco of Bianco Research has been warning that June may be peak disinflation. After falling to three percent on a year-over-year basis, inflation may drift higher as base effects drop out. Here’s Bianco on Bloomberg “Surveillance” explaining the idea.

Bianco has the honor of being one of the few analysts who correctly predicted the outbreak of inflation. In a December 2020 interview with CNBC, Bianco warned that a generational comeback of inflation was on the way.

CNBC reported:

Wall Street forecaster Jim Bianco is bracing for a 2021 inflation comeback.

His main catalysts: hundreds of billions of dollars in federal coronavirus aid and vaccines that begin normalizing the economy.

“Once you get all of that into the pipeline, you could have a burst of economic activity that could produce higher inflation for the first time in a generation,” the Bianco Research president told CNBC’s “Trading Nation” on Tuesday. “That’s the big worry I have for 2021.”

So, if Bianco is warning that we may be in for even more inflation, it’s probably a good idea to pay attention.

COMMENTS

Please let us know if you're having issues with commenting.