Student loans are coming out of a deep freeze this week but the Biden administration has provided enough wiggle-room for borrowers that the political and economic impact will likely be small.

When the pandemic struck in 2020, Congress included in relief legislation a provision pausing student loan payments and interest, essentially freezing student loans in place, until the end of the year. The Trump administration extended the pause into 2021 and the Biden administration subsequently extended the pause eight times. This summer’s debt ceiling deal included a provision requiring payments and interests to restart.

Interest will begin to accrue again on Friday, September 1. The first payments will not be due until October.

The Supreme Court in June struck down the Biden administration’s unilateral student loan forgiveness program, ruling it was an illegal overreach of presidential power. The program would have essentially transferred the burden of the debt from those who borrowed to attend college to U.S. taxpayers, including many who did not attend college, did not borrow student loans, or have already repaid their loans.

Even though payments officially restart as early as October 1st, the Biden administration has put in place a program that will allow many borrowers to avoid payments for up to a year. Biden’s Department of Education has said it will provide an “on-ramp” for repayments that includes a “grace period” covering the next 12 months. During that period, borrowers who do not make payments will not be reported to credit agencies and missed payments will not trigger delinquencies or defaults.

As a result, many borrowers may decide to hold off on making payments for some or all of the coming year.

That could diminish the economic benefits and risks from the restart of student loans. Prior to the announcement of the “on ramp,” many economists were forecasting a decline in consumer spending due to the need to make payments. This would likely have had the benefit of diminishing inflationary pressures, including diminishing the demand for housing that has sent home prices and rents soaring over the past few years. For retailers and providers of leisure and hospitality services, it risks sapping some customer spending power.

With the “on ramp” in place, student loans repayments are likely to phase-in over time. This could have the unfortunate effect of supporting higher inflation. It is also likely to benefit sales by retailers, including mega-retailers such as Walmart, Target, and Amazon.

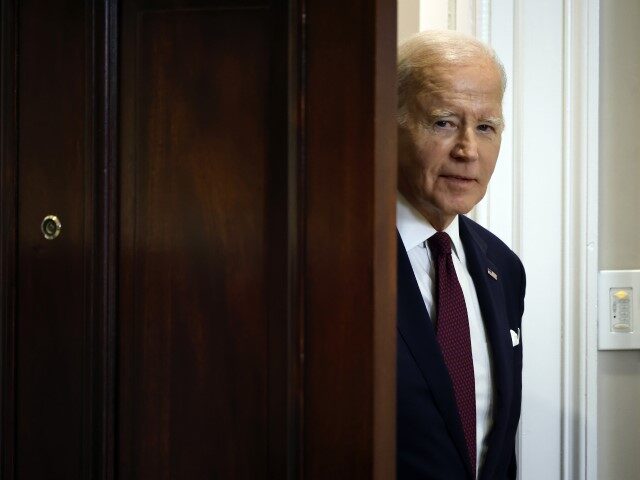

The backdoor extension of the student loan pause may also help Biden politically. The Biden administration has frequently sought to buy political support by providing subsidies to possible supporters and directing spending at constituencies it regards favorably.

COMMENTS

Please let us know if you're having issues with commenting.