China Hides the Bad News

Why didn’t we think of that?

China announced on Tuesday that it had arrived at a novel solution to the problem of burgeoning unemployment among its young men and women. The jobless rate for China’s young, between the ages of 16 and 24, has been rising steadily for six months. In June it officially hit 21.3 percent, up from 12.2 percent before the pandemic. The unemployment rate was expected to climb even higher as millions of graduates hit the job market in the coming months.

China’s authorities have responded by suspending the publication of data on youth unemployment. Like the old riddle which posits that a tree falling in the forest cannot make a sound if there is no one there to hear it, youth unemployment in China presumably cannot continue to rise if there is no one counting it.

Although this particular application is new, this is really just the latest version of a not uncommon response by China’s authorities to inconvenient facts: conceal them.

Of course, greater opacity is unlikely to increase the confidence of investors. If anything, the move only highlights the dire circumstances of China’s economy. Many China-watchers already believed unemployment was higher than the official statistics revealed. Zhang Dandan, a Peking University economist, estimated back in March that the unemployment rate was 46.5 percent if you counted the youngsters who had dropped out of the workforce.

It also seems unlikely to achieve much by way of reassuring the young people of China that the basic social contract of their society remains intact. Withholding jobless numbers does nothing to provide young men and women with jobs or incomes or to quell political restiveness. Failing to provide the young with jobs is a path toward instability, particularly in totalitarian societies. Why live under a dictatorship of the Communist Party if it cannot even provide the workers with the means to produce a living?

Job seekers look for employment opportunities at a job fair on February 18, 2023, in Taiyuan, Shanxi Province of China. (VCG/VCG via Getty Images)

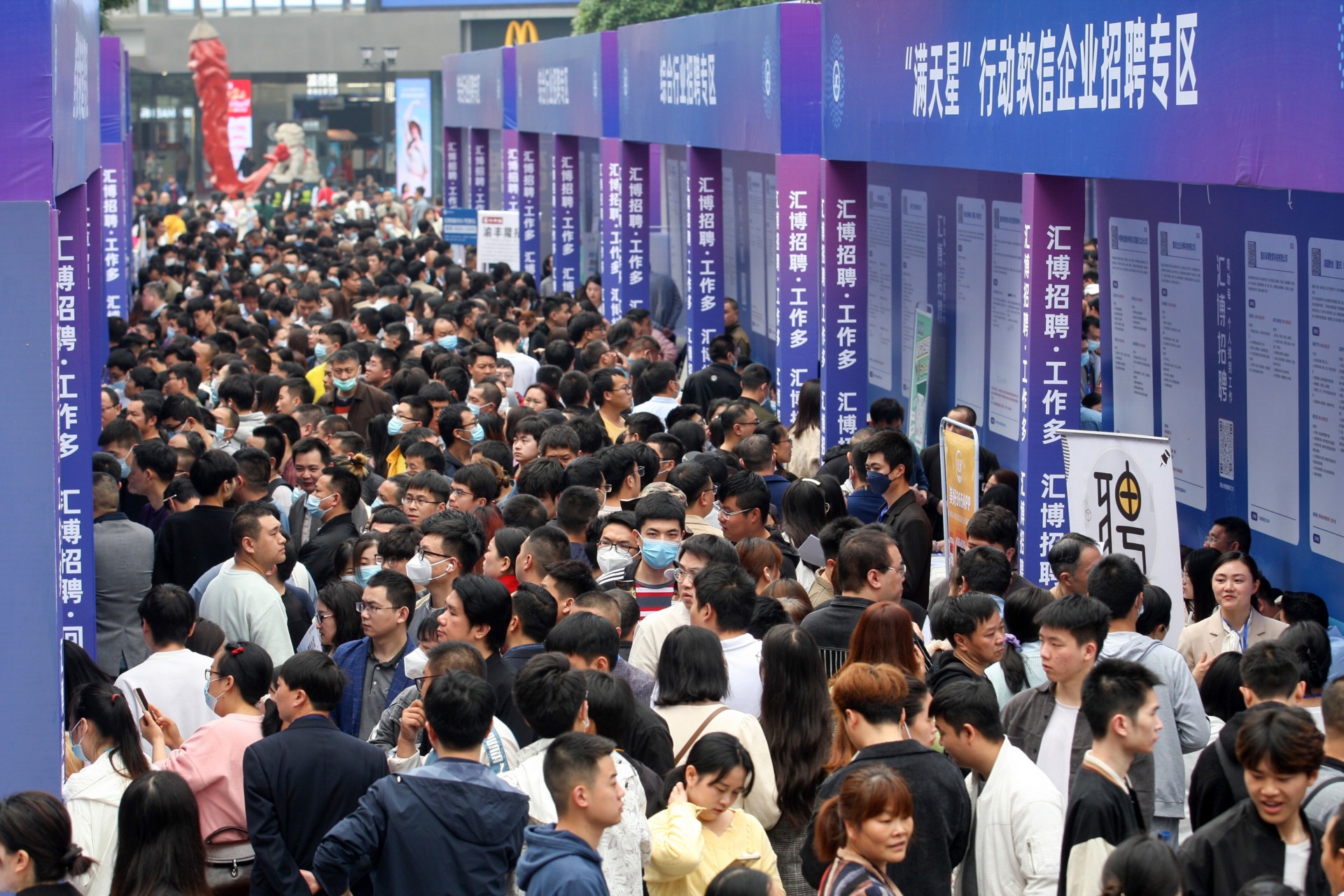

Job seekers look for opportunities at a job fair in southwest China’s Chongqing Municipality on April 11, 2023. (ZHAO JUNCHAO/Feature China/Future Publishing via Getty Images)

Job seekers look for employment opportunities at a job fair on July 15, 2023, in Tengzhou, Zaozhuang City, Shandong Province of China. (VCG/VCG via Getty Images)

A man offering work talks to a group of job seekers at Majuqiao day-labor market in Beijing, China, on July 20, 2023. (Andrea Verdelli for The Washington Post via Getty Images)

China’s prolonged zero-COVID policy has done its economy and perhaps its political regime great harm by contributing to a widespread feeling of economic insecurity. Households are so focused on building precautionary savings—nest eggs to rely upon in the case of further shutdowns—that it is doubtful that even sending out consumer stimulus checks would do very much to increase consumption. While much of the rest of the world is battling inflation, China is locked in a deflationary spiral.

No doubt there are plenty of Biden administration officials looking on with envy at the ability of Chinese authorities to make inconvenient facts vanish with the stroke of a pen.

U.S. Consumer Spending Points Toward Overheating

Closer to home, the July figures on retail spending were nothing less than shocking. Forecasters had penciled in 0.4 percent for overall spending. Retail ex-autos and retail ex-autos and gas were also forecast at 0.4 percent growth. The so-called “control group”—which feeds into the calculation of gross domestic product—was forecast to rise 0.5 percent.

Instead, the government said overall spending rose 0.7 percent. Excluding vehicles, spending rose one percent. Excluding autos and gasoline, it is also up one percent. The control group? That rose one percent also. Both the ex-autos and the core control figures were revised up about two tenths on net over the previous two months, which means we were rising faster from a higher starting point.

Spending contracted meaningfully in furniture and electronics and appliances. This is likely related to a still sluggish rate of home sales rather than reflective of consumers pulling back on spending.

Spending on clothing was up a sharp one percent. Department store spending jumped 0.9 percent. Spending at “sporting goods, hobby, musical instrument, & book stores” rose 1.8 percent. Non-store spending jumped 1.9 percent, likely boosted by Amazon’s Prime Day sales. Healthcare and beauty product store sales rose 0.7 percent. Home improvement store sales also rose 0.7 percent. Grocery store sales were up 0.8 percent.

While this was described in the business media as a sign that the consumer “remains strong” or “resilient,” the surge in spending is likely to be unwelcome news to officials at our Federal Reserve. It indicates that the Fed’s rate hikes are not acting as much of a drag on aggregate demand. Perhaps they have already run their course or perhaps interest rates are less powerful as a macroeconomic tool than commonly supposed.

The Atlanta Fed’s GDPNOW barometer jumped to show a five percent rate of growth for the third quarter. While that is likely to come down in the weeks ahead, it suggests that the economy is accelerating rather than slowing down as we move through the second half of 2023. The result is that without further rate hikes, monetary policy is actually loosening on its own, and inflation is likely to accelerate.

Unlike his Chinese counterparts, Fed chair Jerome Powell cannot just wish away the embarrassing numbers.

COMMENTS

Please let us know if you're having issues with commenting.