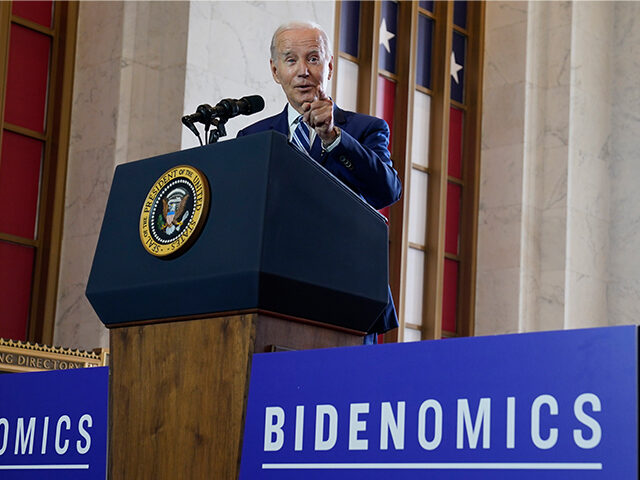

Bidenomics: A Fancy Word for Things Getting More Expensive

President Joe Biden desperately wants to convince Americans that they have done well under his presidency. That’s going to be a tough sell.

There are parts of the economy that are doing well, as the establishment media and its friends in the White House have been reminding us for months. The unemployment rate is extremely low. Despite the steep rise in interest rates, economic growth has remained stronger than many economists expected. Consumer spending is holding on, as Americans continue to spend down the excess savings created by pandemic stimulus measures.

Yet Americans are still deeply unhappy with Biden’s economic stewardship. Just 34 percent of the public approve of his handling of the economy, barely changed from 33 percent in May. An Economist/YouGov survey from early July found that 45 percent of the public rate the economy as “poor” and 29 percent rate the economy as “only fair,” for a negative assessment of 74 percent. Just 17 percent think the economy is improving.

Biden and his political advisers understand that his re-election chances very well may turn on the public’s perception of the economy. So, they have decided to embrace a high-risk strategy that offers potentially high rewards. Beginning with a speech in Chicago last month, Biden has embraced the term “Bidenomics” to push a positive spin on economic developments.

Biden Says Wages Are Up

On Sunday night, for example, Biden proclaimed that real wages for American workers are higher than before the pandemic. This got challenged by “readers” of the Tweet who pointed out that real wages are still lagging behind where they were as the economy went into lockdown in March of 2020.

Right now, real wages for the average American worker is higher than it was before the pandemic, with lower wage workers seeing the largest gains.

That's Bidenomics.

— President Biden (@POTUS) July 16, 2023

This is not quite fair to Biden, however. (Also, the phrase “real wages” means “adjusted for inflation wages,” so “real wages AFI” is a silly redundancy. Real in economics indicates an adjustment for inflation, while nominal means the figures are not adjusted for price changes.) The average wages in March of 2020 were above where they are now, but that was in part because the average jumped from $11.03 in February to $11.15 in March (measured in constant 1982 dollars). The reason for this jump was almost certainly the fact that so many of the lowest earners lost their jobs in March 2020, with employment shrinking by 701,000 jobs.

This is a very normal pattern in downturns. Average wages rise as many companies lay off recent hires first, and these are often at the lower end of pay scale. What’s more, it is often the lower-skilled and lower-wage workers that first feel the brunt of a downturn. As a result, average wages increase even as unemployment rises. Indeed, by April 2020, the average hourly wage was up to $11.71 because nonfarm payrolls had collapsed and 20 million people had lost their jobs.

Slow Progress Since 2020, Falling Behind Since 2021

A better rejoinder to Biden’s touting real wages being higher than before the pandemic is just to point out that it has been more than three years. Meaning, it took the economy three years to cross the threshold where people are earning more than they were before we got clobbered by COVID and lockdowns. That’s hardly an impressive feat.

Even more pointedly, average real hourly earnings still are underwater when measured against the beginning of the Biden presidency, when they were $11.34 in constant dollars. For almost the entirety of Biden’s presidency, inflation has outpaced wage gains. In the chart below, the red line represents inflation and the blue line is private sector average hourly earnings. Beginning in April 2021, prices were rising faster than wages. This has only reversed in May and June.

Even though wages have risen faster than inflation on an annual basis for two consecutive months, workers are still underwater for the totality of Biden’s presidency. Nominal average hourly earnings are up 11.57 percent while inflation is up 15.2 percent. So, people are still feeling pinched by what many have taken to calling Bidenflation.

And even though the month-to-month and year-over-year figures for food inflation have come way down, Americans are still feeling squeezed when they go to the grocery store. A recent piece in Barron’s pointed out:

Americans have also seen their grocery bills grow exponentially over the past four years. According to CPI data, food at home costs have jumped about 25% since June 2019. But again, that average hides some even bigger spikes. A loaf of white sandwich bread, for example, typically sold for $2.34 in June 2019. That same loaf sold for $3.16 last month—a 35% gain, according to average list price data collected for Barron’s by Datasembly at some of the largest U.S. retailers.

Egg costs, which experienced major price spikes in late 2022 and earlier this year, increased 28% since 2019. Meanwhile, a 12-pack of Coca-Cola or Mountain Dew has more than doubled in price. It adds up to a hefty bill for average consumers.

This is reflected in the polls. The Economist/YouGov poll shows just 14 percent of people say they are better off than a year ago, while 42 percent say they are worse off. Just 15 percent believe inflation will be lower six months from now, while 43 percent say they expect inflation to climb.

That’s Bidenomics, at least as far as the American people are concerned.

COMMENTS

Please let us know if you're having issues with commenting.